This is the final part of my Sea deep dive series. Over the past few months I have written articles on each of its individual businesses (Part 1 - Garena, Part 2 - Shopee, Part 3 - SeaMoney). This article will tie it altogether and cover a number of other elements that are critical to understand the Sea group, as well as my overall thoughts on the business and the stock. In this piece I will cover the following:

New initiatives: Sea Capital and AI labs

Management, culture, and compensation

Key business updates and Q3’21 results

Valuation and returns

Concluding thoughts

Disclaimer: I am long Sea, and this article is not investment advice nor a substitute for your own due diligence. The objective of this article is to help formalise my thinking on the stock and hopefully provide some interesting insights on the business.

NEW INITIATIVES

Sea Capital

In its Q4’20 results Sea announced they acquired HK-based investment management company Composite Capital Management and are establishing Sea Capital, a platform to manage Sea’s overall investment efforts. The founder of Composite, David Ma, was assigned to lead Sea Capital as its CIO, and Sea committed $1bn to Sea Capital to be deployed over the next few years. David Ma is a highly experienced and well regarded investor who founded Composite in 2016 as a fund that invests in both public and private equities. At the time of Sea’s acquisition, it is believed Composite had approximately $2bn under management. Previously David spent seven years at the esteemed private equity firm Hillhouse Capital in Beijing/HK, and many years in management consulting before that. Prior to the deal Composite was an investor in Sea, so they would have already been highly familiar with the business and Forrest Li.

Many large tech companies have investing arms (a la Tencent, Softbank) and this venture seemed to follow that playbook. Often the objective of these corporate-style investment arms is to invest with a strategic element in mind, to focus on investments that may be somewhat synergistic or aligned with the core business in some sort of way. After speaking to some people in the Sea Capital team however, it was clear that that was not necessarily the case here. They are run completely independently of Sea and are purely financial return focused, meaning they can invest in whatever tech themes and businesses they think are compelling. For instance some of the themes that they are interested in include web 3.0, blockchain, and education, amongst others - sectors that are completely unrelated to Sea’s core businesses (it’s had two forays into crypto already - see below). The question that I had then was why create this group in the first place. The reason is that it essentially creates pure option value for Sea. Even if their investments do not have any immediate synergistic benefits, it may help Sea stay on top of innovation and oncoming disruption trends, and may help seed ideas for new businesses in the future. I think this is another demonstration of Forrest Li running Sea as a flexible, decentralized business with a long time horizon. Some of the public investments that Sea Capital have made include:

Forte: a blockchain-based gaming solutions company. Forte’s platform allows game publishers to easily integrate blockchain technologies into their games, enabling features such as seamless, embeddable token wallets, NFT minting and selling, payment rails, and other services built specifically for blockchain token economies and the management of digital and virtual assets. This effectively allows players to truly own goods, rather than making pure entertainment expenditures in games. Sea Capital led the $725m Series B round in Forte alongside Kora Management. Web 3.0 gaming is a potential disruptive force to traditional gaming, so this investment will help Sea stay on top of this trend. Forte claims to be currently working with over 40 game development companies globally, so it would be interesting to see Garena start to experiment with some of these features in the future

FTX: one of the world’s largest crypto exchanges. Sea Capital invested in a $430m Series B1 round alongside many investors including Ontario Teachers’ Pension Plan Board, Temasek, Sequoia, Tiger Globa, Lightspeed, and Ribbit

Kavak: Mexico-based used car marketplace that operates across Latin America. Sea Capital invested as part $700m Series E alongside Tiger Global, Spruce House, Softbank, Ribbit

Sea AI Labs

In that same quarter, Sea announced they are establishing Sea AI Labs (SAIL), and hired Dr. Yan Shuicheng as Sea’s Group Chief Scientist to build and lead this division. Dr. Yan is a leading expert in the field of artificial intelligence, with a particular focus on computer vision, machine learning and multimedia analysis. He is an ACM Fellow and Fellow of Academy of Engineering Singapore. The stated aim of SAIL is to attract and collaborate with top talent in AI with the goal of developing long-term insights and technologies related to Sea’s existing businesses and new opportunities beyond.

Not much has been said about this new venture since launch, but AI capabilities are clearly becoming important for tech firms as they look to leverage the vast amounts of data they are collecting to drive product improvements and generate new business opportunities. According to SAIL’s website, their research priorities are:

Artificial General Intelligence (AGI) - “In the future, AGI may lead us to a world where humankind and NPCs all live as real creatures.”

