Zebra Technologies: The Picks and Shovels of Industries

Zebra Technologies (ticker: ZBRA) is an under-the-radar company which receives little attention due to its somewhat unglamorous, industrial-like products, and relatively low growth. However, it is the definition of a quality compounder who’s solutions are essential to just about every physical asset-based industry. In this piece I will step through the business and its value proposition, the investment thesis, valuation and projected returns, and risks.

The TLDR version:

Zebra is the global leader in the provision of enterprise-grade barcode printers, scanners and mobile computers, as well as an expanding software business

Zebra’s products are mission critical to most industries from e-commerce to healthcare. Its growth is underpinned by structural trends towards automation, mobility, IoT and cloud, all of which have been accelerated by the pandemic

It is the undisputed market share leader in its product categories, and its moat is being enhanced by its superior go-to-market strategy and continued investment in value-add software solutions which increase switching costs

It is highly profitable (20%+ EBITDA margins), has high FCF generation (currently trading at 4.5%+ FCF yield), strong ROIC (20%+), and sensible capital allocation towards accretive bolt-on software acquisitions and share buybacks

The stock is down over 30% over the last few months, and the current price of $415 (21x fwd P/E) I believe is a reasonable entry point. My base case suggests 5 year IRRs in the 10-15% range

Disclaimer: I am long Zebra, and this article is not investment advice nor a substitute for your own due diligence. The objective of this article is to help formalise my thinking on the stock and hopefully provide some interesting insights on the business.

BUSINESS OVERVIEW

Zebra is a $22bn market cap company who’s core business is designing, manufacturing and selling barcode printers, scanners and mobile computers which are used for scanning, tracking and recording the movement of assets. In addition, it is expanding its suite of software solutions which enable its users to generate data analytics, predictive insights and monitoring. All of these solutions are critical to customers across a range of industries in helping them improve operational efficiency, optimize workflows, increase asset utilization, improve regulatory compliance, and improve customer experience.

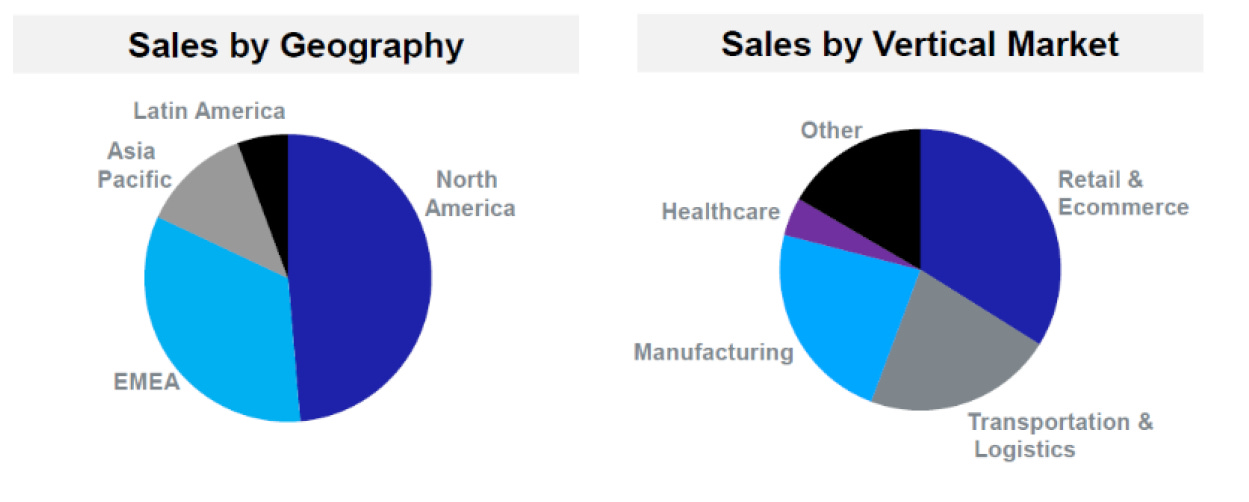

The business was started in 1969 and is headquartered in Illinois, US, however it has operations across the world with over 8,800 employees in 45 countries. US accounts for about 50% of its revenue, EMEA 35%, Asia Pacific 10% and LATAM 5%. Its products are distributed through a direct sales force as well a network of over 10,000 channel partners (more on their go-to-market strategy later).

