Sea Limited (Sea) has become the crown jewel of Singapore’s technology scene and the leading internet company of Southeast Asia. Since its listing on the NYSE in 2017, the business has been in continuous hyper-growth, driven by an exceptional founder-led management team and riding on the tailwinds of mobile and internet penetration, gaming and e-commerce adoption, and rising wealth across the region and other emerging markets. I first invested in Sea shortly after I moved to Singapore in 2018 when I was introduced to the company by a friend who was working in its gaming arm Garena. Listening to him talk about the business and the exciting things they were doing, I sensed that there was something interesting there and I had to look into it further. The stock has since grown to be by far my biggest position and the company which I follow most closely. There are few companies that are as broad in scope as Sea, so I will break this deep dive into four parts related to the businesses that it operates in. This Part 1 will focus on its gaming business Garena. Over the next month or two I will release Part 2 on the e-commerce business Shopee, Part 3 on its fintech business SeaMoney, and Part 4 will wrap it all together.

In this piece I will cover the following:

Overview of Garena and its global smash hit game Free Fire

The market opportunity

Assess the sustainability of Free Fire

Garena’s acquisition strategy

Forecasts and valuation of Garena, including the bull and the bear cases

Disclaimer: I am long Sea, and this article is not investment advice nor a substitute for your own due diligence. The objective of this article is to help formalise my thinking on the stock and hopefully provide some interesting insights on the business.

BUSINESS OVERVIEW

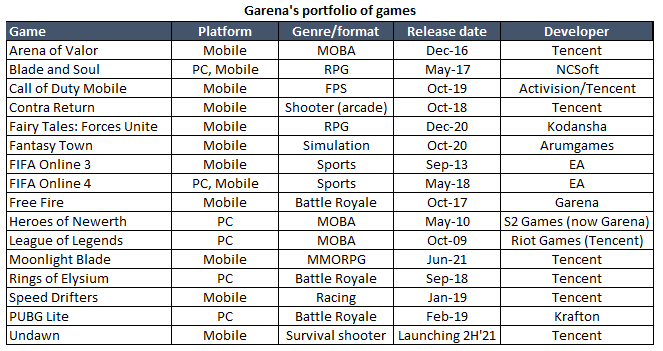

Before the business was renamed as Sea at its IPO in late 2017, it was operating under its gaming brand Garena. Garena was originally founded in 2009 by Forrest Li and Ye Gang as a publisher of PC games and a chat platform for gamers in Southeast Asia. It got its breakthrough in 2010 when it secured the rights to publish Riot Games' League of Legends in the region. League of Legends is one of the biggest multiplayer online battle arena (MOBA) titles to this day, and this deal got the attention of Tencent, who was an investor in Riot Games. Soon after, Tencent bought a 40% stake in Garena (currently 22%) and began a long-standing strategic distribution relationship with the company. In 2018 Garena entered into a five year exclusivity agreement with Tencent which gave them the right of first refusal to distribute any Tencent game in the region1. This gives Garena a solid foundation and a significant competitive advantage in the market. Tencent can keep producing a consistent pipeline of hit games either itself or via its various subsidiaries (such as Riot Games), which Garena can then cherry pick and distribute exclusively in the region. Some of the Tencent titles that Garena has exclusive distribution over include the mobile MOBA game Arena of Valor, racing game Speed Drifters, its recently launched RPG Moonlight Blade, and an upcoming survival shooter Undawn. There is perhaps some concern that the Tencent agreement won’t be renewed in 2023, but I think the risk of this is low given their long, mutually beneficial relationship and Tencent’s significant ownership in Sea which creates an alignment of interest. Garena provides Tencent with a high-growth distribution channel outside of China, something that is no doubt increasingly valuable to Tencent given the domestic regulatory and political situation. Outside of Tencent, Garena also publishes some major titles of other large gaming companies including EA’s FIFA Online 3/4, and Activision’s Call of Duty Mobile.

The reason Garena has been able to forge such strong relationships with leading international game developers is because it provides a one-stop solution that helps them launch and scale games in the region. Southeast Asia is a complex market due to the diverse population and uniqueness of each country in terms of culture, language, economic status of consumers, and lifestyle, making it a challenging region for global gaming companies to succeed in independently. Garena, having operated in the region for over a decade, has become the preferred publishing partner for new games in the region due to its deep expertise in understanding local gamer preferences and languages, content modification, marketing, hosting, distribution and payment mechanisms, and creation of communities and ecosystems including e-sports events. Some of their capabilities were particularly evident in their work with Arena of Valor, which they co-developed with Tencent and publish in the region. Arena of Valor is a modified version of Tencent’s highly popular Chinese game called Honor of Kings. Honor of Kings is a MOBA game who’s characters and content are centered around Chinese folklore and Chinese mythology - something that may have limited appeal to audiences outside of China. Garena played an important role in helping change the contents to reflect other nations’ folklore, as well blend in other themes which were popular outside of China, including Lovecraftian horror, steampunk and high fantasy. Garena modified the content and characters to such an extent that Tencent felt like an entirely new name had to be given to the game. Other examples of significant customisation/localisation includes EA’s FIFA Online, where Garena helped introduce local Southeast Asian football players and icons into the game. This hyper-local approach I believe is the key strength of Garena which has underpinned their growth.

While Garena started off as a PC game publisher, it has been living through Southeast Asia’s rapid rise in mobile penetration over the last decade, and has been able to transition its business away from its PC roots to now being predominantly mobile. In emerging markets, the majority of people cannot afford PCs or consoles, and thus mobile phones are often their sole device for gaming or accessing the internet. Some 87 per cent of the Southeast Asia's gamers play on mobile phones, compared with about 60 per cent in North America and Europe. The popularity of mobile gaming is helping accelerate the growth of gaming in the emerging markets, expanding Garena’s TAM (more on this later).

As well as its transition to mobile, Garena had one other important transition that really catapulted its business to new levels, and that is its move into self-development. While publishing provides a relatively secure revenue stream, it requires the payment of 20-35% royalties to the developers on all booked revenue, eroding the profit margin. While carrying more risk, self-development can lead to significantly higher margins since you don’t need to pay external developers. Development was a natural extension of the heavy content modification work and gameplay tweaks that Garena has already been doing as part of its publishing efforts, but nonetheless this is an extremely challenging transition that few publishers make successfully. Forrest Li poured significant time and resources into building out Garena’s development teams in Shanghai, which now have a headcount of several hundred people.

Free Fire: Garena’s self-developed, global sensation

Garena’s self-development efforts paid off massively with the launch of its battle royale game Free Fire in late 2017. With Free Fire, Garena literally caught lightning in a bottle. It quickly became a global sensation and year after year collected numerous accolades and broke new records:

For two consecutive years in 2019 and 2020 it was the most downloaded mobile game in the world

It Q2’21 it reached over 1bn downloads on Google Play and a record of 150m peak daily active users

In Q2’21 it was the highest grossing mobile game in Southeast Asia, Latin America and India. Free Fire has maintained this leading position for the past eight consecutive quarters in Southeast Asia and in Latin America, and three consecutive quarters in India

It’s also surprisingly gaining significant traction in developed markets - in the US it has been the highest grossing mobile battle royale game for two consecutive quarters, and the second highest grossing mobile game on Google Play for Q2’21

To understand the reasons for Free Fire’s success in what is a competitive field requires diving a bit into the battle royale genre and its key games.

