Etsy: Empowering the Passion Economy

Deep dive on Etsy, a compelling long term e-commerce investment

This is a deep dive on Etsy, the leading online marketplace connecting artisans and individual entrepreneurs selling handmade vintage products to customers around the world. In this piece I will step through the business and its value proposition, the investment thesis, valuation and projected returns, and risks. Here is the TLDR version:

Etsy has carved out a niche as the leading two-sided marketplace which connects millions of individual entrepreneurs and passionate creators selling unique handmade and vintage goods to customers globally

Etsy benefits not only from the structural growth of e-commerce adoption, but also a rise in individual entrepreneurship (accelerated by the pandemic), the trend of 'supporting local', and people's desire for uniqueness, self-expression and sustainability

There is a long runway for growth and reinvestment (conservative TAM estimate is ~10x the size of the current business); there are strong and growing network effects which create a sustainable moat that will be difficult to replicate; it has strong unit economics which leads to a highly profitable business model with high cash flow conversion; and is led by a high quality, experienced management team with a good track record of execution

Etsy has shown that it can fend off competition from other platforms through a strategy that is dedicated to its niche and developing a brand that has become associated with vintage and handmade. However I think the key risk to the business is missteps in execution and loss of focus as it expands. Other risks include customer retention and frequency of purchases, M&A execution, and post-pandemic growth slowdown

At the current price of $185 the stock does seem fairly valued. Based on my modelling with some reasonable growth assumptions, 5 year IRRs could be in the 10-11% range. While this meets my minimum return threshold of 10%, ideally I would like to see returns closer to the 12-15% range. There could certainly be realistic upsides to my numbers as I believe I’ve been fairly conservative, but nonetheless I would prefer the stock to drop closer to $170 for a greater margin of safety

Disclaimer: I am long Etsy, and this article is not investment advice nor a substitute for your own due diligence. The objective of this article is to help formalise my thinking on the stock and hopefully provide some interesting insights on the business.

BUSINESS OVERVIEW

Etsy was co-founded in 2005 in Brooklyn by talented wood-worker Rob Kalin and his two friends. They wanted to create a marketplace for crafters and artisans that had a strong human touch, and this ethos has largely remained the core value of the company to this day. Over the next few years Etsy raised $85m of venture capital, including most prominently from Fred Wilson of Union Square Ventures (one of the early investors in Twitter, Tumblr and Coinbase), who is now the Chairman of the Board of Etsy. In 2011 Rob Kalin was replaced as CEO by Chad Dickerson, who was the Chief Technology Officer of Etsy at the time. Mr. Dickerson oversaw tremendous growth in the business, and by the time the company went public in 2015 it was doing $1.9bn of Gross Merchant Sales (GMS) and had nearly 20 million buyers. Growth however started slowing soon after the listing, and concerns around competition from Amazon who just launched a competing vertical Handmade at Amazon caused the stock to fall 75% from its listing price. Activist investors started buying in and agitating for change, and the Board was under pressure to do something. In 2017 Etsy underwent a significant management change with Mr. Dickerson being replaced by 48 year old Josh Silverman, an ex-executive at American Express and former CEO of Skype. After a period of sweeping changes, growth accelerated significantly under Mr. Silverman and reached an inflection point during the pandemic. By the end of 2020 GMS reached $10.2bn, and the stock has been almost a 20x bagger since Mr. Silverman’s appointment. The company’s current mission statement of “Keeping Commerce Human” was created under his watch, and he has stayed true to what makes the company special while growing the business significantly.

Etsy is a two-sided marketplace which connects millions of individual entrepreneurs and passionate creators selling unique handmade and vintage goods to customers globally. The platform has 85m listed items across 50 product categories, with 80% of Gross Merchant Sales (GMS) coming from six categories: home furnishings, jewelry and accessories, craft supplies, apparel, paper and party supplies, and beauty and personal care.

Etsy attracts a global customer base, however it identifies seven markets as its core geographies at present - US, UK, Canada, Australia, Germany, France and India. As of Mar-2021 it had over 91m active buyers and 4.7m active sellers. which had grown from 48m and 2.8m respectively at the end of 2019 as Etsy’s business went into hypergrowth during the pandemic. While most of the business is still in the US, there has been a steady rise in international GMS which now accounts for 42% of total, up from 38% two years ago.

VALUE PROPOSITION

Etsy fills a unique niche of e-commerce which is specifically focused on crafted, non-homogenous products that you would not typically find on mass market platforms such as Amazon and Ebay. Its buyers are not necessarily looking for best value, delivery times or efficiency. As described by the company, Etsy buyers “value self-expression, unique items, and buying directly from creative artisans and entrepreneurs.” According to the company's internal survey 88% of Etsy customers agree that its products can’t be found anywhere else.