Zebra is diversified across a range of industries including retail and e-commerce, transportation and logistics, manufacturing, healthcare, hospitality, warehouse and distribution, energy and utilities, government, public safety, education, and banking enterprises around the world. Its highly diversified customer base has given the business a high level of resiliency over the last two years of the pandemic. As some customers have experienced significant disruption (such as retail and hospitality), this has been offset by others who have seen significant growth (such as e-commerce, logistics and certain segments of healthcare).

The company doesn’t disclose the exact mix or number of its end users, but it is estimated they have over 10,000 customers globally. It claims to have 94 of the Forbes 100 companies as customers. Some of the better known customers can be seen below:

Zebra segments its business along two lines: Asset Intelligence and Tracking, and Enterprise Visibility and Mobility (EVM).

Asset Intelligence and Tracking (AIT) (30% of FY21 revenue)

The AIT segment designs, manufactures and sells barcode and card printers which produce labels, wristbands, tickets, receipts and plastic cards. These are used for a range of applications such as routing and tracking of inventory, transaction processing, personal identification, and receipts and ticketing.

The printers come in the form of heavy duty, rugged industrial models to less rugged mobile models for relatively lighter workloads. The emphasis is specifically on durability and high volume industrial usage. Most of the product range focuses on barcode printing, but Zebra also offers RFID tag printers, and other location solutions. The products range from simple desktop printers ($400-800 price point) to industrial print engines (over $10,000).

Enterprise Visibility and Mobility (EVM) (70% of FY21 revenue)

This segment is really the core of the Zebra business and represents its range of mobile computers, scanners and value-add software solutions. Mobile computers is the largest product category of this segment accounting for about 70% of its revenues. Essentially mobile computers are rugged, industrial smartphones or tablets. They have a number of features which makes them superior to normal smartphones:

Protective casing which allows them to be used in any environment

They can detect and read at speeds and distances that typical smartphones can’t match

They operate at a much higher security standard

They have a software suite and operating system that is especially built for enterprise use.

The apps and general software of these mobile computers differs from that of consumer products. Applications are built for industrial / enterprise use containing minimal consumer features, and include much deeper optionality to allow enterprises to set different permissions and access levels.

Just like with the printers in the AIT division, Zebra’s range of mobile computers varies in price, functionality and longevity to meet different customer needs.

There is an additional dynamic going on with mobile computers that better positions Zebra vs. its competitors. Operating systems for the mobile computer market were traditionally dominated by Microsoft and Android. 10 years ago Zebra made a deliberate decision to develop all of its mobile computer applications on the Android OS, even though Microsoft was more dominant at the time. Subsequently in 2015 Microsoft announced that it will be ending its support of its operating system for mobile computers by late 2020, which means all operating systems are now shifting to being Android based. With 2.5x more Android-based products than it’s nearest competitor, Zebra’s long-standing investment in Android systems has allowed them to stay ahead of the technology adoption curve and increase their commanding lead in the market. Zebra’s share of all new Android mobile computers sold is around 60% (its overall share of the mobile computer market is 50%).

The other products that the EVM segment develops are barcode scanners and RFID readers. It’s this range of products through which most consumers would probably come into contact with Zebra in their daily lives - for instance, a photo of a Zebra barcode scanner below from the self-check out counter in my local supermarket in Singapore.

Software solutions and other expansion categories

Although Zebra’s heritage is in peripheral hardware, it has been evolving to become a vertical workflow company, seeking to provide more holistic, outcome-orientated solutions to its customers. This is what it calls its Enterprise Asset Intelligence vision. This vision refers to the unification of hardware and software to develop broad solutions for a company that allows every asset and every frontline worker to be connected, visible and optimised from a workflow perspective.

Zebra thinks of its solutions through the framework of ‘sense, analyze, and act’. The sensing part, which comes from its heritage scanner business, refers to the visualisation and tracking of assets in the real world. The ‘analyze’ and ‘act’ pieces are more of the software capabilities that get paired with Zebra’s devices to help clients analyze data and act on that analysis in real time.