Free Fire vs. the competition

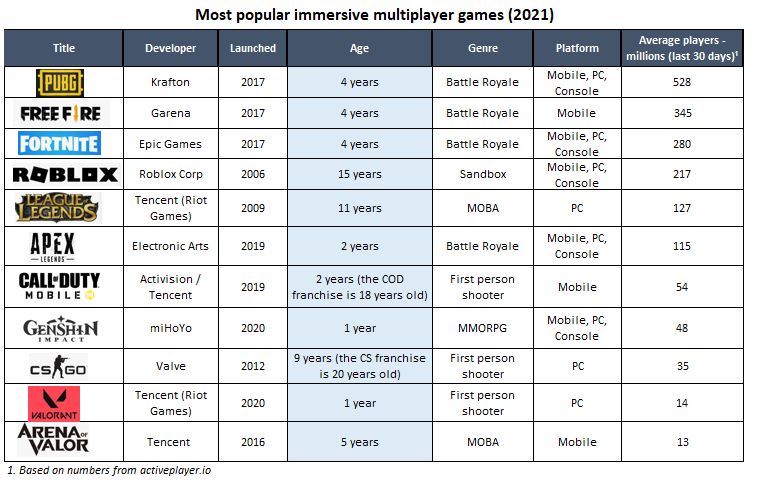

Battle royale is having its time in the sun right now, becoming the most popular game genre over the last few years. Prior to that MOBAs were extremely popular, led by heavyweights such as League of Legends, DOTA 2 and Arena of Valor; and before that MMORPGs had their moment dominated by games like World of Warcraft and Guild Wars. As usually happens during these hype cycles, a number of games emerge trying to grab their share of the market, however most don’t survive. Following the classic pareto principle often exhibited in business, the market typically consolidates around at most 2-3 titles which take the majority of market share due to strong network effects. These games then typically endure for a long time as switching costs are high once players have invested in mastering a game and spent money on their profile.

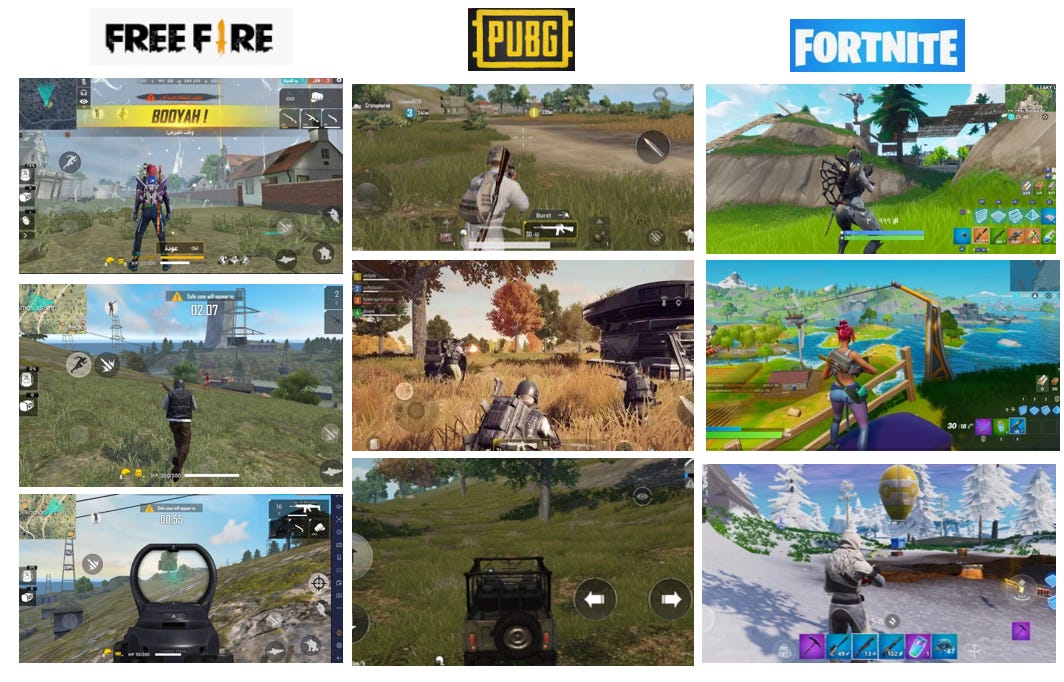

Battle royale is a game mode which pitches dozens to hundreds of players on a map with a Hunger Games style last-man standing survival gameplay. Players must eliminate other opponents while staying within the map’s “safe zone” which shrinks over time, with the winner being the last man or team left alive. The games are usually fast-paced, highly social and unpredictable, and easy to pick up and learn. The most dominant titles in the battle royale genre in terms of number of players are PlayerUnknown’s Battlegrounds (PUBG), Fortnite and Free Fire. All three utilise similar gameplay mechanics, however Free Fire reigns supreme in the emerging markets (Southeast Asia, LATAM and India) while the others are traditionally more popular in developed markets. The reason for this is that Free Fire was first to market in these regions, and most importantly it was created as a mobile-only game, made to be easily played on low-end mobile phones. Given the dominance of mobile gaming in these regions, Free Fire became the obvious choice for people wanting to play a battle royale game. Fortnite and PUBG both started as PC/console games utilising Epic’s Unreal engine, which is very popular with PC/console games and allows for more advanced graphics and gameplay than Free Fire. While both have mobile ports, they demand a large download (~2 GB) and higher system requirements, requiring smartphones on the higher end of the performance spectrum which are more expensive, and a fast internet connection (not always available in emerging markets). In terms of gameplay, it is fair to say that both PUBG and Fortnite offer a wider scope, with more characters, more vehicles, more detailed maps, and ability to handle large player counts each game (up to 100 players). Fortnite also features a sandbox Creator mode which significantly extends its playability. In contrast, Free Fire is more of a lightweight battle royale experience with a much lower download size (launching at 200MB and now sitting at 600MB) and less advanced graphics, but that in turn makes it compatible with even low-end devices and not requiring a fast internet connection.

“Being one of the first to market and with a focus on mobile has been beneficial to us [as it pertains to competition]. All of our designs and product features are made specifically for mobile users, so we didn’t have to translate anything.”

Harold Teo, Producer at Garena

Free Fire drastically reduces the number of players from 100 (as in PUBG) to 50, and has much shorter game times at 10min (vs. 20-30mins for PUBG). Free Fire’s maps are also easier to traverse and have lower number of locations. Various other features are designed to make the game easier to get into for newbies and quicken the pace of the game, such as the aim assist which is significantly more ‘assisting’ than any other shooter game. All of this helps to optimise the game for more casual mobile-play and make it very welcoming for people who have never played shooters before. Also in contrast to PUBG, which has the feel of a more classic military shooter, Free Fire doesn’t take itself too seriously and offers a cartoony, tongue-in-cheek type of experience with lots of fantasy elements, which would resonate with a more general audience. It is more similar to Fortnite in that regard.

Even if consumers in emerging markets upgrade their phones over time as disposable incomes rise, Free Fire’s already well established network effects should ensure the game will continue to stay dominant. Most encouragingly however, its recent performance in the US highlights that it can even win head to head against its more premium competitors in developed markets where hardware requirements are not a constraint. This suggests to me that its gameplay, social aspects and virality are differentiators in their own right. Another way to assess Free Fire’s popularity is Google search interest. As seen below, PUBG and Fortnite initially had much greater interest than Free Fire but flattened out and started declining a bit over time, whereas Free Fire was a slower burn initially but has been steadily building, and has decisively overtaken both of those. This to me shows a more engaged audience over time and that Free Fire has demonstrated the ability to win despite very strong competition.

International expansion

It’s often a bit surprising that when you look up Youtube videos of Free Fire, most are by Brazilian players in Portugese, or Indian players in Hindi, or Middle Eastern players in Arabic. Just two and a half months after Garena soft-launched Free Fire in Southeast Asia (October 2017), it launched globally in 130 countries, with a particular focus on the emerging markets of LATAM, India and MENA. Garena saw a lot of similarities between these markets and that of their home market in Southeast Asia; low incomes, high mobile penetration, lack of access to traditional payment infrastructure, and general underinvestment by big game studios. Free Fire, which was mobile-exclusive and designed to work on low-end phones, was essentially created with emerging markets in mind. Garena invested heavily in the regions themselves, building up teams on-the-ground which are in touch with local communities of gamers, understanding local preferences and requirements. It also poured significant resources into marketing and localising the content to better engage local gamers. With such a heavy focus on these regions from the get-go, it is no surprise that Free Fire quickly became the most popular game in LATAM, India and increasingly MENA.