Game AI - “Pursuing human-like intelligence on non-player characters (NPCs). Game AI is a workable way towards realizing AGI”

We can also get some more insights from some of the jobs that they are advertising for. This team is in a strong hiring mode right now with over a dozen job ads for machine learning/AI model scientists, with some of the more interesting ones including Research Scientists for Music AI, and Computer Vision / Graphics.

The relevance of the above projects/roles for gaming and metaverse applications are obvious, particularly as management looks to establish Free Fire into a sort-of metaverse of its own, but it will be interesting to see what other unexpected value these deep tech capabilities can create for Sea over time.

MANAGEMENT, CULTURE, AND COMPENSATION

“Stay hungry. Stay foolish” - Steve Jobs, 2005 Stanford Graduation speech

Management

A key part of the investment thesis for many Sea investors is the quality and track record of the management team. Led by founder and Chairman Forrest Li, the team is relatively young (average age around 40), ambitious, tightly knit, resourceful and considered to be one of the best management teams in the region.

Forrest Li (43) is the Co-founder, Chairman and CEO of Sea Group. He holds an MBA from Stanford and a degree in Engineering from Shanghai Jiaotong University. Forrest is soft-spoken and reserved, and in the past did very few interviews or public appearances, although that’s changed more recently as Sea has become a regional giant and Forrest has become more prominent in the Singapore business community and his involvement with Singapore football team Lion City Sailors. Despite his modest nature and reserved demeanor, Forrest is a visionary leader who is fearless in taking risks and entering new businesses and markets that most conventional wisdom would say to avoid due to intense competition or unfamiliarity. In a 2020 interview he mentioned that he “can’t see the ceiling”. Judging by the performance of Sea’s stock, investors clearly agree.

Forrest’s rags to riches story is nothing short of incredible. Coming to Singapore from China 15 years ago ladled with $100K of student debt, he was looking for a change from the corporate career that he started in Shanghai where he was working as a recruiter for Western companies. Soon after he got into Stanford, and it’s fair to say that he drew a lot of inspiration from his US education, which he ultimately fused together with his knowledge of Chinese tech business models. It was also in the US that he decided to adopt the Western name Forrest, as he identified with Tom Hanks’ character in the movie Forrest Gump. According to Forrest, Gump is “not always the smartest person, or the strongest one physically, among his peers, but he has a very good heart. Because of his persistence and his courage, he lived a very successful and very meaningful life… by helping a lot of other people.” These personal values manifest themselves in Forrest’s leadership and vision for Sea.

Most people also know the story of how Forrest was inspired by Steve Jobs’ famous “Stay Hungry. Stay Foolish” speech at the Stanford graduation 2005, for which Forrest was there. Forrest made this line his life motto, and supposedly used to listen to the speech 2-3 times a day to help him bolster the courage to pursue his dreams. He always had a passion for gaming, and upon returning back to Singapore with his girlfriend (now wife) post Stanford, he decided to try his hand at entrepreneurialism by raising some seed capital and starting a gaming business by the name of GG. Although GG didn’t live long, Forrest was unperturbed, and managed to raise more money from the same investors in 2009 to co-found Garena with his wife’s former classmate Ye Gang. The name Garena comes from “Global Arena”, and is a reflection of Forrest’s vision that interactive gaming has the power to connect millions of people of different backgrounds and countries, thus why Garena’s slogan is “Connecting World Gamers”. However Forrest’s vision extends beyond just gaming. The decision to start adjacent e-commerce and fintech businesses is consistent with his ethos that technology can be used to serve humanity, particularly the underserved segments of population such as lower income demographics and small mom and pop sellers particularly in emerging markets.

Interestingly Forrest Li is also the oldest of the management team at 43, which emphasises how young (in a business sense) the team is.

Chris Feng (38) - CEO of Shopee and SeaMoney. Group President from 1 Jan 2022. After Forrest, Chris is generally seen as the second most critical person to the business. Chris has a degree in Computer Science with first class honors from the National University of Singapore. Prior to joining Sea Chris had significant experience in e-commerce, having worked in Lazada where he was the Chief Purchasing Officer, and prior to that Zalora where he was the regional managing director (both are Rocket Internet companies where Chris was a managing director). At Sea, he started off working in Garena where he was overseeing the mobile games business. When they got the idea to start Shopee as an adjacent business in 2015, Forrest entrusted Chris to run with this new venture. Later in 2019 Chris was given the role of CEO of SeaMoney as well. More recently he was promoted to Group President, where along with overseeing Shopee and SeaMoney, he will also also work on “Sea’s long term strategic initiatives, with an increasing focus on synergy creation across Sea’s various businesses.”