Core to this strategy has been Zebra’s significant investment in R&D as well as acquisitions to build out adjacent capabilities. Below are some examples of some of the newer solutions that it’s developed:

Inventory management solutions: a range of solutions that help retailers have real-time inventory visibility, automatic restocking and replenishment, forecasting, and omnichannel integration

Case studies: retailers Leroy Merlin and Hans Anders

Workforce Connect: productivity tools that enable scheduling and planning of frontline workers, seamless communication between teams, and workflow consolidation. More efficient utilisation of workers allows customers to generate significant payroll savings. The majority of this new solution came from the acquisition of Reflexis (discussed more below)

Case studies: retailer Vera Bradley and logistics company ArcBest

Machine vision and fixed industrial scanning: Advanced cameras that can be used in a warehouse with conveyancing system to track fast-moving packages. This solution is getting good traction with management claiming a big win recently in the automotive space

A perfect illustration of how Zebra combines its hardware and software to become integral to customers’ supply chains is what it did with Ford in building out a company-wide real-time location system. The below extract is from Morningstar (h/t Logos_LP on Twitter).

Acquisitions

Acquisitions has been the major use of capital for Zebra. It’s acquired seven businesses in the last two years. Zebra targets value-adding capabilities and software solutions which help them achieve their vision of enabling customers with intelligence and analytics. Management is very thoughtful about the types of capabilities it acquires. A lot of it is driven by listening to what its customers need so that it knows what sort of solutions will be important in the future. These capabilities in turn make Zebra’s hardware products more differentiated and sticky. Below are some of its more recent acquisitions.

Antuit (October 2021, $145m): Antuit is a high-margin software-as-a-service business which provides an AI-powered demand forecasting solutions mainly for retail and CPG customers. It helps customers have the right inventory at the right time at the optimal price, whether it's fulfilled through online ordering or in-store shopping

Fetch Robotics (July 2021, $305m). Fetch produces autonomous mobile robots which are used in warehouses and fulfilment centers. Zebra initially made a venture investment in Fetch in 2018, so they’ve been working with the company a long time prior to their acquisition. Fetch taps into the trend of warehouse automation, and works well with Zebra’s machine vision and industrial scanning solutions

Reflexis Systems (September 2020, $548m). One of Zebra’s larger recent acquisitions, Reflexis is a provider of task and workforce management, execution, and communication solutions for customers in the retail, food service, hospitality, and banking industries. Reflexis has been a particular highlight of how well Zebra can integrate acquired solutions with its hardware products to add more value to customers. It has been repeatedly cited as a tool that is getting wide adoption with tangible ROI to customers:

“We have expanded our relationship with a leading international energy company to empower thousands of convenience store associates in the United Kingdom with Workforce Connect and Reflexis workforce management applications on their Zebra mobile computers and tablets. Our solution enables the store associates to automate their daily responsibilities, maximizing productivity and streamlining task management and administration.”

Anders Gustafsson (CEO), Q4’21 Earnings Call

In 2021 Zebra also made five venture investments, which like Fetch Robotics, could become the seeds for future acquisitions. This staged investment model helps manage acquisition risk by ensuring that the companies are a good fit with Zebra from both from a capability and cultural perspective.

A couple more points on the company’s operations which are important to understand.

Go-to-market strategy

Zebra sells its products mainly through distributors in what they refer to as a ‘two-tier distribution system’. Distributors typically sell to other middlemen such as value added resellers (VARs) or independent software vendors (ISVs), who typically customise solutions for end users based on their domain expertise. In turn, these VAR’s and ISV’s may require Zebra to tailor certain software, firmware along with integration and support services for their end users. Core to Zebra’s distribution strategy is their partner rewards program. This is effectively like a loyalty program that rewards partners for selling more Zebra products with rebates and other marketing incentives, as well as closer engagement with Zebra on products and technical matters. This creates a virtuous cycle for Zebra which further increases its lead. Approximately 80% of Zebra’s sales are through distributers, with the rest being sold directly through their own sales force.

With a network of over 10,000 partners, the breadth of Zebra's distributor and channel partner network is a competitive advantage, giving it a stronger ability to reach a large group of diversified customers. It must be noted that there is significant partner concentration, with approximately 50% of sales coming from three distributors (Scansource, Blue Star, and Ingram Micro), however no single end customer would account for any meaningful percentage of revenue.

Manufacturing

Assembly of Zebra’s hardware products is performed by third party contract manufacturers including electronics manufacturing services companies and joint design manufacturers. The products are primarily manufactured in facilities across China, Southeast Asia, Mexico and Brazil. Post the trade wars in 2019 Zebra made significant efforts to reduce its reliance on China and established a manufacturing footprint in Taiwan, Vietnam and Malaysia.