“If you walk down the street today in Sao Paulo or Mexico City, you are just as likely to see someone playing a Garena game as you would in Bangkok or Ho Chi Minh City… What we have seen from this global success is that many of the factors that drive a game's success in our core market in Southeast Asia are the same as those in other parts of the world. I truly believe that Garena can play an important role in helping to build and develop gaming communities in many faster-developing markets globally, leveraging our success and experience in Southeast Asia.”

Forrest Li (Chairman and CEO), Sea’s Q2 2018 Earnings Call

To grow the game’s popularity in these different markets, Garena has pursued a strategy of localising the content beyond just the text and language. Garena adapts the game to local cultures, festivals and celebrities. For instance in India, they featured big actor Hrithik Roshan as a character in the game, in Brazil they featured footballer Lucas Silva Borges, and for the MENA audience Egyptian megastar Mohamed Ramadan was the first Arab character to be featured in the game. Garena has also been regularly incorporating cultural events into the game to embrace local communities. For instance it hosts special events for Carnival in Brazil, Diwali in India and Ramadan for its MENA players, incorporating in-game events, bonuses, new accessories and other aesthetics. Garena also organises a large number of local e-sports events to further enhance the communities around Free Fire and its other games (more on e-sports later).

Garena’s international success with Free Fire has caught the attention of other developers who have traditionally been underexposed to emerging markets and may be looking for a publisher to help break into these fast-growing markets. It would be a natural extension of the teams and capabilities that Garena has already established in these markets, further increasing revenue opportunities and extending its moat and brand as a leading global company.

“...one specific opportunity we are very excited about is because of Free Fire now doing very, very well in Latin America. And this generated a lot of interest from global developer community and which they never really launched their games in Latin America. And they see our success, they come to us and we have multiple discussions with the global game developers to potentially launch their portfolios in Latin America so with us. So we see this could...tremendously increase our addressable market beyond Southeast Asia. So we are very excited about this opportunity.”

Forrest Li (Chairman and CEO), Sea’s Q1 2019 Earnings Call

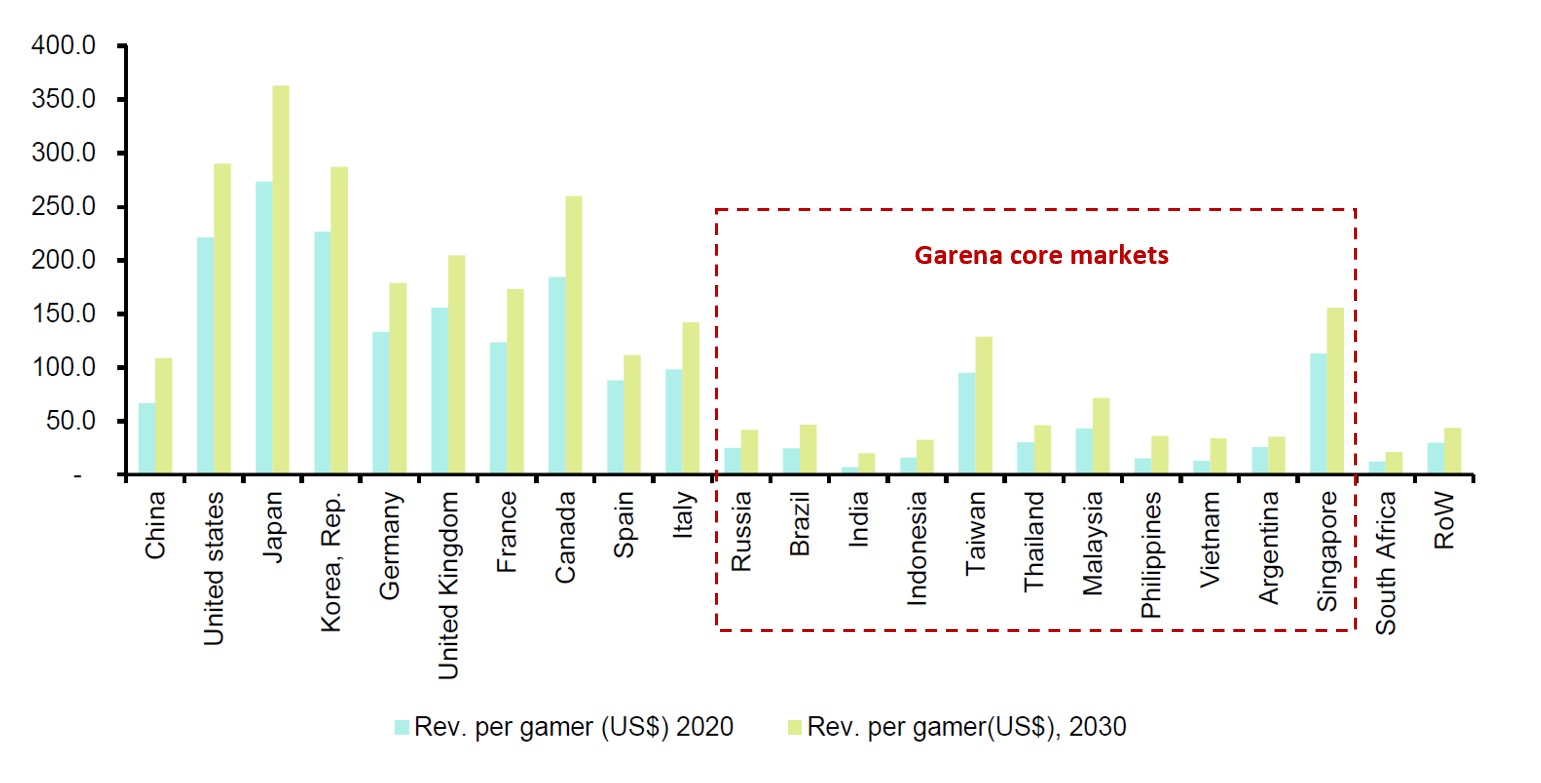

THE GAMING MARKET OPPORTUNITY

Video gaming is a structural growth industry, growing faster than all other entertainment mediums. Essayist and venture capitalist Matthew Ball in his fantastic 2020 article “7 Reasons Why Video Gaming Will Take Over” beautifully articulated the reasons for the growth of the medium, and I highly recommend everyone read this article (I also summarise the key points in my Take-Two deep dive, so won’t repeat it here). Garena benefits from a couple of other specific market tailwinds that should underpin its growth for years to come. From the perspective of the overall target addressable market (TAM), there are currently approximately 3.2bn2 gamers globally, and with Garena having 725m quarterly active users, that would imply a ~22% market share. This may seem like a fairly large market share, however on a dollar revenue basis, Garena’s share is much smaller; of the ~$220bn global market3, Garena’s ~$4.5bn of bookings only represents about ~2%. This is because more than 80% of gaming spend is concentrated in the more mature North America, Western Europe and East Asia (China, Japan, Korea), despite these regions only accounting for 32% of the population. As can be seen in the chart below, the average revenue per gamer in these developed markets is considerably higher than the emerging markets where Garena is most focused on (Southeast Asia, LATAM, India).