By all accounts, Forrest lets Chris run Shopee/SeaMoney pretty autonomously. While he will get involved in the strategic direction of the business, all of the execution is really driven by Chris. Further, various channel checks indicate that Chris is very well regarded by employees, albeit demanding and having high expectations of his team (more on this later in Culture). Given how important these two businesses are to the Sea group, it is not surprising that Chris represents significant key man risk to the business. His recent promotion to Group President was no doubt a move to keep him retained in the business. Hopefully this comes with more equity as well (discussed later under Compensation).

Ye Gang (40), COO of Sea Group. He holds an holds B.S. degrees in Computer Science and Economics at Carnegie Mellon University. He was one of the original co-founders of Garena and was particularly pivotal in those early years. It was supposedly Ye Gang who travelled to China and secured the deal with Riot Games that gave Garena publishing rights to League of Legends in Southeast Asia, which eventually led to the Tencent investment and distribution deal, and really kickstarted the growth of the entire business. Prior to Sea, Ye Gang worked at Wilmar International and the Economic Development Board of Singapore.

Yanjun Wang (40), Group Chief Corporate Officer, Group General Counsel, and Company Secretary. She holds a degree from Harvard Law School and a bachelors. degree in Economics from Harvard University. She wears a few hats, overseeing the group corporate functions including communications, corporate development and strategy, investor relations, legal and public policy. Most investors would recognise her as she is the one answering all the questions on earnings calls, and channel checks indicate she is a very good operator with a strong handle for the fundamentals of the business.

There are many other important execs including Tony Hou (CFO) and Feng Zhao (President of Garena) and David Chen (Chief Product Officer, Shopee). The key takeaway is that this is a team that has worked together in Sea for a long time, and although some of the earlier execs such as Nick Nash (ex-Group President) left shortly after IPO, the core of the management team is still working together and according to reports are quite tight.

Sea has five self-defined core values: “We Serve”, “We Adapt”, “We Run”, “We Commit”, and “We Stay Humble”. From the way Sea runs its businesses and the comments made on earnings calls, it seems that the management team really embraces these values. Frequent references to staying humble, playing down expectations, doing experiments, learning, and not assuming, have become a bit of a hallmark of Sea earnings calls.

“We remain very humble. Being humble is one of our core values, in fact, and we constantly tell ourselves that we need to carefully evaluate all these market opportunities, as we learn. At the same time, we should develop a localized and tailored solution for each market. We wouldn't make any assumptions”

Yanjun Wang (Group Chief Corporate Officer), Sea’s Q3 2021 Earnings Call

Their track record of tight execution speaks for itself in the almost 30x appreciation in the stock since its 2017 IPO. During this time the business itself has outperformed virtually all e-commerce and gaming peers, including during and now post the pandemic. I also like to see a history of consistently beating or raising guidance, which earns the company significant investor trust. Sea has raised guidance already twice this year and has a consistent history of beating guidance over the last few years.

Culture

It’s quite important to discuss the culture at Sea, as it has both significant positive points that strengthen the thesis for the company, and at the same raises some questions. The culture of Sea seems to be one that mixes both US tech style innovation (move fast and break things) and hard-driving, demanding culture of Chinese tech firms. According to many channel checks, the culture at Sea is one of high very high performance, with people given the autonomy to operate freely and do whatever it takes to win. This results in a lot of resourcefulness and aggressiveness, which can be considered positive given the competitive intensity of their markets and the need to move faster and outexecute its competitors. One good example of this is during the peak of pandemic in 2020. Shopee management were on the front foot trying to push various government officials to allow them to operate routes and logistics so that the business could serve customers during lockdowns. Meanwhile its competitors like Lazada were slow to act and went into shutdown for a while. This allowed Shopee to decisively overtake Lazada during this pivotal period, and not look back since. Chris Feng in particular seems to have been recognised internally as someone who is talented but also very demanding, resulting in a culture that seems to almost emulate the infamous 996 work culture1 in China. In fact a large portion of Sea’s workforce is from China, so that intense work culture may be something that has come naturally from that market. Another key takeaway from some Shopee employees is that the work environment can be somewhat messy and chaotic, with people’s roles sometimes being ill-defined and changing frequently. With how fast the business is growing and ramping headcount, it’s perhaps not surprising that Sea may feel more like a startup environment, which is certainly not for everyone. At the same time Sea seems to take pride in looking after its employees, with much of its social media focusing on the strong career prospects, great facilities, fully stocked kitchens and sleeping pods (although a cynical view would be that this is just encouragement for people to work longer hours).