The platform allows buyers to connect directly with sellers to ask questions about the products and make customisation requests. I think that the ability for buyers and sellers to have meaningful interactions is another point of differentiation for Etsy, as it allows for the building of a personal relationship and enabling of ‘high trust’ commerce. Approximately 30% of products on the platform are customisable to some extent, and Etsy says that conversion rates and average order value is significantly higher if the products can be personalised or customised. That is something that a mass market retailer like Amazon is just not set up to handle given the huge volumes that they are pushing through.

One risk of facilitating buyer seller conversations is that the seller may of course encourage the buyer to take the purchase off the platform to sidestep Etsy's transaction fees. Certainly it has never been easier for an entrepreneur to start their own online stores and target customers directly with tools like Shopify, Wix, Facebook and Instagram. However the friction and costs related to managing this stack of products will likely mean that seller profit margins are not going to be materially higher from doing it themselves. Also by transacting outside the platform buyers and sellers lose the protections and assurances that are provided by Etsy. Certainly various comments that I read on Etsy community forums seem to suggest that buyers are quite wary of sellers who ask them to take the transaction off the platform.

On the seller side, Etsy sellers are mainly artisans and mini entrepreneurs, with 97% running their business from their own homes. Etsy’s 2021 seller survey found that 45% of Etsy sellers only sold through Etsy; the other 55% are multi-channel sellers but on average, Etsy is their primary source of sales. This highlights the benefits of the aggregated demand that Etsy provides its sellers, which further mitigates the risk of sellers moving entirely off Etsy to their own stores. I have been listening to the Etsy Success podcast for a few weeks to get a better sense of the sellers on the platform, and one thing that is clear is the amount of dedication and passion they have to their craft and the stories behind their products that they wish to carry across to the customers. From one seller who writes personalised poems to customers with every vintage dress that she sells, to another that decorates each shipped box with her own custom drawings, this is the sort of ‘high trust’ and ‘feel good’ experience that you just simply would not be able to replicate on other platforms.

Over time, the Etsy brand has become synonymous with vintage and handmade goods. Over 80% of its buyers come organically via word of mouth, and its customers are highly engaged as evidenced by its strong social media presence (Etsy has 2.8m Instagram followers and 42m tags, Amazon has 3.2m / 15m respectively, Ebay has 1m / 5.2m respectively). All of this helps keep its customer acquisition costs low and contribute to high profitability.

Further, Etsy's business is not limited by the sellers and their "handmade" capacity - buyers (demand side) determine what gets made as sellers can shift rapidly to changing trends. The benefit of a marketplace business model is that there no requirement for the platform to predict product trends or take inventory risk. The marketplace will itself adapt to fill the need of what is required. There was no better example of this as during the pandemic in 2020, as a spike in demand for masks and (surprisingly) bread goods on the Etsy platform resulted in sellers stepping in to increase supply of these products (masks accounted for 7% of GMS in 2020). Subsequently as lockdowns were lifted and social activities normalised demand for special event products such as weddings increased. Again Etsy's sellers adapted to fill the need.

Curation and search is a significant challenge in a marketplace of non-commoditised handmade products. There is often difficulty in matching these highly unique products with exactly what the buyer had in mind when keying in search words. Etsy has invested significantly in AI and machine learning algorithms to better match the right items when the buyer doesn’t have the right words to describe it, as well as personalising discovery for buyers based on past behaviour. It's taken Etsy years of investment to get this right (and they are still not quite there yet), and is something that will be difficult to match by any competitors such as Instagram.

All of management's investments and execution seems to be paying off, with engagement and buying activity steadily rising across the platform. Total ‘repeat buyers’ (defined as those who purchased more than once in the last 12 months), and more importantly ‘habitual buyers’ (defined as those with 6+ purchases in the last 12 months) has been consistently increasing as a proportion of total buyers.

House of brands

In addition to its core platform, Etsy has acquired a few other marketplaces of unique products, such that is it now referring to itself as a 'house of brands'. Their acquisition strategy is to acquire other niche, capital-light marketplaces which it intends to keep and operate as standalone brands.

Reverb

In August 2019, Etsy also acquired Reverb for $275m, an online marketplace of new, used, and vintage musical instruments. In 2020, Reverb had 0.9 million active buyers and 0.3 million active sellers, and accounted for 5% of Etsy’s GMS, so it is still quite small. It ended the year with 1.8 million listings which includes unique used and vintage gear; instruments played on tour and on popular albums by well-known musicians; and exclusive, boutique, and handmade items that can only be found on Reverb. Etsy has driven operational improvements through Reverb and has lifted its gross margin from 33% at acquisition to 53% in Q1 2021, which is an encouraging sign.