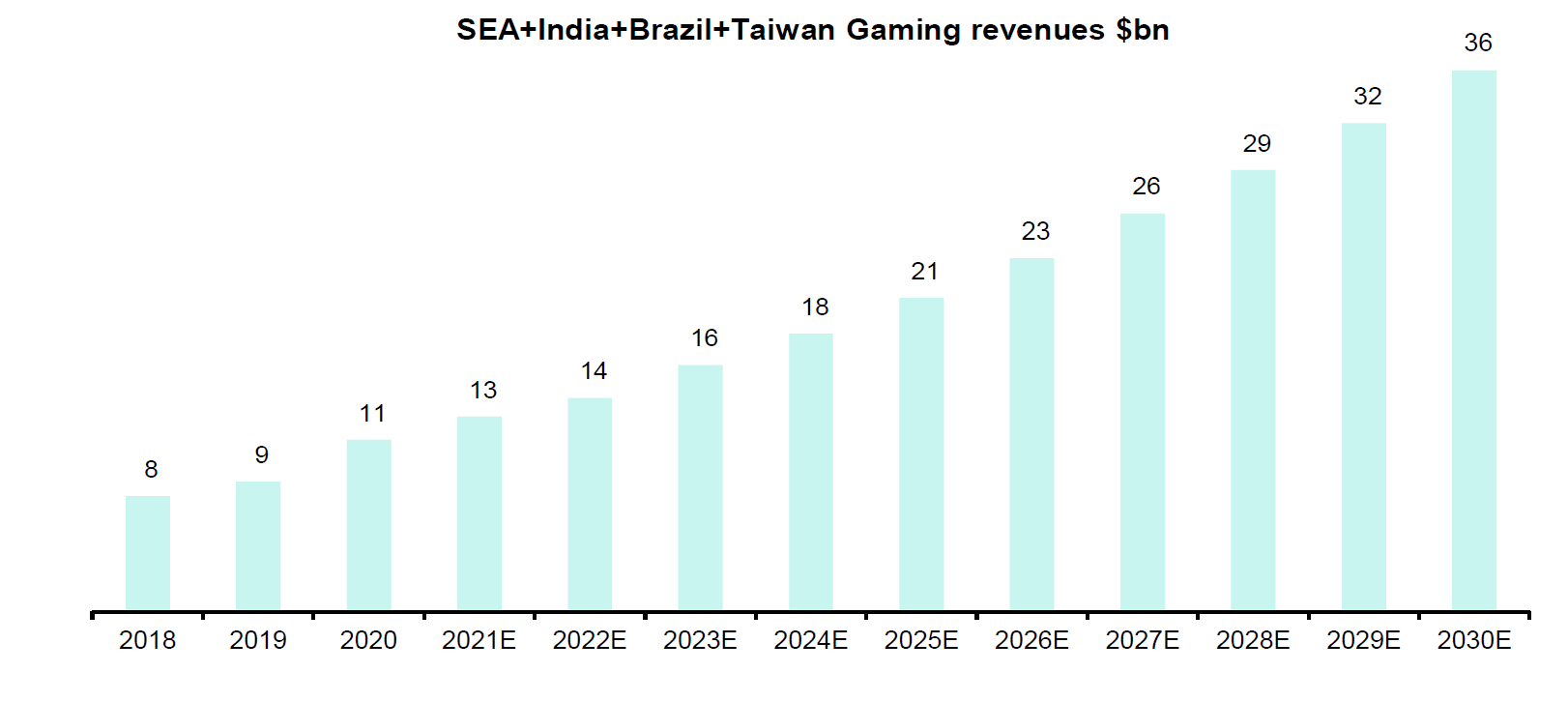

The growth of gaming spend in Garena’s core markets is expected to significantly outpace the rest of the world, growing at a CAGR of 13% to 2030, double that of the whole gaming market which is expected to grow at c. 6%. Therefore the TAM for Garena is large and growing.

ASSESSING THE SUSTAINABILITY OF FREE FIRE

The longevity of Free Fire is one of the most important questions facing Sea investors. Garena is the cash engine crucial to funding Sea’s other loss-making growth businesses, and the majority (65-70%) of Garena’s earnings single-handedly come from Free Fire. The bear case is that Free Fire, which is about to enter its 5th year, may be nearing the end of its lifecycle, and if it unwinds then it may bring down the entire business before it is able to reach profitability. There is sometimes the comparison made between Garena and AWS as the two cash engines of the broader Sea/Amazon businesses respectively. I think Sea’s position is significantly shakier, as a gaming business, particularly one that is concentrated in one title, is in no way comparable in risk / cashflow profile to one of the leading cloud businesses in the world. However, I believe evidence seems to suggest that Free Fire may be becoming one of the enduring global gaming franchises with an extended lifecycle. As I discussed extensively in my deep dive of Take-Two, leading, category-winning game franchises have exceptional durability with strong network effects, user stickiness and ‘winner-take-most’ dynamics. I believe Free Fire has established these characteristics as it has developed a franchise effect and become one of the key winners in the battle royale category. I will now step through my arguments on why I believe this is the case.

Pareto principle and winner-take-most dynamics in gaming: very few franchises become category leaders, and those that do, generally last a long time

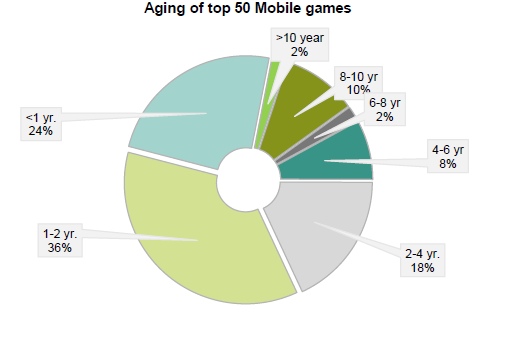

There is a classic pareto principle and winner-take-most dynamic in gaming whereby a minority of games in each category will tend to draw most of the players, dollars, and reinvestment, allowing them to exist for a long time, whereas majority of the long tail won’t survive past 1-2 years. It is generally very difficult to keep monetisation and engagement somewhat stable or growing year on year. Bernstein produced this really interesting analysis that breaks down the aging of mobile games, which shows that only ~20% make it to 4 years+. By getting to this point, Free Fire has already beaten the odds and has proved itself as a title that is amongst the minority that has had an extended lifecycle.

With Free Fire now entering its 5th year, some might argue that this brings it closer to the end rather than the beginning. However, if we look at for instance just the current most played online multiplayer games in 2021 across all platforms, the majority have been around for 4yrs+, and many games/franchises are over a decade old, emphasising once again the incredible user stickiness for the top games in each category.

Another important point is that some of the longest running games which have become category leaders are still generating significant revenues despite being well past their peak in popularity, largely driven by the stickiness of their online multiplayer users:

World of Warcraft (17 years old); one of the long-standing leaders of the MMORPG genre, is still bringing in almost ~$1bn of annual revenue;

GTA 5 (8 years old); the defining game of the open-world genre, is still bringing in almost ~$1bn of annual revenue, most of it via in-game spending in the multiplayer mode GTA Online;

Call of Duty (annual iterations, but first launched in 2003); the heavyweight of the FPS genre, is bringing in over ~$1bn annual revenues, with the online mode being a key driver of its popularity

Roblox (15 years old); a purely multiplayer sandbox game, is bringing ~$2bn annual revenue and growing rapidly

Candy Crush (9 years old); casual mobile game, is bringing in over $1bn annual revenue and still growing

The key point is that even after the popularity of Free Fire or the battle royale genre starts fading, whether that’s next year or in a few years, it can still be expected to bring in stable (even if slightly declining) revenues for many years into the future due to a long tail of sticky users who will still be happy to spend in the game. On that note, it was encouraging to hear management’s Free Fire cohort analysis show continued strength in both its older and newer cohorts - a positive data point which shows the continuing strength of the game despite its age:

“Our Free Fire cohort analysis shows that even as strict lockdowns in our core markets have been gradually eased since the second quarter of 2020, time spent per daily active user on Free Fire remained far higher than pre-pandemic levels. We are encouraged to see that for older cohorts, the time spent per active user, and especially paying user ratio, are still rising even though these users have been playing Free Fire since its early days. New cohorts also start off stronger than older cohorts, displaying a higher and faster growing paying user ratio than older cohorts over time.”