While shareholders may be happy about having a hardworking and driven workforce, it does raise the question of whether this sort of culture is sustainable and if it may create risks down the line, particularly as Sea competes for talent with other tech firms who may not have such cultures. As a data point, Shopee’s Glassdoor review rating is 3.7, which I consider to be pretty average (ideally I like to see a rating above 4). Lazada however is even lower (3.4), perhaps not surprising given the management and workforce issues over there post the Alibaba acquisition. Tokopedia is relatively high at 4.3. Garena, however, is at a very healthy 4.4, and Sea corporate group is also at 3.7, with a 97% approval rating for CEO Forrest Li.

Capital allocation

From a capital allocation standpoint, Sea’s main use of funds is reinvestment back in the business. This is likely to be the case for many years as Sea is in a high growth phase, growing its multiple businesses in high growth sectors, and expanding geographically. Garena is the cash engine of the group, producing roughly ~$3bn of cash earnings a year, which is being redeployed almost entirely into the loss-making high growth businesses Shopee and SeaMoney. There have also been selective acquisitions, with the largest being game developer Phoenix Labs, Bank BKE in Indonesia, and the aforementioned Composite Capital.

In addition to the cash generation from Garena, Sea has been raising significant capital from the capital markets, raising money every year since its 2017 IPO either through convertibles or equity raisings. Their raisings have been somewhat opportunistic, capitalising on points of high valuation in Sea stock to manage the effects of dilution. The most recent and largest raise was early this year when Sea raised a total of $6.5bn via converts and equity. This was particularly timely as it was essentially building up a war chest right before Grab went public in the US and before GoTo started raising a $2bn pre-IPO round (their IPO in Indonesia is planned for 2022, likely followed by a secondary listing in the US). However I think the key advantage that Sea has over GoTo and other Southeast Asia tech giants like Grab, is that they have the internally generated cash flows from Garena, which allows them to not have to rely as much on external funding, while the others do not as of yet have profitably core businesses and are much more reliant on capital markets. This means that Sea’s ability to suffer cash burn to scale its e-commerce and fintech businesses is much greater than its competitors. Of course the bet that investors are making is that as Shopee and SeaMoney reach dominant scale, entrench their moats and establish pricing power, profitability and high returns on capital should follow.

Compensation

Generally there is little information on management compensation, but we do know there was $7m in cash awards granted to executives and directors in 2020, which was broadly flat relative to 2019 ($7.1m) and 2018 ($6.5m). The fact that the cash comp hasn’t grown much over the last few years while the business and the stock has grown multiple folds makes me comfortable that their compensation package isn’t egregious.

On share ownership, other than Tencent that owns 22% (as at Mar-21), Forrest Li is the largest insider owner with approximately 11% ownership, but a massive 38% voting power. The disparity between his ownership and the voting power is for two reasons. Firstly, Li’s 59.6m shares are split into 14.1m Class A shares (publicly traded shares, one vote per share) and 45.5m Class B shares (non-traded shares, three votes per share). Secondly, Tencent has pledged its voting rights to Li for 46.6m of Class B shares that it owns. This much concentration of voting power in the hands of one person may be understandably uncomfortable for some investors. Essentially, Sea is a founder-controlled company, and if you are investing in Sea you need to get comfortable with having Forrest Li at the helm. From everything I’ve seen so far, I am. As at 19-Nov-21, Li’s holding was worth ~$18.5bn. I think his significant shareholding provides a strong alignment of interest between him and shareholders. Also the fact that Tencent entrusted him with the voting power for their shares gives me a lot of comfort on Forrest Li’s capabilities and leadership. Fellow Garena co-founder Ye Gang is the next largest insider with approximately 6% ownership. Perhaps the only concern I have is that Chris Feng holds less than 1%, and as mentioned he is probably the second most critical person to the business. Hopefully with his new promotion to Group President this will change.

KEY BUSINESS UPDATES AND Q3’21 RESULTS

It feels like a week doesn’t go by without there being some major news about Sea, and there have been quite a few material updates since I published my first Garena article back at the end of August. Below is short ‘post-script’ to each business, including some thoughts on the Q3’21 earnings, as well a summary of any revisions to my base case forecasts.