Depop

In June 2021 Etsy announced its largest acquisition to date - a $1.6bn acquisition of Depop, a Gen-Z focused marketplace of resold apparel, mainly vintage clothing and sneakers. Through this acquisition Etsy is staking a claim on a much younger generation of sellers and shoppers. 90% of Depop’s users are under the age of 26, compared to Etsy's average seller age of 39. Depop has 4m active buyers, 2m active sellers, and extremely strong customer engagement and loyalty - in 2020 its customers made an average of 6 purchases and 40 visits a month to the app - admittedly this level of engagement is even stronger than Etsy's. All of this has been achieved with very little brand marketing - only 10% of their GMS is via paid. However, the acquisition was not cheap at 2.5x GMS and ~24x revenue. The business has been growing at rates of over 100% over the last few years, but nonetheless there is going to be a lot riding on Etsy’s ability to execute here to justify the price tag.

Elo7

On the heels of its Depop acquisition, Etsy announced an acquisition of Elo7 for $217m, a leading marketplace of custom and handmade goods in Brazil - commonly referred to as the ‘Etsy’ of Brazil. Elo7 is one of the 10 biggest e-commerce sites in the region with 1.9 million active buyers, 56,000 active sellers and some 8 million items for sale. Not much has been disclosed about its financials but public sources seem to suggest a GMS of around $140m, suggesting a GMS multiple of around 1.6x, which at face value is not overly high. This is an interesting deal which bolsters Etsy’s presence in LATAM. The opportunity in LATAM is significant, with less than 10% e-commerce penetration in the region (much earlier in adoption than developed markets) and expectations for robust growth in the coming years.

INVESTMENT THESIS - WHY IS THIS A GOOD INVESTMENT?

Beneficiary of secular tailwinds including e-commerce adoption and individual entrepreneurship

Etsy is a beneficiary of the structural growth of e-commerce adoption, which as shown shown below has been increasing continuously over the years. 2020 saw online penetration accelerate dramatically as the pandemic significantly shifted global consumer shopping behavior towards online purchases of many retail categories, and new habits have been formed which are likely to persist. As mentioned earlier, Etsy’s habitual buyers have increased 160% during 2020, and there is an opportunity for Etsy to deepen engagement by encouraging buyers to purchase from Etsy for a number of occasions throughout the year, such as weddings, birthdays, holidays, home decorations and the like.

Etsy is also a beneficiary of the boom in entrepreneurialism and small business formation, which again accelerated significantly as a result of the pandemic. 2020 saw the highest number of new business applications in the US on record, and the retail trade sector saw the biggest share of these new businesses. Etsy saw its number of sellers almost double in 18 months from 2.5m at the start of 2020 to 4.7m in Q1 2021. While there will always be a place for mass market retail and the value and efficiency it provides, Etsy allows people to tap into the trend of shopping ‘local’, supporting individual entrepreneurs and self-expression through unique items. As explained earlier, there is a ‘feel good’ experience that comes with purchasing on Etsy that other platforms can’t provide.

Long runway for growth with the TAM potentially ~10x larger than current GMS

Trying to size any TAM is a notoriously tricky task and estimates often tend to be overly optimistic. In its 2019 Investor Day Etsy provided an estimate of what it thought its TAM was. Starting with the total retail spend in its relevant categories across its six core markets at the time of $1.7tn, $249bn of this was online (15% online penetration). However, not all of the online segment is addressable to Etsy given focuses on what it terms the “special” segment - the customers who are willing to spend a bit extra on unique goods. Based on their internal studies, management thinks 40% of consumers fall into this camp, implying that their TAM is probably around $100bn of the $249bn total online spend in these categories. Management also estimated that by 2023 total retail size would increase to $2tn, online penetration would increase to 22% (or $437bn), and the portion addressable to Etsy would grow to $170bn, assuming the same 40% ratio of “special” customers that make up its TAM.

Now, this was all pre-COVID. As per my point earlier, online penetration reached over 21% in 2020 alone, bringing forward almost three years of online growth. So it is reasonable to expect that the size of the online market would be considerably larger in 2023 than Etsy’s original forecast. Further, it is quite likely that the actual categories that they defined as part of their TAM are fluid. As the pandemic showed, even management couldn’t have predicted that goods like face masks and bread could come to be sold on Etsy. And finally, while the above TAM estimates are only for six markets, Etsy is actually available everywhere - there is nothing stopping me in Singapore from opening an Etsy store, or purchasing goods from US sellers. So even if their 40% estimate of the “special” segment is wrong and the addressable market is actually smaller, given all of the upside factors described above, a $170bn TAM in 2023 seems quite reasonable. Given Etsy’s 2020 GMS of $10.3bn, and potentially reaching $18bn based on my conservative estimates in 2023, this still only implies approximately 10% market share or less, suggesting plenty of runway for growth and reinvestment provided management can keep executing.

Monopoly-like network effects which provides a durable moat against competition

Two-sided networks tend to lead to winner-take-most effects, because as more buyers join the network, it encourages more sellers to join, who in turn increase the product offering and makes the network even more valuable to buyers, and so on so forth in a virtuous cycle. That means that as the network grows, it can facilitate more transactions, which increases its durability and accelerates business growth. This is exactly what’s been playing out with Etsy. Etsy’s network grew from 2.7 million sellers and 46 million buyers at the end of 2019 to 4.7 million sellers and 91 million buyers in Q1 2021 following the pandemic surge. As a result, it is now experiencing faster revenue growth now than what it was pre-pandemic in 2019, when the business was more than half the size.