Forrest Li (Chairman and CEO), Sea’s Q1 2021 Earnings Call

As a massive online multiplayer game, Free Fire has infinitely scalable playability, strong network effects, and a regular stream of content updates and events through its live ops concept of game development

A lot of the belief that video games are one-hit wonders and have short life spans relates largely to traditional offline games. These games tended to be monetised just once upfront at purchase and completed within a set number of hours, resulting in the games generally fading in interest within a few months or a year unless they became franchises with a regular release cadence (Call of Duty, Assassins Creed etc). However, games are now increasingly moving online and many now only have multiplayer modes, which means they can accumulate large audiences and have content that is dynamic and constantly being updated. There is no need for game developers to write new storylines or build new levels just to extend the playability of a game. Games like Free Fire are born as massive online multiplayer games, the social nature of which means that every time you play it will be a new experience, bestowing the content with unlimited scalability and playability. It also exhibits strong network effects; people prefer to play games that they know everyone else is playing, which increases player stickiness. With Free Fire being the most downloaded mobile game in the world for two years running and hitting 150m peak daily active users in 2021, it’s safe to say that its network effects are significant. The monetisation model has also shifted from upfront purchases associated with traditional offline games, to digital-born models such as “freemium” - free to download with optional in-game purchases. This means that games can build up a user base much more quickly who then can choose to pay for things like cosmetic upgrades, weapons or other attributes as they see fit, which makes the revenue more recurring rather than lumpy.

To help extend the lifecyle of Free Fire, Garena utilises a live ops concept of game development, with around half of its developers just working on updating new content for the game in fast iteration cycles. Every month for instance Garena releases new themed skins, weapons accessories (accessed via the paid Elite Pass), which keeps the game fresh. Garena also often organises themed-events and collaborations with culturally popular brands. For instance, it has had collaborations with popular Netflix TV series Money Heist, a music collaboration with popular EDM musician KSHMR which saw the release of a track and music video Booyah, and a collaboration with football legend Cristiano Ronaldo, which saw him appear as a playable character in the game.

Finally in what may be its biggest sponsorship deal to date, Free Fire recently became the official sponsor of the Brazilian national football team in a two year deal. This is a good move that capitalises on the popularity of football in the country and will introduce new skins with the Brazilian jersey in the game, and introduce Free Fire activations during matches.

In summary, all of the above elements - the social multiplayer nature, the constantly evolving content and playability, network effects, monetisation model, and special cultural events and sponsorship - enhance Free Fire’s adoption and durability.

E-sports: enhances community and network effects

Garena has been one of the key players in driving the growth of the nascent global e-sports market. It regularly organises e-sports events around the world (hundreds per year), which are important in building communities around Free Fire and other Garena games. E-sports is important in growing its games’ network effects and user stickiness by introducing new players to the games and strengthening relationships between existing players. Since 2018 Garena has been hosting an annual e-sports event called Garena World in Bangkok, which showcases competitions for its range of games. Garena World has become the biggest gaming and e-sports event in Southeast Asia, with the most recent 2021 version (held virtually) attracting an online attendance of 1.2m and 40m online views across social media, and hosting tournaments for Free Fire, Arena of Valor, Call of Duty Mobile, and FIFA Online. More specifically to Free Fire, Garena’s hosts its annual global tournament Free Fire World Series. The 2021 edition, which had a prize pool of US$2m and 18 teams across the world, held its finals in Singapore and attracted a peak viewership of 5.4m - the highest for any e-sports match outside of Chinese platforms. It’s worth noting that as an industry, e-sports is expected to experience huge growth. Grandview Research estimates that the global e-sports market was US$1.1 billion in 2019 and could compound at an impressive annual rate of 24.4% from 2020 to 2027. Garena is extremely well positioned to capitalise on this growth and strengthen the durability of its games in the process.

Free Fire as a platform: new versions, in-game modes, and the Metaverse

Sea management has been increasingly referring to Free Fire not just as a game, but as a platform. This has a number of elements to it that extend the Free Fire offering beyond just its original core game. Firstly, an enhanced version of the game, Free Fire Max, is due for launch globally later this year (it’s already been launched in MENA). Essentially Free Fire Max is a more upmarket version of Free Fire; it has exactly the same gameplay but with enhanced graphics, sound, and more realistic appearances of weapons, gunfire and other effects. In turn, it is more spec-heavy and larger in size (1.5GB vs. 600MB for Free Fire), suitable for those with more expensive higher-end mobiles. The two versions are meant to be interoperable and can be accessed with the same login credentials and all your Free Fire data (costumes, skins, ranks etc.) carried over. This means that you could play either version depending on your mobile device and preference. As discussed earlier, one of the ‘disadvantages’ of Free Fire vs. its more advanced competitors like PUBG and Fortnite has been its more cartoonish, less realistic graphics, which is perhaps why it’s traditionally not been as strong in developed markets. Free Fire Max aims to improve these exact points and target a more upmarket audience, thus it will be interesting to see whether this new version will help grow the game’s presence in developed markets, particularly on iOS. However it’s also encouraging to see Free Fire becoming a top grossing game in the US recently without the need for Free Fire Max, showing that it can outcompete its more advanced competitors on its own.

Garena is also experimenting with new modes within Free Fire so that people can enjoy experiences outside of just the battle royale mode. During Q2’21 they introduced Pet Rumble, an Among Us-inspired social deduction game mode where players can use their in-game virtual pets to take part in a game of cooperation and infiltration. These ancillary experiences are meant to be highly social and community-enhancing. Garena clearly understands that the more Free Fire can become an experience where people spend time and hang out rather than just a battle royale game, the greater its durability will be. It is steering Free Fire closer to the direction of the Metaverse (what’s a gaming article without at least one mention of that buzzword). It regularly hosts party events where people can hang-out with friends, partake in new in-game activities, receive various gifts and rewards, and watch concerts and in-game displays. Its most recent event, Free Fire’s fourth year anniversary party room, hosted superstar EDM DJs Dimitri Vegas & Like Mike, Alok, and KSHMR, who even created a new track for the event. Essentially, Free Fire is evolving from just a game to a social experience, which should enhance its staying power over time.