Management

The management team of Zebra is highly experienced and most have been in the business a long time. CEO Anders Gustafsson has been in the role since 2007, prior to which he was an executive at other technology companies. CFO Nathan Winters joined the company in 2018, and was previously in GE. Chief Revenue Officer Joachim Heel (responsible for the sales strategy) has been with the company for over 7 years. Management strikes me as non-promotional, solid executors, and have a good track record of beating guidance. They are also sensible capital allocators with a history of successful acquisitions and return of excess capital to shareholders. Zebra’s market value has increased over 10x under the helm Anders. From a cultural perspective, the company has a healthy Glassdoor rating of 3.9 which has been trending up over time, and a 94% CEO approval rating.

INVESTMENT THESIS - WHY IS THIS A GOOD INVESTMENT?

Growth is underpinned by secular tailwinds which have been accelerated by the pandemic

Zebra plays in the Automatic Identification and Data Capture (AIDC) industry, which provides equipment, technologies and services used to track, locate and record the movement of assets. The AIDC industry is experiencing structural growth driven by the themes of growing connectivity, digitization, automation, IoT and cloud. More companies across a range of industries are being enabled to derive higher economic benefits from tracking, locating and recording the movement of goods and people. These benefits are set to grow as the industry shifts from simple connectivity to the integration of data analytics and actionable insights, which should grow the demand for both hardware and software content for Zebra’s products. More so, all of these trends have been accelerated by the pandemic.

“The strong secular trends that have been supporting our business for a long time, they have accelerated through COVID, and we don't see any abatement in those trends. They're continuing to build. I'd say our customers across pretty much all our vertical markets are prioritizing, digitizing and automating their workflows.

Anders Gustaffson (CEO), Q2’21 Earnings Call

The company defines its target addressable market (TAM) as a $30bn opportunity in which it can achieve a 5-7% long-term through-the-cycle growth rate. This comprises of the following:

Core market: mobile computing, data capture, barcode printing. $10-12bn TAM, growing at 4-5% (slightly faster than average world GDP growth of around 2-3%)

Adjacencies: mainly products like RFID, rugged tablets and adjacent services. $12-14bn TAM, growing at high-single digit

Expansion: new expansion areas which the company has recently entered, together comprising a $6bn TAM growing at double digits. The company breaks this down as fixed industrial scanning/machine vision ($2bn), warehouse automation robots ($1bn), and software solutions ($3bn)

It is difficult to externally validate the market size given the somewhat niche nature of this industry, however even if it is smaller than that, with current revenue of $5.6bn, Zebra has a significant runway for growth and reinvestment. Further, the TAM keeps expanding as the company incrementally bolts on new services and enters new adjacencies. A few years ago, the company stated its TAM as $25bn (vs. $30bn today). For instance, machine vision and autonomous robots are new solutions that only came online in the last year or so, and I expect this trend of incremental expansion to continue.

Leading market share in each of its products which it should be able to grow over time

Zebra is the undisputed market leader in each of its products:

In mobile computing it has 50% market share while the next competitor's share is three times less

In scanners it has 30% market share and the second largest is at around 20%

In printers and barcodes it has 40% market share with a couple of competitors in the low-double digits

As can be seen above, the next biggest competitor across all three markets is Honeywell, followed by Datalogic and Sato.

There are number of reasons to believe why Zebra will maintain and even extend its leading position:

Zebra’s main competitor, Honeywell, is a large conglomerate for who mobile computers and scanners is a small part of their business and not really a focus area. There is something to be said about a pure-play focused provider like Zebra who excels in its niche and can accrue marginal gains over time. We see the same dynamic often when niche players outcompete larger companies who try to offer a similar service (Etsy vs. Amazon Handmade, or Match vs. Facebook dating)

Zebra is the most widely distributed brand with access to over 10,000 distributors. They are the main and arguably only must carry brand in the sector. This serves a natural moat in terms of brand equity and access to market.

The aforementioned transition from Microsoft OS to Android OS in mobile computers puts Zebra at a significant advantage vs. competitors. Zebra was one of the earlier and larger investors into software applications on the Android OS which the company claims have given it an edge over rivals like Honeywell who devoted a meaningful amount of investment into the Microsoft OS up until recently. Zebra enjoys 60% market share in all new Android wins, so its overall share of mobile computers should grow towards that over time

Zebra’s strong competitive position is further confirmed by Gartner who ranks it as a visionary leader in location services with high ability to execute, for multiple years running.