Garena

Free Fire Max was launched globally on 28 September and performed strongly for several weeks subsequently, becoming the top most downloaded mobile game in over 30 countries. It awaits to be seen whether it will actually increase the active user base (expanding the TAM to higher spec mobile gamers) or be predominantly a tool to drive engagement/monetisation of existing users. Management suggests the focus is more on engagement, and has been really talking up the new Craftland feature, which allows players to create their own custom maps. It’s an important step in turning Free Fire into more of a platform rather than just a game

Probably the more material update to Garena came in Q3 results. Investors were somewhat spooked by what seems like significant slowing in the growth momentum. Quarterly Active Users (QAU) and Quarterly Paying Users (QPU) were almost flat quarter-on-quarter, something that hasn’t been experienced before. QAU was 729m (vs 725m in Q2), and QPU was 93m (vs. 92m in Q2), although both still grew 27% and 43% respectively on Q3’20. With $1.2bn bookings in Q3 and no revision to the $4.5-4.7bn booking guidance for FY21, this suggests a declining Q4 bookings number even at the top end of guidance. This could be conservatism on behalf of management (which they typically are), or maybe a temporary effect of more countries opening up and less users being stuck at home, or maturity of Free Fire. Time will tell. Zooming out, it’s important to remember that Garena has added a phenomenal 157m QAUs over the last 12 months, and more than doubled their QAUs since the start of 2020. In the context of such huge growth perhaps a slow down was not surprising (after all, current numbers suggest that 1 in 10 people in the world have now played a Garena game). Nonetheless even if the Free Fire user base peaks in 2022, top gaming franchises can still earn significant revenues for many years past their peak in popularity (see Part 1). The rest of the games portfolio (maybe ~30% of revenue) along with a steady pipeline of new releases will also provide buffer, so I wouldn’t expect Garena earnings to just drop off precipitously

Overall no changes to my Garena forecasts at this stage as I have assumed FY21 bookings would be within guidance, and we’ll have a better sense about FY22 and beyond after Q4 results in February. In October Free Fire was the top grossing mobile game globally, which shows continued strong engagement and hopefully a reasonably strong Q4. The one major revision that I am thinking about however is decreasing the active user base growth, but increasing the paying ratio and ARPPU. With well over 700m active users, there is an argument to be made that Garena may be shifting its focus now from growing its scale to focusing on monetisation. One data point that I recently heard is that in some of its more mature gaming markets in Southeast Asia (Indonesia in particular), Garena is reaching a paying ratio of 17%, setting the bar for what other markets can reach. I have assumed that Garena’s paying ratio increases from sub 13% to 14% by FY25, however that may be too conservative. Similarly there may more upside to ARPPU which I assumed only grows with inflation. The revenue per gamer in developing markets (where Garena is concentrated) is many times smaller than those of developed markets, so there could be room for ARPPU to grow much faster as incomes in those markets rise over time. Also Free Fire has been doing really well in the US, so continued penetration of higher ARPPU developed markets could provide a favourable mix-shift effect over time

Shopee

At the time of writing the Shopee article, the company had just announced its entry into India and Poland. Subsequent to that, they then announced they are entering Spain and France, making that a total of four new markets in a space of two months. While I expected that they would enter more countries, I certainly didn’t expect it as fast as that. Based on app downloads, they seem to be off to a good start in each of them: in the Google Play shopping category they are now number #1 in Poland, #1 in Spain, #2 in India, and #2 in France. This is a similar pattern to what we saw with its LATAM entry, where Shopee rose to the top of the download charts in each of Brazil, Mexico, Chile and Columbia. Of course app downloads does not directly translate to GMV or revenue, but it’s a key part of Shopee’s mobile-first strategy of new market expansion

In the Q3 results management referred to Brazil as a core market along with Southeast Asia and Taiwan. They first entered Brazil in 2019 and management for a long time was playing down expectations about it (“we stay humble”). This new labeling however is a strong affirmation that they are seeing significant and sustainable success there. They have reported over 1m local sellers, which shows that their strategy of using cross-border merchants to seed the initial supply and then attracting local merchants is working. According to some sources they are also now run-rating approximately $2bn GMV in Brazil. In terms of the other new markets, management is once again describing them as ‘testing the water’ and learning opportunities. This is smart as it gives them the flexibility to pull out of these markets if they are not working. Investors of course are hoping that they can emulate their Brazil playbook there and turn them into core markets over time