[Based on Q2 2021 guidance] At the midpoint, we’ll do about 27% growth versus last year, and last year was an enormous comp. So just on our base business, we are growing faster than than the long-term compound annual growth rate targets that we put in March of 2019. We had said that we think that we’ll do 16 to 20% over that 5 year period. And this one year just on our base business, we’ve materially stepped up in terms of our growth rate.

Rachel Glaser (CFO), Q1 2021 Earnings Call

So the business is now bigger and growing faster than it was pre-pandemic. This is the sort of superlinear growth that is possible when you have true network effects. At the same time, profitability is also growing due to the high margin on each dollar of incremental revenue (see next point), allowing Etsy to earn monopoly-like profits which can be reinvested back in the business, further increasing its moat against competition. This sort of network will be quite difficult for someone to replicate.

Strong unit economics leading to high profitability, cash generation and ROIC

One of the things that I like most about this business is that unlike many other high growth tech firms, Etsy is already highly profitable and cash generative. A key driver of this profitability is the very attractive unit economics that the business exhibits.

Unit economics: The company helpfully provides regular cohort data which we can use to work out approximate life time value of customers vs. how much it costs to acquire them. The below chart shows the retention rates of buyers on the platform by different vintage years from 2013 to 2017. We can see that consistently Etsy loses a bit more than half of the buyers between year 1 and year 2, but then the drop off in the retention rate declines considerably such that by about year 4 approximately 35-37% of your original buyers still remain. This has been pretty consistent as far back as the company reports this data. We don’t have data beyond year 4 but if we extrapolate the retention curves further it would probably would be reasonable to assume that buyer retention asymptotes at around the 30% level longer term. This is a pretty healthy retention rate for so many years out and indicates that Etsy retains a really loyal subset of customers who stay with the platform a long time.

The company also provides the GMS per buyer by cohort in the table above. This also indicates strong customer loyalty with GMS growing an average CAGR of around 15% over four years for the 2013-2016 cohorts. The growth of 2017 cohort was dramatically higher at a 27% CAGR given the fourth year for them was the 2020 pandemic-induced hypergrowth year. Using the above data and applying some assumptions we can roughly work out the contribution of each buyer over time. As can be seen below, I’m getting a 5 year LTV of $43.5 per buyer.

Next we need to work out the Customer Acquisition Costs (CAC) for each buyer. For 2020 and Q1 2021 the company disclosed its direct marketing spend, which came out at ~80% of total marketing spend (the rest being brand marketing). Assuming the same 80% applied for the prior years, we can calculate approximate direct marketing spend, and divide it by new buyers added to calculate the CAC. In reality this may overstate the CAC a bit as some of this spend may be targeting the acquisition of sellers, but nonetheless it should be close enough.

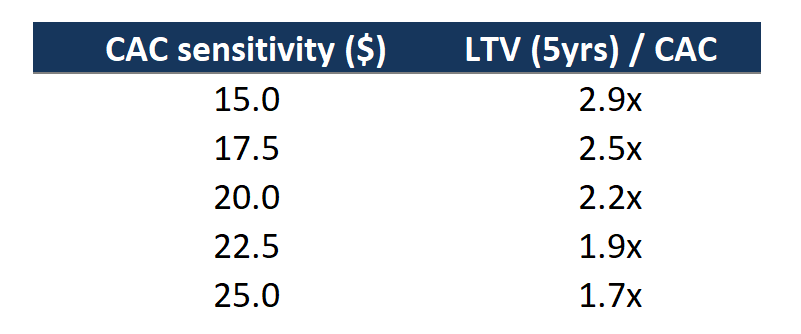

Based on these calculations, the CAC has been between $18-25 per buyer prior to 2020. The low CAC in 2020 was understandable given the surge in buyers going online and reduced CPM rates from Facebook, Google and other platforms for a portion of the year. However I will assume that this is an anomaly and will not be sustained. As we can see in Q1 2021 CAC started increasing again, although still below historic levels. Since we have no way of knowing the actual CAC of the company I have shown a sensitivity between $18-25 range based on the pre-2020 numbers.

Taking the $43.5 customer LTV over 5 years calculated earlier, we can see that LTV/CAC is pretty comfortably around the 2x mark, indicating strong ROI on marketing spend and that that each incremental customer is quite profitable to Etsy. The numbers could actually be more attractive as 1) customers will actually have lives beyond the 5 years I assumed above with growing GMS beyond Year 4, 2) my CAC numbers may be slightly overstated.