Zebra management consistently mentions that they believe they are gaining share in both AIT and EVM, and I expect this trend to continue.

Fast-growing software capabilities driven by high R&D spend which enhances Zebra’s value proposition to customers, increasing switching costs

As Zebra expands its software content, it makes its hardware even more valuable to its customers by being able to provide analytics, intelligence, and broader enterprise planning solutions. This increases the switching costs and thereby helps entrench Zebra with end users. According to the company, a significant portion of its products are deployed with software applications.

Software is a big differentiator in all our devices. If you look at mobile computing, print and scan, the majority of our engineers, a huge part of the differentiation and the value add comes from the software. And we certainly expect that to be the case here also. So we are investing in building more of that software capability

Anders Gustafsson (CEO), Q2’21 Earnings Call

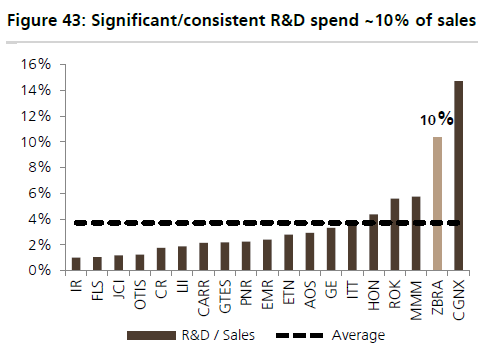

A major benefit of Zebra’s scale and high profitability is that it is able to outspend all of its competitors on R&D. It currently spends about 10% of its revenue on R&D, which as seen below far outpaces its key competitors (like Honeywell) and just about all industrial tech players.

Zebra today has more software engineers than hardware engineers dedicated to developing its software suite. As a testament to their efforts, Zebra currently has ~4,900 US and international patents issued or pending. Over time, Zebra’s R&D investments should continue to increase the differentiation of its solutions and further their lead over the competition.

FINANCIALS, VALUATION AND RETURNS

Business model

As can be seen in the company’s revenue breakdown below, almost 80% of its revenue comes from sale of hardware products, and this figure has been pretty consistent over the years. The replacement cycle varies by product but typically the majority of Zebra’s products are replaced every 3-5 years. There has however been a trend towards shortening of product life cycles due to the incessant demand for more compute and memory capacity, particularly with the Android OS mobile computers which enable more innovative features.

The recurring revenue components of software and support services together make up around 14%, and again percentage has also been pretty steady over the last few years. This may increase over time with all of Zebra’s investments in software capabilities.

Financials and projections

From 2015-2021, Zebra’s revenue CAGR was been 7.5%, outpacing global industrial growth (2-3% pa) and the core AIDC market (4-5%). The growth has been consistent year on year, with the business experiencing sales declines only twice: during the GCF (-24% in 2009) and during the pandemic (-1% in 2020). EVM has been the faster growing segment due to mobile computers representing more advanced technology that is sought after by customers, and also because most of the newer software solutions are included in that segment.

I expect that the business can grow at a CAGR of 6% over the next five years. This is in the middle of management’s guided range of 5-7%. It is also higher than the sector growth, as the company should continue to win market share. Growth should also be aided by a growing mix of adjacent and expansion product categories, which are growing at a much faster rate than Zebra’s core product market.

Gross margins and Adj. EBITDA1 margins have have been in the range of 45-47% and 20-23% respectively over the last few years, which are industry-leading levels of profitability. Both of these have been rising over time driven by investments in initiatives improving operating efficiency, some pricing power, and increasing software mix/adjacent product categories, which come with higher margins. I expect profitability to continue to increase moderately over the forecast period. The company’s guidance for FY22 Adj. EBITDA margin is 23-24%, and I expect that it will be able to grow this to about 25% by FY26.

Zebra’s high single digit revenue growth has translated to 20%+ CAGR in EPS over the last few years as a result of rising operating margins, rapid deleveraging, and some buybacks (see Capital Allocation section below). Assuming some further increase in margins and a higher rate of share buybacks going forward, I expect that a 6% revenue CAGR over the next five years should translate to an EPS CAGR in the low teens.

Free cash conversion is very strong as the business is asset-light and management has done a good job managing working capital cycles. It generated $1.1bn of FCF in 2021, which represents about 80% cash conversion relative to Adj. EBITDA. I expect that it will be able to grow this to $1.5bn by FY26.