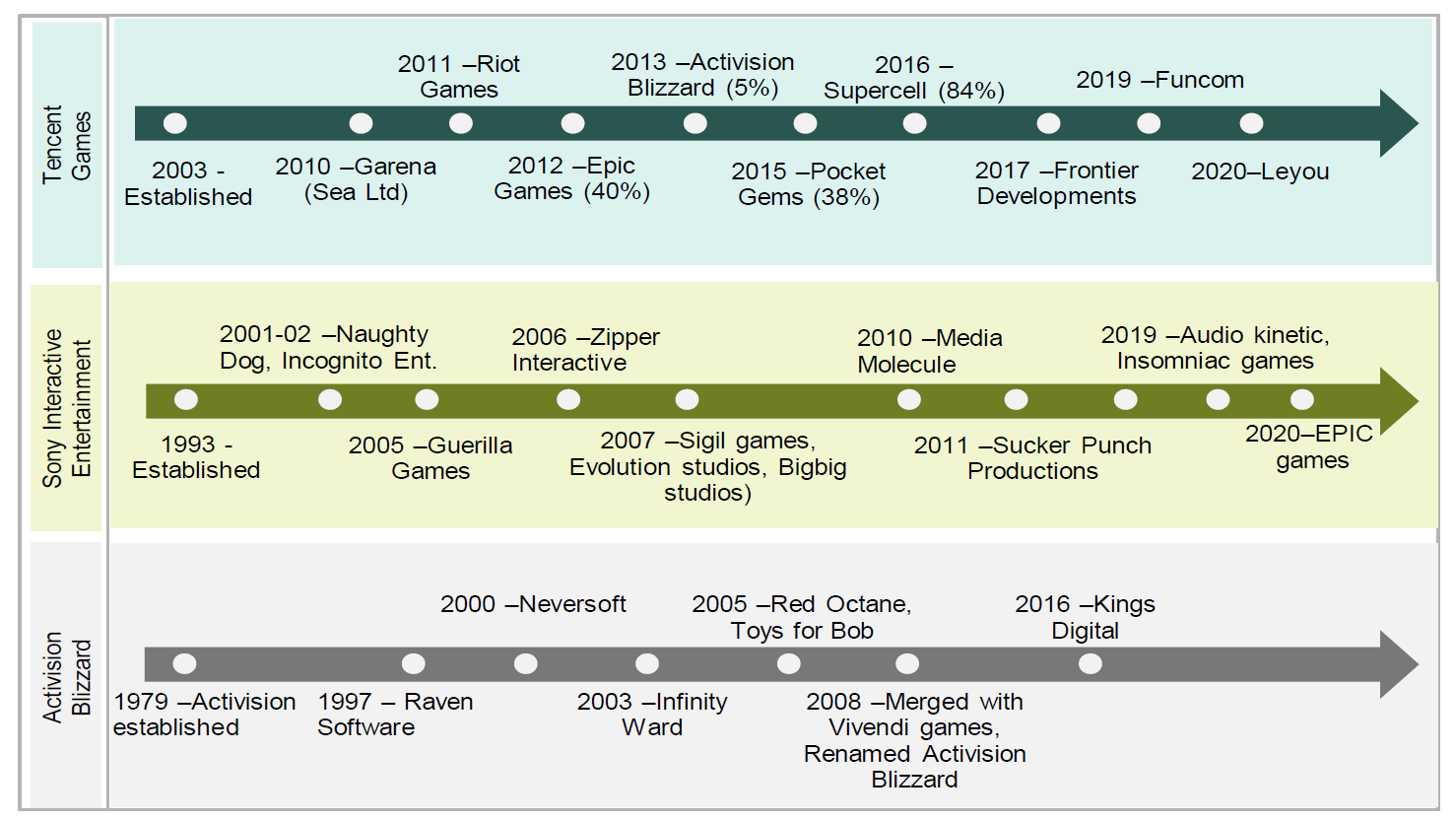

GARENA’S ACQUISITION STRATEGY

M&A is a very common growth strategy for global gaming companies, with most of the world’s current biggest franchises having originally come from acquisitions. Game development is a highly creative and complex process with success often unpredictable and difficult to put into a repeatable formula. While a development team may achieve phenomenal success with an internally developed game (like Garena has with Free Fire), it doesn’t mean that they can necessarily replicate the same level of success with all future games. Successful games are just as likely to come from independent studios as they are from large developers, and that is why larger gaming companies try to invest in these studios while they are still young and relatively small, particularly if they have seen some early success in publishing the games of that studio. They can then use their financial muscle and marketing/distribution capabilities to scale these games and hopefully turn them into commercial successes. The below chart (from Bernstein) summarises the acquisition path of some of the world’s biggest gaming companies.

Tencent, for instance acquired independent US studio Riot Games in 2011, the developer of the hugely successful MOBA game League of Legends (it first invested in the company in 2008). League of Legends then inspired Tencent’s massive Honor of Kings, which then became Arena of Valor (published by Garena). Activision’s Call of Duty came out of a $5m acquisition of studio Infinity Ward in 2003. It’s other huge franchises World of Warcraft, and Candy Crush came out of the acquisitions of Blizzard and King respectively. Take Two’s iconic franchise Grand Theft Auto, came out of an acquisition of studio DMA in 1999 for just $11m, just like its huge sporting franchise NBA2K which came out of a $24m acquisition of Visual Concepts in 2004. Garena is also following a similar playbook. In 2015 it acquires S2 Games, the developer of Heroes of Newerth, a PC MOBA game that Garena published in Southeast Asia and Russia. In January 2020 it made its biggest investment, acquiring Canadian game developer Phoenix Labs for an estimated $150m. Garena was also one of the early investors in Phoenix Labs, employing a similar strategy to Tencent of first making a small investment to learn about the company and then following through with a complete acquisition. This may prove to be an interesting growth option which should help diversify Garena’s business away from Free Fire and entrench its position as a leading global gaming company.

Phoenix Labs

Phoenix Labs was started in 2014 by three ex-Riot Games developers Jesse Houston (CEO), Sean Bender (CPO) and Robin Mayne (VP of Development). All three had leading roles in the development of League of Legends and significant industry experience prior to that (Ubisoft, BioWare). Phoenix Labs is a AAA game producer with approximately 150 employees at across four locations - Montreal, LA, San Mateo and Vancouver. At the moment they are best known for their MMORPG called Dauntless. Dauntless is a free-to-play game that was launched on consoles and PC in 2019 and currently has over 25m registered players. While this doesn’t make it a massive game, it is considered to be a high quality title that is being built for longevity rather than fast growth. Phoenix Labs trialed a number of monetisation methods before settling on the Hunt Pass - similar to a season pass, it is a model which encourages and rewards gameplay. What makes Phoenix Labs unique is their team’s aligned values around strong community engagement and ongoing dialogue and transparency, ensuring that the community feedback is constantly being considered and getting gamers vested in the development process. Dauntless is currently predominantly played in the North America, with barely any presence in Asia. There would be significant opportunity for Garena to publish the game in Asia and other regions, and as part of that create a mobile version which is more compatible with these markets. Aside from Dauntless, Phoenix Labs is working on a number of other game projects across their four studios and is ramping headcount significantly. Since Sea’s acquisition the company has added 50 employees during 2020 and is targeting 250 employees by the end of 2021. It also added two new studios - Montreal and LA, headed up experienced senior developers from Ubisoft and Riot Games, which are working on new game prototypes as well as supporting the ongoing development of Dauntless. The financial value of Phoenix Labs is hard to quantify, and it is fair to say that the jury is still out whether this was a wise piece of capital allocation by Sea. However I like the fact that it provides Sea with the optionality to generate new IP and further diversify their gaming business.

Other investments

Garena has made a number of investments in small/seed-stage mobile game studios in the last 12 months:

Double Loop, a US-based mobile startup who is working on a social hybrid puzzle game

UnusuAll, a Barcelona-based a mobile game developer started by former members of King’s Barcelona studio focused on creating casual, unique, and social games

Hound 13, a Korean studio known for its mobile action RPG Hundred Soul. This was one of Garena’s bigger recent investments at more than US$17.5m

While these investments are relatively small, they show Garena’s intent to keep investing in new gaming IP, especially ones that are mobile-orientated and social in nature, consistent with its core strengths.

FINANCIALS AND VALUATION

Business model

Free Fire along with Garena’s other games adopt a ‘freemium’ model, with the games available for download for free, and then monetised via several in-game methods. I will focus on Free Fire given it accounts for majority of the revenue. It should be noted that none of these monetisation methods are ‘pay-to-win’ features, i.e. they do not improve a player’s competitive positioning, which is a very controversial feature as it can make the game unfair and unbalanced for those who choose to spend money to get an advantage. All of these methods purely give you cosmetic upgrades.

Elite Pass and Elite Bundle: This is a monthly package which grants access to exclusive in-game cosmetic items for doing certain daily tasks (Elite Pass) or instant access to the items (Elite Bundle). Depending on whether you get the Elite Pass or Elite Bundle, the package costs between ~$5 to ~$13 (paid via the game’s virtual currency Diamonds) and gets renewed at the start of each month. For instance the most recent Elite Pass Season 40 granted access to Wildland Walkers bundles, with themed skins, weapons and accessories.

Memberships: Free Fire offers weekly and monthly memberships (~$2 and $8 respectively) which allows players to buy Diamonds at a discounted rate, which can then be used to make cosmetic purchases in-game

In-game store: Free Fire offers many in-game items and cosmetics that the players can purchase from the in-game store. This includes fashion items, weapon skins and special characters. There are 35 characters available for purchase at different prices. with the cheapest starting from ~$2.