Driven by the strong unit economics, the company has been EBITDA profitable as far back as 2012 and is now running ~30% Adj. EBITDA (and here the only adjustment they are making is addback of share based comp). Being an online marketplace it is highly scalable and has low marginal costs (each dollar of additional revenue is high margin), is asset-light, carries no inventory, has very little capex (1-2% of revenue), and has negative working capital. All of which leads to very strong cashflow conversion of 100% or greater relative to its EBITDA. Its revenue is also highly recurring given it takes a cut of millions of transactions that are continuously happening on its platform. ROIC is at now at a healthy level of 23-25%, indicating efficient use of capital and a strong competitive moat which should help drive long term compounding.

High quality, experienced management with a good track record of execution

In May-2017, Etsy went through a major management change, with new CEO Josh Silverman assuming the role after joining the company’s Board in Nov-2016. Mr. Silverman is 52 years old, and previously had senior leadership roles in American Express, Skype and Ebay. Most notably, he was the former CEO of Skype between 2008-2010, a period during which Skype added 300m users, became ubiquitous across mobile and consumer devices, doubled revenues and tripled profits. Skype’s valuation increased from $2bn at the start of his tenor to $8.5bn when it sold to Microsoft a few months after he left. He was brought in because Etsy needed someone with experience in marketing, software and e-commerce and who was comfortable at a big public company. He also brought in new CFO Rachel Glaser, CTO Mike Fisher, and Chief Marketing Officer Ryan Scott. Like Mr. Silverman, they are all relatively young (in a business sense), have been in their roles at Etsy now for a number of years, and have extensive prior experience at various tech companies. While the market was initially skeptical of Mr. Silverman’s appointment with the stock falling 14% on announcement, he and the new team have since proven themselves definitively. GMS and revenue growth growth, which was slowing in the few years before 2017, stepped up markedly post his appointment, and the stock has since been almost a 20x bagger.

Mr. Silverman and his team implemented a number of initiatives to grow revenue - increasing the take rate, making Etsy payments compulsory, introducing Offsite ads, free shipping for order values of $35 dollars. Of course not all of these measures have been popular, with some sellers being quite vocally angry - understandably as who would want to pay away a higher portion of their proceeds to the platform. However on balance the usage of the platform has grown tremendously, benefiting all stakeholders including sellers, buyers and shareholders. Mr. Silverman has achieved this all while maintaining the company’s ethos of keeping the human touch in commerce. Nonetheless achieving this balance as the company scales is an execution challenge that I will discuss a bit more in Risks.

Management also undertook a number of important operating initiatives including significant investment in technology such as AI and machine learning to improve search and discovery, a migration of all their IT systems to Google Cloud in 2020 which saw large cost savings and increased compute capacity, large investment in mobile which has since seen majority of GMS now transacted through mobile, and various other examples of tools and features that have improved the buyer and seller experience, with engagement metrics and number of repeat and habitual buyers rising steadily over the period. During the pandemic, Etsy’s growth of over 100% significantly outperformed the overall e-commerce market. Mr. Silverman and his team undertook a number of actions during this period to support sellers such as waiving of fees on Offsite ads, grace periods allowing more time for sellers to pay their bills, donations and investments in the community, publishing guides assisting sellers on running shops during this period, extended 24/7 support services, and when it was clear that masks were in high demand, encouraging sellers to produce masks while supporting the sellers by providing educational resources on best practices and permissible mask products.

I also like to see a track record of meeting or exceeding guidance, which highlights management’s ability to deliver on what they promised and a good handle on business forecasts. As can be seen below, Mr. Silverman’s team has pretty much consistently beat the top end of their revenue and EBITDA guidance over the years. In 2019 even though EBITDA came in slightly lower than the top end of their original guidance it was still right at the mid-point of the range.

From a capital allocation perspective, management has pursued selective buybacks in the past, staggering out its $200m buyback program announced in 2018 over two years. A new $250m buyback program has been approved.

There is one big question for me at this stage and that is their M&A execution capability, which looks like it will be becoming increasingly important given their recent slate of deals and potentially more going forward. I will discuss this more in the risks section below.

Moving onto the executive compensation, I think the compensation structure is generally sensible and has a good mixture business-related and stock-performance driven components which should incentivise balanced growth. In May 2017 Mr. Silverman was given an upfront mega-grant designed to provide him with a meaningful equity stake in the company and also barred him from receiving any additional equity grants until 2021. Early this year, Etsy implemented a new compensation plan for Mr. Silverman to reward for his exceptional performance. Under the new plan, Mr. Silverman will earn between 0 and 229,672 shares of Etsy as PSUs (performance share units), with the number of PSUs to be determined by Etsy’s (1) GMS, (2) revenue, (3) adjusted-EBITDA margin, and (4) total stockholder return relative to the constituents of the Nasdaq index. All four metrics are equally weighted and will be measured over the three year period from 2021 to 2023. The new plan will also see Mr. Silverman be granted Etsy shares with a grant-date value of US$9 million, of which 60% will be in RSUs (restricted share units) and 40% in stock options. The RSUs and stock options vest over a four-year period, beginning on 1 October 2021. Meanwhile, the equity-related compensation for Etsy’s other key leaders in 2021 would have a mix of 25% in PSUs, 50% in RSUs, and 25% in stock options that all have the same terms as Mr. Silverman’s. So there is appropriate long-term equity-related compensation determined by multi-year performance of the business and the stock. It would be better to have an ROI-linked target for the PSUs as well as it would help incentivise better capital allocation decisions such as avoiding expensive M&A deals to grow earnings, but overall the structure seems like it would provide appropriate alignment and focus on balanced growth.