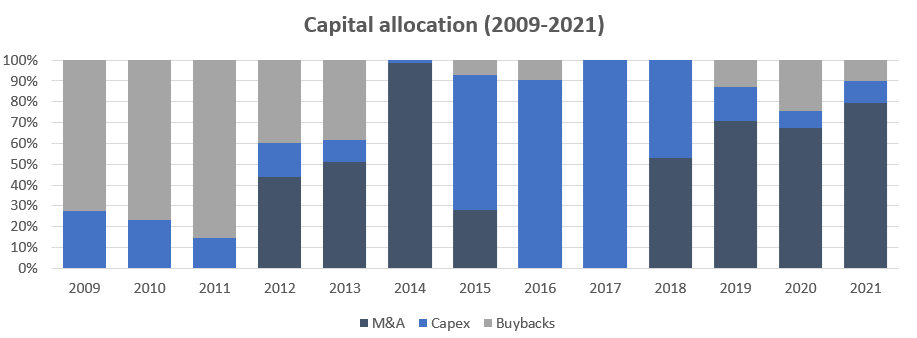

Capital Allocation

Historically Zebra’s capital deployment has focused on investment (M&A and internal). In 2014 it made a large $3.5bn acquisition of Motorola Solutions Enterprise, which formed the foundation of Zebra’s core mobile computer business. To fund the acqusition Zebra leveraged up to ~8x Net Debt / EBITDA, following which management has prioritized deleveraging the balance sheet. Consequently, share repurchases were put on hold from 2014 to 2019, as the company deleveraged to management’s target leverage range is 1.5-2.5x. During that period, the company also completed 7 smaller acquisitions totaling ~$1.2bn. Over the last 13 years Zebra’s capital allocation has been concentrated on M&A (~75%), followed by buybacks (14%) and capex (11%).

Zebra currently has a strong balance sheet, ending 2021 with Net Debt / EBITDA of 0.5x. This provides it with significant capital flexibility. I expect that share repurchase will become more meaningful contributor to capital deployment going forward, as well as continued acquisitions.

In terms of my base case forecasts, I have assumed a significant step up in buybacks going forward, averaging ~$1bn pa from 2022-2026. While this may seem high, the company generated $1.1bn of free cash flow in 2021 which should continue to grow going forward, and management does have a history of returning excess capital to shareholders. In reality, we should also probably expect more M&A deals, however these are impossible to predict from a modelling perspective.

Zebra’s high profitability and efficient capital allocation has led to high ROICs of >20%, which I believe it will be able to maintain over the long term due to its sustainable moat.

Valuation

As with most profitable industrial companies, Zebra is typically valued on a PE multiple. At the current price of $415 it is trading at 21x forward PE. The stock has come off over 30% from its highs a few months ago, and as can be seen below, it is almost in line with its five year average multiple (20x). It is however still more expensive than where it traded pre-COVID (18x). I believe the business is now arguably in a much stronger position than it was a few years ago, with an acceleration in its secular growth drivers, increasing market share, and growing software business which is further entrenching its lead. The company is also generating significantly stronger free cash flow and has much more balance sheet flexibility for buybacks or acquisitions than in the past. Over a five year hold, I have assumed a 20x PE multiple at exit (FY26). This implies ~5% FCF yield which feels like a reasonable valuation for a business like this.

Returns

Assuming the above projections and a 20x PE exit, I get an 5 year IRR of about 13% from today’s share price of $415. Assuming a full reversion back to its pre-COVID average of 18x, the IRR is closer to 10%. The below table shows a sensitivity table around the multiple from 16-24x.

I have run also some sensitivities to see what the returns could look like for a range of earnings outcomes. The base case is a 6% revenue CAGR which results in a 12% EPS CAGR. The below table shows the sensitivity around management’s long-term guidance of 5-7% revenue CAGR, and even below that for conservatism. I have assumed the same range of 16-24x PE exit multiples as above. On the downside, it seems like it is quite difficult for us to lose money over 5 years even in the worst scenario, which provides some comfort. On the upside, returns can reach the high teens range, which is certainly pretty attractive.