Q3 results saw Shopee shoot the lights out, delivering triple digit growth on what was already a huge quarter last year, and smashing the growth of all e-commerce peers who have been struggling with a mixture of post-pandemic slowdowns or supply chain impacts. It achieved GMV of $16.8bn (81% growth yoy), revenue of $1.45bn (134% growth yoy), and marketplace take rates now increased to 7% (key measure of pricing power). This has resulted in Shopee revising its FY21 guidance upwards for the second time this year, now expecting revenue of $5.0-5.2bn for the year vs. previously $4.7-4.9bn). Maybe the only criticism is that EBITDA loss per order and S&M expense as % of revenue did not improve yoy, although given the big ramp in new market expansion this is not a bad outcome

Shopee’s 11.11 sales saw an exponential increase on last year, with 2bn items sold over one day (vs. 200m last year), setting the pace for a strong Q4

As a result of the above, I have revised upwards my FY21 GMV to $62bn (from $59bn) and revenue growth to be within the new guidance ($5.1bn), which had a flow-on effect to the rest of the projections, resulting in an overall increase in my valuation of Shopee of +$5bn (in today’s terms), or +$8 p/s ($217 p/s)

SeaMoney

No material updates to SeaMoney since my last article, other than just the continued acceleration of its growth. Q3 revenue was $132m (vs. ~$90m in Q2), and management emphasised continued focus on ramping offline vendors and value-added services, mainly digital banking, as well as insurance mentioned for the first time. The loan book continues to grow, now reaching almost $1.1bn in Q3 (vs. $808m in Q2)

With run-rate annual revenue of ~$500m, my $780m2 forecast for FY22 may be somewhat conservative as the business will only continue to grow. I’m leaving my forecasts unchanged however as I’d prefer to underwrite more conservative case and be surprised on the upside. I am extremely bullish on this business and believe investors don’t pay enough attention to it. This may change over time as management starts to emphasise it more

FINANCIALS, VALUATION AND RETURNS

This section will be pulling together the forecasts and valuations for each of the three Sea businesses. If you’d like to go through the specific details and assumptions please refer to the earlier articles (Part 1 - Garena, Part 2 - Shopee, Part 3 - SeaMoney).

Financials

Overall, I’m expecting group revenue to grow from c.$9bn in 2021 to $25bn by FY25, or approximately a 30% CAGR. Adjusted EBITDA is expected to grow from -$280m in 2021 to $5bn by FY25. Adjusted EBITDA is the metric that management likes to focus on. The key difference between GAAP EBIT and Adj. EBITDA is that it takes bookings for Garena instead of GAAP revenue, as bookings reflects cash received upfront but not yet earnt as revenue (pre-purchased virtual currency and monthly packs etc). This is quite typical of gaming companies who prefer to focus on bookings as a measure of cashflow.

Of course all of these numbers are highly speculative and will no doubt be wrong. Forecasting a high growth, rapidly evolving business like Sea is extremely difficult, so we need to take these numbers with a grain of salt. Nonetheless for me it’s a helpful exercise as it helps me visualise and understand the business, and get a rough sense of risk-return asymmetry. The key thing is that I am not too focused on the accuracy of the year to year numbers (which are always going to be off) as I am on the ballpark trajectory of the business over the long term. What I am trying to get a sense of is whether I can get a reasonable return (which for me 12-15% IRR) under what I believe are a conservative set of assumptions.

Valuation and returns

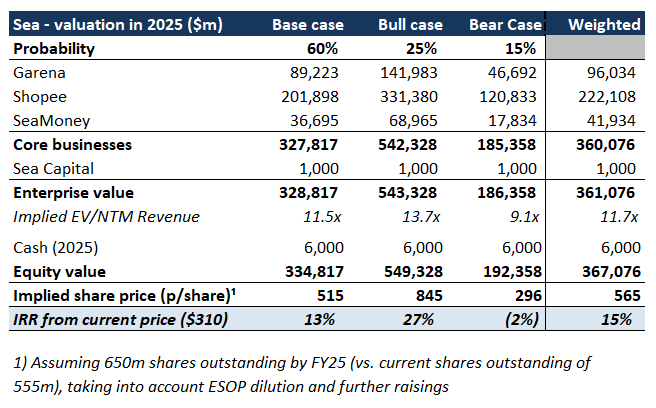

The below table summarises the SOTP valuation of Sea Group in 2025, the implied share prices and the IRRs from today’s price levels. The valuation methodologies for each business are based on long-run average comps as laid out in each of the earlier articles.