Finally one more point on company culture. People and culture are of crucial importance especially in technology companies where you are working with assets of intangible nature, and people become your main asset. Employee satisfaction seems very high. Esty has a Glassdoor rating of 4.2 out of 5, Mr. Silverman has a 95% approval rating as CEO, far higher than the average Glassdoor CEO rating of 69% in 2019. Initially there was a lot of skepticism and suspicion of Mr. Silverman when he was appointed, especially post sweeping changes in the organisation which resulted in significant firings. However, the result was a sharper, more driven and innovative workforce.

“The tolerance for risk has gone up significantly. There’s been a cultural shift of accountability in a good way”.

Linda Kozlowski, COO (from 2017 Forbes article “The Revolution Inside Etsy”)

As Reed Hastings observes in his fantastic book No Rules Rules: Netflix and the Culture of Reinvention, when you get rid of underperformers, the talent density increases, leaving the rest of the organisation with higher morale and productivity. This is exactly what Mr. Silverman and his team seem to have driven at Etsy.

FINANCIALS, VALUATION AND RETURNS

Business model

Etsy’s revenue is reported in two segments: Marketplace revenue (~75% of revenue), and Services revenue (~25% of revenue).

Marketplace revenue comprises of the following components:

Transaction revenue: 5% transaction fee on the transaction value. This was increased from 3.5% in 2018. This forms the majority of the revenue base

Listing fees: $0.20 per listing on the site (for up to 4 months). This means that Etsy earns revenue from sellers even when there aren’t any successful transactions. Even though the listing fees appear insignificant, with 4.7m sellers and 80m listings, this component starts to add up

Payment-processing fees of between 3.0% and 4.5%, plus a flat fee; there are additional fees for transactions that involve currency conversions. In 2020, 92% of total GMS from the Etsy marketplace was processed through Etsy Payments, up from 62% in 2015. This has been driven by Mr. Silverman making the use of Etsy Payments mandatory by sellers in 2017

Services represents optional value-add services that sellers can choose to use to help grow their business, mainly comprising of advertising. There are three components:

Etsy ads: Etsy on-site advertising for ad placements or ‘promoted listings’ on Etsy properties. In 2020, ~15% of active sellers advertised on Etsy. This number has hovered around 15-17% in last 5 years, indicating only sub-section of the sellers choosing to use this service

Offsite ads: Under this program, Etsy itself will advertise sellers’ products on Google, Facebook, Instagram, Pinterest, and Bing. If a shopper clicks on any of the ads and buys product from the shop in the next 30 days, Etsy will take 15% of that. Sellers will only incur the fees for actual sales, not for clicks. Sellers can opt out of Offsite ads program if they want, however sellers that sell more than $10,000 cannot opt out, although for them the take rate is reduced to 12%

Shipping labels: This refers to sellers purchase discounting shipping labels from Etsy (who can purchase them in bulk at cheaper rates than what sellers would be able to get individually) and reducing the administrative burden for sellers (such as by automatically populating shipping addresses and providing buyers with tracking and shipping notifications)

Projections

I will caveat upfront that forecasting and valuation is an inherently imprecise activity, and I do not hang my hat on these numbers. I run models as it helps me visualise the business, understand the key drivers of returns, and get a rough sense of risk-return asymmetry by understanding the upsides and downsides from current prices. I run a five year model to calculate a range of possible IRRs over such a hold period. I will outline the basis for my forecasts here at a high level but happy to share my detailed model or assumptions with anyone who should request it.

The key driver of revenue is GMS, as most of the revenue components are driven as some form of fee or take rate on the total value that is transacted on the platform. The other key driver are the revenue take rates themselves. I believe I have been relatively conservative in my forecasts for both of these:

GMS: 30% growth in FY21 (from 107% growth in FY20) which incorporates 1Q 2021 results and management guidance, and slowing from there on to about a 17% CAGR from FY20-25 to reach $22.5bn in FY25. I believe this is slightly conservative as management’s pre-pandemic long term growth rate forecasts were between 16-20%, and the business is now growing faster than that

Revenue take rates: Overall take rates have grown from 13.6% in FY17 to 16.8% in FY20, and reached 17.5% in Q1 2021. This has been driven predominantly by marketplace rates (+3.1%) as transaction fees were hiked in 2018 and payment-processing fees have grown as majority of sellers were forced to adopt Etsy Payments. Services rates have grown slightly as well driven by advertising demand. I have assumed continued growth in take rates although at a much slower rate, as it is a fine balance between growing revenue and not taking too much value from the sellers. I have assumed overall take rate rises to 18% by FY25, with marketplace take rates rising slightly due to more sellers adopting Etsy Payments, and rising services revenue as more ads or other value added services get adopted over time.