RISKS

Technological disruption

Arguably the biggest risk to the business is technological change which could structurally diminish the demand profile for Zebra’s products. This biggest potential rivals are RFID or NFC technologies, which are often considered superior to barcodes. There are a number of mitigants, however, as to why I think these technologies are unlikely disrupt barcodes anytime soon:

RFID tag cost is much higher than barcodes as there needs to be an inbuilt chip inside the tag. While barcodes cost around 1c, RFID tags can cost between 5-10c, so multiples higher. This amounts to significant cost differences over large volumes. Hardware costs for RFID scanners are also higher than that of barcode

RFID implementation is time-consuming and highly disruptive to customers. It would require significant retooling and reconfiguration of all the other assets through the supply chain

RFID uses radio waves to scan products, which sometimes produces the problems of tag collision (numerous tags in the area respond at the same time) and reader collision (two signals from different readers overlap). From that perspective, barcodes are more precise due to their requirement for line of sight

Zebra itself also sells RFID tags and scanners, and although that is a much smaller part of its business compared to barcodes, it does have the ability to lean into this harder should RFID start to disrupt barcodes in a material way. On this exact question on the recent earnings call regarding growth in RFID, management indicated that it is a supplement rather than a complete substitute:

“So if you want to say, print and encode an RFID label, it is one of our traditional label printers with an RFID encoder attached to it. And similar, if you want to read the labels, that is an attachment to Sled or something like that on our mobile computers. So it is an incremental part of our core business…it's a supplement, but not a substitute for our core”

Anders Gustafsson (CEO), Q4’21 Earnings Call

Other emerging technologies like robots and vision scanning are also being trialed by large companies like Amazon and Walmart, although these are likely to be complimentary to humans rather than wholesale substitution. Also as discussed earlier, Zebra is investing in these capabilities as well.

Cyclical / macro conditions

Zebra is prone to some cyclicality as demand for printers, mobile computers and consumables is driven in part by volume of manufactured goods and other economic activity. Spend on Zebra products tends to come out customers’ capex budgets, and capex spend is usually more vulnerable to being deferred in cyclical downturns due to the perception of it being more discretionary (compared to say opex). However, Zebra has become somewhat less sensitive to business cycles over time due to the secular tailwinds of industrial digitization and e-commerce growth, as well as its strengthening market position. We could see that in 2020 during the impact of the pandemic. The complete lockdown of manufacturing and industrial activities that happened that year only resulted in Zebra revenues declining 1%, as the business was supported by strong e-commerce volumes and trends in digitisation of supply chains.

Supply chain disruptions / geopolitics

As Zebra is an industrial company which deals with manufacture and delivery of physical products around the world, it is vulnerable to supply chain disruptions and geopolitical events that affect trade, such as tariffs. Over the last 1-2 years its products have been impacted by the global semiconductor shortages as well rising freight costs. Similarly in 2019 it was impacted by the trade wars which saw tariffs increase its cost of goods. The company has been able to manage these skillfully so far with minimal impact on their customers (evidenced by the strong growth rate in FY21). It has also been increasing the prices of its products to absorb some of the rising costs, redesigning its products to use components not exposed to supply constraints, and shifting some of its manufacturing from China to Southeast Asia. Management believes that the supply chain and semiconductor issues are slowly resolving in 2022, however these issues are constantly evolving and so the company needs to be constantly navigating these types of dynamics.

Litigation

In September 2021 Honeywell filed a law suit on Zebra regarding patent infringement with its barcode scanner technology. It’s hard to speculate on what could be the outcome of this case, although Zebra CEO Anders Gustafsson notes that these IP-related issues are quite common in the industry and Zebra is well versed in dealing with them. This is probably something that will take some time to play out.

CONCLUSION

In summary, I believe Zebra is a compelling investment opportunity that should keep compounding for a long time. Its products are mission critical to a host of industries, its growth is underpinned by secular tailwinds, it has by far the leading market share in each of its markets, and a sustainable moat via a strong go-to-market strategy and growing software capabilities which increase the company’s value proposition and switching costs. It is also highly profitable and cash generative, has a consistently high ROIC, and sensible capital allocation driven by a very capable management team.

I have established a position in Zebra in 2020 at a price of $197 and have been adding recently between $380-$420.

Thank you for reading and hopefully you found the article helpful. I welcome all feedback, good or bad, as it helps me improve and clarifies my thinking. Please leave a comment below or on Twitter (@punchycapital).

If you like this sort of content please subscribe below for more.

The main adjustments to Adj. EBITDA are acquisition-related costs and share-based comp.

Good

Nice write up! What impact do warehouse automation systems like Autostore and Ocado have on Zebra if any?