For context, the current EV of the business is about $164bn. As can be seen, under my base case, I think the EV in 2025 could get to ~$335bn, so essentially double from today’s levels. This also assumes no growth from the $1bn allocated to Sea Capital, and cash balance roughly halves from today’s $12bn level due to continued cash burn. Taking into account continued dilution from share issuance/conversion of convertibles, the implied share price is $515, representing a ~13% IRR from today’s price. As I believe my base case is relatively conservative, I think Sea represents a reasonable investment at current levels. However, the range of returns is clearly quite wide. Under a bull case (FY25 revenue of $33bn), where I assume Garena can produce another hit game and reach over 1bn QAUs by FY25, and Shopee can reach over $180bn GMV FY25, Sea can comfortably become over half a trillion dollar business, with an implied share price of $845, resulting in a very attractive IRR in the high 20% range. Conversely, in a bear case (FY25 revenue of $18bn) where Garena’s QAUs start declining from 2022 and Shopee starts losing significant market share, the EV and implied share price may be largely flat from today’s levels over the next 4-5 years (of course in the short term steeper price corrections are always possible). However, a downside case which suggests somewhat limited losses over the long term, and an upside case with over 20% IRRs, overall suggests a pretty favourable risk-return asymmetry to me. I will leave it to the readers to consider where they think Sea could fall in this spectrum (or outside of it).

Having a look at the long-term rolling EV/NTM Revenue multiple (on which Sea is typically valued), current valuation of 12.5x has come off quite a bit from the 15x+ level where it’s traded most of the year. While this is still elevated relative to its longer term history, you could argue the business is now significantly stronger, with larger global scale than it was in the past. As a cross-check in my SOTP above, my base case implies an EV/NTM revenue at exit (2025) of 11.5x, a contraction from today’s levels.

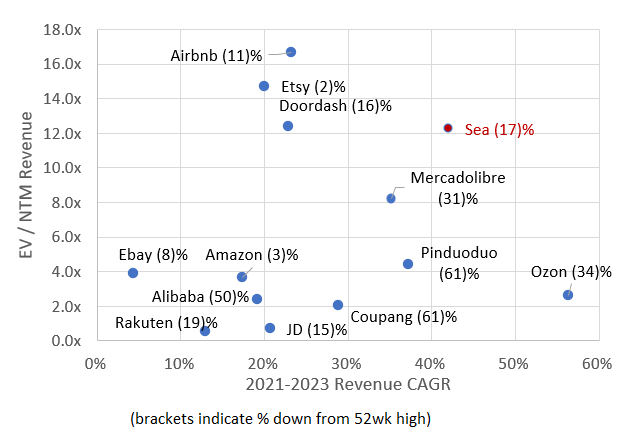

Finally, comparing Sea to other global marketplace/e-commerce peers (as Shopee is the largest business and key growth driver of Sea), it is clearly on the more expensive end (although a bit cheaper now post the recent correction). I would argue, however, that the intrinsic value perspective would justify this pricing, driven by Sea’s higher growth and a massively profitable cash cow gaming business.

CONCLUDING THOUGHTS

Sea is by far my largest position, and thus the objective of these articles has been for me to re-evaluate the thesis for the stock and form a view on possible returns going forward. The core thesis is that Sea will continue to evolve to be one of the dominant gaming companies in the emerging markets, and the leading e-commerce player in Southeast Asia, with upsides from geographical expansion and the nascent fintech business. Overall I believe the thesis is very much on track and this is still a comfortable long-term hold for me.

Garena is the cash cow of the business with almost unheard of ~60% EBITDA margins, but the key concern is the longevity of Free Fire. So far all evidence seems to suggest that Free Fire is becoming one of the biggest mobile franchises in the world, with staying power. Even if its user base is close to peak, there is still plenty of room to grow monetisation, and precedents have shown that enduring franchises can still generate significant earnings for many years past their peak in popularity. Management is also taking appropriate steps to diversify the business with its publishing pipeline and acquisitions.

Shopee is a monster that keeps outperforming all growth expectations, however a common criticism of is that it has been ‘buying market share’ and doesn’t have a sustainable business model. I believe this is a very superficial view of the business. Its cash burn is part of a highly effective, tightly executed and battle-tested strategy that has been designed to enter a market and build scale incredibly fast in a way that is difficult for competitors to stop. The fact that Brazil has now become a core market, the first beyond Southeast Asia and Taiwan, suggests that its blueprint is working. What follows should be pricing power and a pathway to profitability, which we are already seeing move in the right direction.