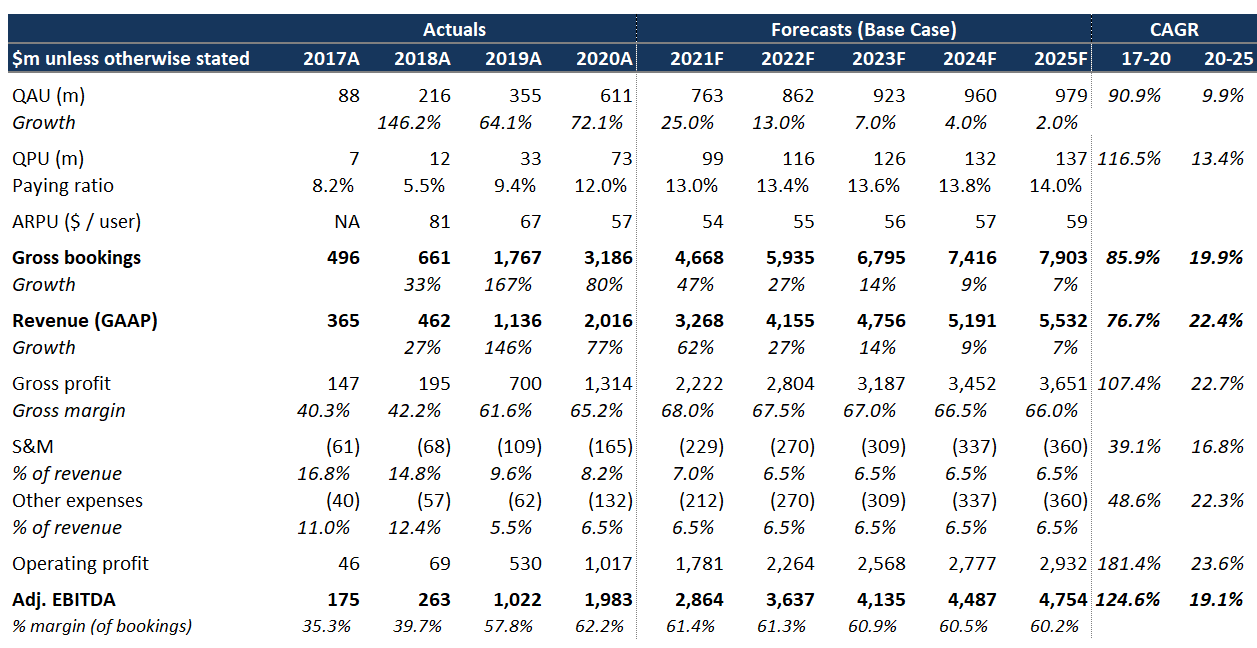

Forecasts

I will caveat upfront that forecasting and valuation is an inherently imprecise activity, and I do not hang my hat on these numbers. I run models as it helps me visualise the business, understand the key drivers of returns, and get a rough sense of valuation and risk-reward asymmetry. I run a five year model to calculate a range of possible IRRs / valuations over such a hold period. I will outline the basis for my forecasts here at a high level but happy to share my detailed model or assumptions with anyone who should request it.

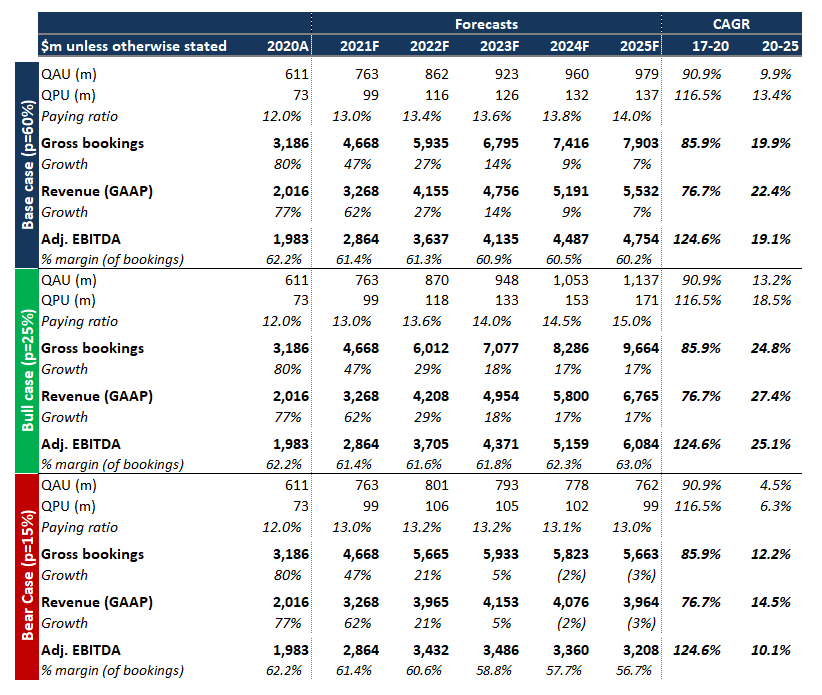

Revenue: The key driver of Garena’s revenue is its Quarterly Active Users (QAU) and the conversion to Quarterly Paying Users (or the paying ratio). Garena only discloses QAU/QPU at an aggregate level, not by game, but generally the consensus is that that Free Fire accounts for ~65-70% of Garena’s revenue, so it would account for the majority of the QAU. QAU has grown tremendously, a ~91% CAGR between ‘17-20, reaching 725m at as at Jun-21, driven by the global success of Free Fire. I have assumed that FY23 (its 6th year) will be the peak year for Free Fire, with its player base seeing low single-digit percentage declines from there. Despite declining Free Fire QAU, aggregate Garena QAU should still continue to grow slightly as Garena publishes a large number of games and adds new ones every year. Overall QAU CAGR is 10% from ‘20-25, reaching 980m by FY25. The paying ratio has increased significantly from 8% in FY17 to its current level at c.13%. I have assumed that the paying ratio keeps improving but at a slower rate - reaching 14% by FY25. This should be realistically achievable, given similar companies like Tencent have paying ratios at c. 20%+ (albeit they are a best-in-class gaming company who is the go-to game publisher in China, so we would expect that Garena would never reach these levels). With some moderate ARPU growth I have gross bookings growing from $3.2bn in 2020 to $7.9bn by FY25, a c.20% CAGR. This is obviously a significant slow down from exceptional 77% CAGR between ‘17-20, and some would say a bit conservative, but I would prefer to underwrite a more conservative base case and hopefully be surprised on the upside (I explore bull and bear cases later on)

Margins: As Free Fire started comprising a larger proportion of Garena’s revenue, its gross margins and EBITDA margins expanded rapidly as Garena doesn’t need to pay the ~30% developer licensing fees on Free Fire given it is self-developed. The only real incremental cost to them is the 30% platform fee paid to Apple/Google app stores, but it can also circumvent that by encouraging transactions through the Garena store or using Garena ‘top-up’ cards. There are ongoing development costs as well but these are relatively low for mobile games (compared to say AAA-game development). This is what allows Garena to generate exceptionally high profitability and cashflows. Garena’s Adj EBITDA4 margin (as a % of bookings) went from 35% in FY17 to an extraordinary ~62% currently. This really encapsulates why Garena is the cash engine of Sea. For conservatism, I have assumed that these current margins are peak margins for Garena and baked in some decline over the forecast period. This incorporates both the decline in Free Fire which I assumed starts from 2023, and Garena not being able to reduce its sales and marketing expense as % of revenue as it tries to ramp up promotion of Free Fire and other games. Overall Adj, EBITDA grows from ~$2bn today to $4.8bn by FY25, a reasonable 19% CAGR.