Overall revenue CAGR from FY20-25 under these assumptions is 18.6%, again a significant slowdown from the last few years. I have assumed gross margins stay flat at 73.1%.

The other key operating cost lines are Marketing, Product Development, and G&A, which combined were 48.1% of revenue in 2020. I have assumed they increase slightly to 50% over FY21/22 due to 1) increased investment in headcount and product development (as guided by management), 2) increased brand marketing, and 3) dilutive effect of integrating its lower margin acquired companies (as guided by management). However these costs are semi-fixed in nature and it would be reasonable to expect some operating leverage over the long term, so I have assumed these decline to 45% by FY25. Overall the net result is a Adj. EBITDA margin profile that declines to a bit under 30% over the next two years before growing to 34% by FY25. Adj. EBITDA reaches $1.38bn by FY25 (from $550m in FY20), or a ~20% CAGR from FY20-25.

There is quite significant cash build up given Etsy’s close to 100% cash conversion, so I have assumed share buybacks at an accelerated pace to what Etsy has done historically. In reality we should also probably expect more M&A deals, however these are impossible to predict from a modelling perspective. As of Mar-2021 Etsy had cash and ST equivalents of $1.7bn, however presumably most of that will be used to fund the $1.6bn acquisition of Depop, which I have included in my modeling.

Valuation

Because Etsy is profitable, an EBITDA multiple is the more appropriate valuation metric than the typical revenue multiple that is used for many unprofitable tech companies. At the current price of $185 it is trading at ~34x EV/EBITDA. Below I have charted its long term rolling EV/NTM EBITDA. As can be seen, the current multiple is elevated relative to its 5 year average of 30x, although it is down from the peaks of late 2020/early 2021. As I’m assuming a five year hold, it would be reasonable to assume a contraction of the multiple closer to the 5 year average. However because growth at that point will be slower than it was historically, I have assumed for conservatism a 25x EBITDA multiple at exit. This implies ~4% FCF yield which feels like a reasonable assumption for a business like this.

Returns

Assuming the above projections and a 25x EBITDA exit, I get an 5 year IRR of 10.5% from today’s share price of $185. This meets my minimum underwrite target of 10%, however ideally I would like to target a return in the 12-15% range to generate a bit more of a premium to average long run market returns (7-8%). This would require a share price of closer to $170. Of course if you take a more bullish view of longer term multiples then there could be some upside to these numbers. The below table shows a sensitivity up to 30x EBITDA (the 5 year average), and if you assume multiples can stay at >30x levels then an IRR of ~15% or greater may be achievable from today’s price.

Also as outlined above, my forecasts may be somewhat on the conservative side (certainly broker consensus numbers are higher). I have run some sensitivities to see what the returns could look like for a range of EBITDA CAGRs (FY20-25) from 15% to 25% (base case is 20%) and the same range of 22.5-30x exit multiples as above. On the downside, it seems like it is quite difficult for us to lose money over 5 years even in the worst scenario, which provides some comfort. On the upside, returns can reach high-teens, which is certainly more interesting.

Of course predicting what earnings and multiples can look like in five years is anyone’s guess, especially for a high-growth technology business such as this. I will leave it to you decide what scenario you are more comfortable underwriting. As mentioned, I err on the side of caution and would prefer a price closer to $170 for a slightly higher margin of safety.

RISKS

Execution: I’m going to start with this as I think this is the most important risk and opportunity facing the business. Mr. Silverman and his team must strike a fine balance between growing revenue and not disenfranchising sellers all while staying true to Etsy’s mission-focused culture. As the company has grown, there has been quite a bit of public discontent from sellers finding it more difficult to stand out and make money as more mass-produced goods have flooded the site. Amazon has had criticisms like this for years - problems like this seem to be part and parcel of scaling a marketplace. Other actions such as raising take rates, pressuring sellers to reduce shipping fees or making the Offsite ad program compulsory for those that earn over $10,000 have reduced sellers’ profit margins, again which has alienated sellers and probably drove a few to leave the platform. The tension between supporting small businesses and making Etsy into a bigger business will be an endless battle during which there will be missteps from time to time. Management will need to constantly have their finger on the pulse to make sure that problems remain small and be able to adapt and pivot as necessary if big issues are arising. Every company has to manage these sort of conflicts to some extent, but it is particularly important at Etsy given its mission and ethos.