SeaMoney has grown from the background to become a critical part of the Sea growth story. It is a synergistic piece that creates value for the entire group but also has the potential to become a valuable fintech franchise in its own right. While the market is competitive, the ability to leverage the large Shopee ecosystem and access to Garena’s organic cash engine provides SeaMoney with a unique advantage vs. the competition. It is able to focus aggressively on scaling and building out the essential network effects without having to worry about monetisation or profitability too early. This puts it in a strong position to become one of the winners of this rapidly growing market.

The key risks to monitor that could indicate an impairment to the thesis:

Garena active users as well as monetisation stalling or starting to decline in the next 12 months (declining payer ratio, ARPPU), which could indicate that Free Fire does not have the durability that I think it does

Tencent distribution deal not being renewed in 2023. Will be interesting to watch the performance of some of the upcoming Tencent games that Garena is publishing, notable Undawn. Indications of Tencent doing more self-publishing in the region would be concerning (a la Tencent-owned Riot Games), although I still think Tencent’s 22% stake provides a significant alignment of interest with Garena

Shopee market share losses to competition, and failure to keep improving pricing power or its net loss position (unable to pare back S&M expenses), as this would indicate that its moat and business model is not as strong as I believe

SeaMoney is symbiotically tied to Shopee, so should Shopee deteriorate then SeaMoney will likely go with it

Having a founder-led management team with significant ownership (alignment of interest) and a proven track record of execution gives me comfort that they will continue to act with a long-term orientation and have the adaptability to evolve the business appropriately over time, as they have continuously done so far.

Finally, from a valuation perspective, while the stock is relatively expensive, it is supported by high growth and I believe you should be able to achieve an IRR of over 10% over the next 4-5 years under a conservative set of assumptions. Of course given management’s track record of outperformance, the upside case could potentially be much greater than that. The downside from today’s levels for a long-term holder I believe is somewhat limited, so overall the risk-return asymmetry seems favourable to me.

While this is the last of my deep dive articles on Sea, I will likely publish shorter update articles from time to time. This is a business that is evolving rapidly, and I look forward to following its journey closely.

Thank you for reading and hopefully you found the article helpful. I welcome all feedback, good or bad, as it helps me improve and clarifies my thinking. Please leave a comment below or on Twitter (@punchcardinvest).

If you’d like to receive my future deep dives on other tech companies as they are published, please subscribe below.

For further reading:

Forrest Li : “Singapore’s Steve Jobs” shoots for the stars (MoneyWeek)

The incredible rise of Forrest Li, modest founder of Singapore’s most valuable listed company (CNA)

996 refers to 9am to 9pm, 6 days a week, a work culture that has become associated with Chinese tech firms

As my Shopee forecasts has been revised upwards due to increased guidance, there’s a flow-on effect on SeaMoney which saw its forecasts increase marginally as well (payments and lending revenue are partially driven by Shopee GMV). Net effect on SeaMoney is c. +$1bn in value, or ~$1p/s, discounted to today

Thank you for the writeup and for sharing it with all of us. Love following through your thought process and really appreciate the detailed analysis.

My channel checks (primarily friends who are merchants in the various platforms in Indonesia) are telling me that Tiktok Shop is gaining significant momentum in Indonesia and encroaching Shopee's territory with short form videos being a channel that has/is continuing to grow rapidly and also arguably a suitable and attractive one especially in the categories that Shopee excels in (fashion, beauty, etc). Curious if you've given any thought on this?

Would also love to look at the model if you can share it. Email is clinton.rezeki@gmail.com

Thank you again. Really appreciate it.

Thank you for this detailed deep dive. Extremely helpful! I am with you on the Garena and Shopee assessment, but have my skepticism on the Sea money business.

In general, I find that in markets esp. in EMs where banks also have pretty decent wallet or similar offerings, it is tough for tech players to gain a significant share without offering promotions - A good example may be PayTM in India - It may be controversial a comment but I really don't find their business model sustainable if they were to stop offering all the promotions and cash back. Similarly, for digital bank to gain scale - its a big question too! I think the capital arbitrage between banks and digital banks will be closed over time through regulations and I simply find it hard to have faith in tech companies (using balance sheet capital to lend) to survive lending cycles. Time will tell I guess.

But thank you again for this great write up! As well as the scenario assessment.

One suggestion - Since you have looked into the market dynamics already, perhaps take a look at GRAB too? Esp. after the de-spac, stock has come off to more realistic valuations and may be an interesting super app to study :)