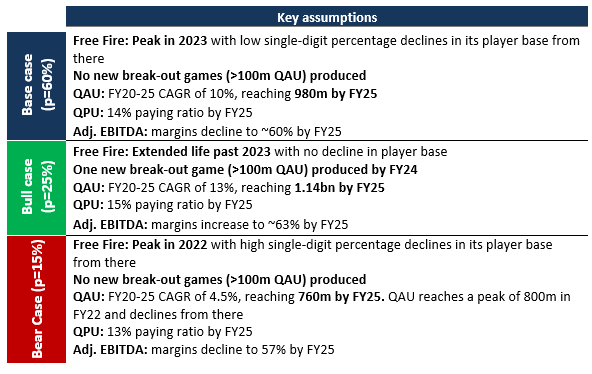

Bull and Bear Cases

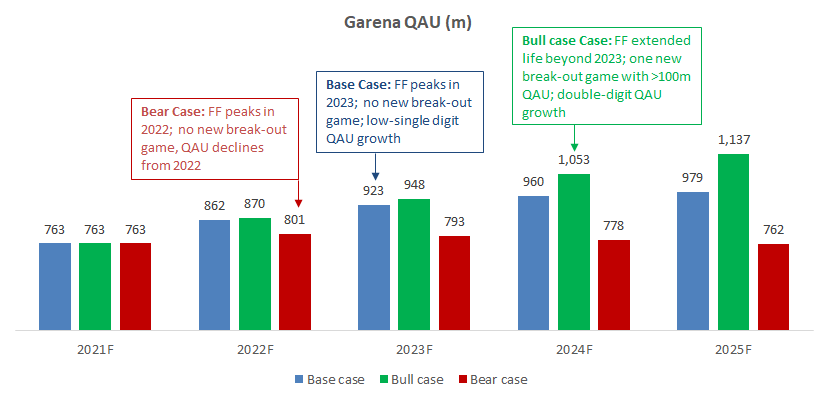

There is significant uncertainty with forecasting a high-growth gaming business such as Garena, made even more difficult by its concentration in one title. Given the wide range of potential outcomes, I have also run bull and bear cases, which I then combined with my base case in a probability-weighted valuation. The key difference between each case is the year in which Free Fire matures and the rate of decline, and whether Garena is able to produce another break-out game (which I define as >100m QAU) to fill the gap. The summary of each of the cases is as follows:

The below chart summarises the QAU path under each scenario.

The below table summarises the key financial KPIs under each scenario.

Overall, the above scenarios results in the following FY25 outcomes:

Gross bookings in the range of $5.7bn to $9.7bn (vs. $3.2bn FY20)

Adj. EBITDA in the range of $3.2bn to $6.1bn (vs. $1.9bn in FY20)

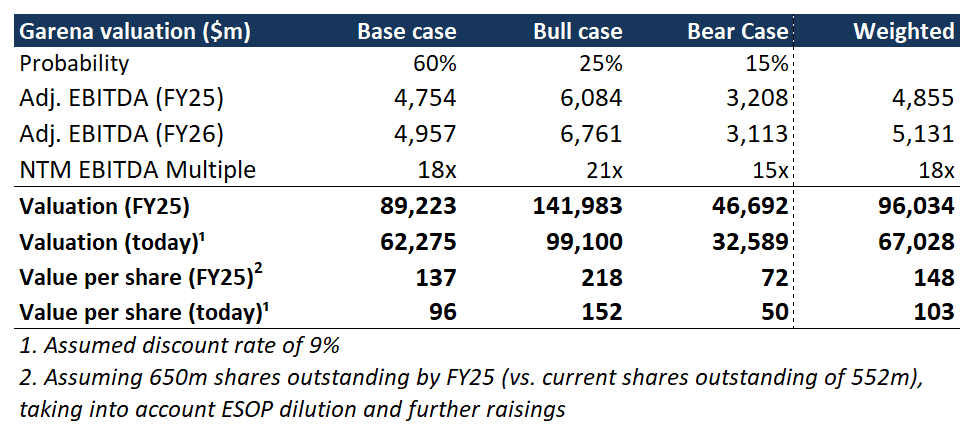

Valuation

I have used long-term sector trading multiples to value Garena in FY25. Looking at the 5-year average rolling NTM EBITDA multiples of key gaming comps (such as Tencent, Activision, Take-Two, EA) an NTM EBITDA multiple of 18x appears reasonable for valuing Garena in the base case. The growth rate of Garena in the outer years under my base case is in line with the growth rate of more mature peers (Activision, Take-Two, EA). These companies typically trade in the 15-18x EBITDA range, however given Garena’s significantly higher margin profile I believe the higher end of 18x should be appropriate. The bear case I have pegged at 15x (the bottom end of the comp range) and the bull case at 21x (based on Tencent’s 5yr average). The resulting probability-weighted valuation is below:

In the base case I am deriving a valuation of ~$62bn if discounted to today , or $96 p/share. However we can see that the range is pretty wide; between $33bn ($50 p/s) to $99bn ($152 p/s). The bottom end (bear case) might look pretty dire, however just to emphasise that this is a scenario which captures the risk of Free Fire dissipating quite early and Garena not being able to replace those lost earnings with another successful game. Based on management’s consistent track record of outperformance to date I would think that my bull case is more likely than the bear case - certainly the market consensus for the expected peak year for Free Fire has been continuously pushed out as the game just keeps surpassing all expectations. Thus I’ve assigned a slightly higher probability weight to the bull case than the bear case (bull case p = 25%, base case p = 60%, bear case p = 15%). Probability-weighting the different scenarios I get a weighted valuation of $67bn if discounted to today, or $103 p/share today.

I will go through the valuations of the other businesses (Shopee, SeaMoney) and the my final IRR calculations in the subsequent articles.

Concentration risk

I want to make one more observation around the concentration risk of Free Fire. By most estimates, Free Fire is believed to account for between 65-70% of Garena’s revenue. While this level of dependence on one game certainly appears high, it is not unusual for earnings of gaming companies tend to become concentrated in a few titles/franchises due to the pareto principle and winner-take-most dynamics that gaming exhibits. For instance:

Activision has 76% (FY20) of its revenue coming from three franchises: Call of Duty, World of Warcraft and Candy Crush

Take-Two has over 85% (FY21) of its revenue coming from three franchises: Grand Theft Auto, NBA2K and Red Dead Redemption

And there are many other examples. While none of this reduces the very real concentration risk that Free Fire represents, for all of the reasons I described in this article I am comfortable that Garena can sustain the Free Fire franchise for many years and that it will continue to diversify its business through a pipeline of new published games and acquisitions.

CONCLUSION

In summary, I believe Garena has established a significant moat that is being extended through the phenomenal success of Free Fire. Its Tencent relationship and the strength of its hyper-local approach gives its publishing business a sustainable competitive advantage in the Southeast Asian region. Further, I believe Free Fire will have staying power as it’s becoming one of the key winners of the battle royale category and an enduring franchise supported by Garena’s live ops development, localisation efforts and strong network effects. Even if its popularity starts to decline in the next few years, precedents have shown that enduring franchises can still generate significant earnings for many years. The global success of Free Fire is in turn raising Garena’s profile internationally, which will have synergies for the rest of its gaming business and not to mention Sea’s other businesses, namely Shopee (to be covered in the next article).

If you made it to the end, thank you for reading and hopefully you found the article helpful. I welcome all feedback, good or bad, as it helps me improve and clarifies my thinking. Please leave a comment below or on Twitter (@punchcardinvest).

Also if you’d like to receive Parts 2-4 of my Sea deep dive as they’re published, or future deep dives on other tech companies, please subscribe below.

The agreement covers Taiwan, Thailand, Indonesia, Singapore, Malaysia, and the Philippines. Vietnam is the only country in Southeast Asia excluded from the agreement, likely because Tencent has an investment in publisher VNG Corporation there.

Source: Statista.

Triangulated via a few sources such as Bernstein and Take-Two management.

The company focuses on Adj. EBITDA as the key earnings metric as it is more representative of the cash earnings. The key difference between its Adj. EBITDA and GAAP EBITDA is that it takes bookings instead of GAAP revenue. Bookings is a higher figure as it represents all cash received upfront but not necessarily recognised yet as revenue (pre-paid virtual currency and other memberships which haven’t yet been spent/utilised in-game).

this is one of the best researches on SEA i have seen.. thank you so much for enlightening us.. one question.. how did you get the split of Sales and Marketing and other income for just Garena? There is 1,016,793 of operating income i can see for Digital entertainment in their 10-K for end 2020.. but i cant find the split for the operating expenses for Digital entertainment between S&M and other expense. Any suggestion would help. Thanks!

Thanks a lot for writing this detailed blog. Most of the analysis I have read on Sea just mentions the Free Fire concentration risk and stop. They don't elaborate on how superhit games evolve, risk profile of other game developers, how Free Fire has already extended its longevity, etc.