Similarly on the buyer side, they will have to keep attracting and engaging buyers to make sure they grow their share of the TAM. According to their internal surveys they are amongst the top 10 choices of consumers shopping online, which is a decent result but not great (their target is top 5). Management need to keep growing Etsy’s awareness, improving the brand and direct response marketing, and improving the user experience with continued investment in optimising search and discovery. There is also a question of whether the nature of Etsy’s products makes it not lend itself well to repeat purchases, as they are more ‘special’ in nature. Management is quite focused on raising awareness of Etsy’s wide product listing and becoming more top of mind for any number of occasions and holidays that people normally shop for. The fact that the proportion of repeat and habitual buyers is growing over time suggests to me they are doing a good job of this.

M&A is an area where management is still proving itself in my opinion, and they have made three acquisitions since 2019 including two in 2021 alone. How they handle integration, managing of the targets’ unique cultures, synergy realisation and operational improvements will be key to assessing management’s ability to pursue M&A successfully. This is particularly pronounced for the Depop acquisition which was not at a cheap valuation. Time will tell whether this was a wise piece of capital allocation.

Competition: Competition from the large tech platforms has always existed for Etsy but it’s been able to consistently fend them off by having a strategy that is dedicated to its niche and building up a brand that has become synonymous with vintage and handmade. Six months after Etsy listed, Amazon launched Handmade, a microsite that allows artisans to sell handmade goods. Etsy stock fell 75% in short order, the usual reaction when a large tech business announces they are entering a niche (think Facebook Dating and Match Group). However not only did Handmade not kill the business, Etsy went on to thrive and has been a 20x bagger since that low point. Mass market platforms such as Amazon and eBay are not going to be associated with handmade and vintage in customers minds. So even if Etsy has a significantly smaller customer base than those players, it’s a customer base that has very strong intent to buy crafted goods. Also given the scale at which Amazon operates, they are just not geared up for personalisation, customisation, and the ability to connect on a personal level with sellers and follow them on their journey, which is so important for these types of products. And finally, given the size of this niche, it will likely be too small for the likes of Amazon, eBay and Facebook to really focus on given it won’t really make a dent to their business. Instagram Shops may be an interesting one to watch as the highly visual nature of vintage and homemade products would synergise well with their platform. However as discussed earlier, search and discovery in this segment is not an insignificant challenge to overcome, and Etsy has had many years lead in investing in its tech to optimise this process. The other key point is that according to Etsy’s internal surveys its main competition is actually local craft markets and fairs, and there is no reason why they can’t keep winning against them particularly as online shopping habits solidify.

The other risk is that Etsy sellers will set up their own stores via Shopify, Wix and Instagram. As mentioned earlier however, 55% of Etsy sellers are already on multiple channels, and on average Etsy is still their prime source of income. This suggests that it will be quite difficult for them to leave the platform entirely given the scale of demand that it provides.

Post-pandemic slowdown: Etsy has been a huge beneficiary of the pandemic, and there is understandably a concern that once things revert back to normal, growth will slow considerably. So far at least this has not been the case, with Q1 2021 GMS growing 132% yoy, with masks contributing only 2% of GMS. Q2 2021 GMS guidance is a very health 27% growth on Q2 2020 (ex-masks), which was already a huge quarter given it was peak pandemic. Various data point show that online penetration has accelerated and consumer online shopping habits strengthened, and it seems unlikely that people will fully revert back to traditional offline after experiencing the convenience of online. It will be important to track habitual and repeat customers of Etsy to see if there is any deterioration in these metrics, although right now these are all trending upward. Nonetheless I have modelled a significant step down in growth over the forecast period to account for slower growth in the post-pandemic years (17% GMS CAGR from FY20-25).

CONCLUSION

In summary, I believe Etsy is a compelling investment opportunity that should keep compounding for a long time. It ticks all the boxes of a punch card investment. It is a unique business that is underpinned by secular tailwinds, has a loyal and engaged customer base, a sustainable competitive moat via strong network effects, an excellent management team with a good track record, strong unit economics, and a highly profitable, cash generative business model. Further the TAM is sufficiently large to provide a significant growth runway and reinvestment opportunities.

I have established a starter position in Etsy over Q2 2021 at an average price of $166, and have built up significant conviction through the process of doing this deep dive. I will be looking to add again if the stock drops closer to $170.

If you made it to the end, thank you for reading and hopefully you found the article helpful. If you like this sort of content please subscribe below for more, as I will be publishing a number of tech deep dives over the next few months. Also please follow me on Twitter @punchcardinvest.

For further reading / information on Etsy:

Inside the revolution at Etsy (New York Times)

Etsy’s growing network effects (John Huber, Saber Capital Management)

Etsy is trying to get bigger, and it’s pushing away small sellers (The Verge)

Good day mate, just having a gander at your investment philosophy derived from the coffin dodger of Omaha - how do you envisage the growth runway for this blog if the founding principle of punchcards is limited to the ballpark of 20 odd calculated bets?

Put another way, would you consider changing your investment mantra once your blog hits the 20 mark? Otherwise the dear reader might be caught in a catch 22.

Take care in your armchair sat in Singapore's wildly mismanaged pandemic. Much love from 2167.