Take-Two Interactive: The Rockstar of Genre-Defining Gaming

Deep dive on TTWO, a compelling long term gaming investment

What if I told you that you could own a piece of the most successful entertainment IP in the world in a company with a market cap of only $18bn. While perhaps not everyone has heard of game publisher and developer Take-Two Interactive (TTWO), everyone has heard of their iconic, genre-defining game, Grand Theft Auto. As of this date, the latest installation GTA V (released in 2013) has earned lifetime revenue of approximately $9bn1 on approximate development costs of $262m, and it is still growing. For some perspective, the most successful movie of all time, Disney’s Avengers: Endgame, made $2.8bn on a budget of $356m. Successful gaming IP has incredible resiliency, and TTWO owns not only one, but three of the most critically acclaimed and commercially successful franchises in the gaming world (GTA, NBA2K and Red Dead Redemption). These three franchises alone I believe can account for more value than TTWO’s current market cap. On top of that the company has a wide range of quality latent IP, and its current pipeline of games is the largest in its history, which provides option value that I believe is not currently priced in. In this piece I will cover why I think TTWO may be a compelling long term investment.

The TLDR version:

The investment thesis revolves around viewing TTWO not as a ‘hit-driven’ video game business, but as an owner of best-in-class entertainment IP that has exceptional durability, user stickiness, and a proven track record of monetising these assets

TTWO’s game franchises get stronger with each iteration and their development teams have become exceptionally good at generating recurring revenues from ongoing live content and online experiences. Recurring revenues now make up almost two thirds of TTWO’s revenue base, increasing earnings stability, margins and cash flow generation over time

Using a probability-weighted sum-of-the-parts approach, I believe TTWO’s three core AAA-franchises alone can account for around $190 per share in value, a significant premium to TTWO’s current price of $158

TTWO has 93 titles planned for release through to FY2025, its largest pipeline to date. This provides a free option on unexpected new franchises, which could structurally increase their earnings

Management has an excellent track record of execution and are disciplined capital allocators with a private equity-like mindset

Disclaimer: I am long TTWO, and this article is not investment advice nor a substitute for your own due diligence. The objective of this article is to help formalise my thinking on the stock and hopefully provide some interesting insights on the business.

BUSINESS OVERVIEW

TTWO is a leading global developer, publisher and marketer of interactive entertainment. TTWO’s games and services are primarily based on a portfolio of intellectual property that is published through its two wholly-owned labels: Rockstar Games and 2K Games. The company also has a Private Division label for independent developers, as well as mobile game developers Social Point, Playdots and Nordeus, which were acquired over the last few years. Each of the labels oversees the development, marketing and other non-creative responsibilities of their own specialised and unique IP that is either wholly owned or licensed. They each either own development studios and teams who develop the games, or they partner with external studios to do so. For instance Rockstar has 10 studios under its umbrella and does all of its own development work, while 2K has 6 owned studios as well as relationships with a number of external studios.

Aside from its sports franchises (NBA 2K, WWE 2K) which have annual releases, TTWO's strategy is to prioritise quality at the expense of quantity, taking much longer and spending more money in development relative to their peers and thus having a much sparser release slate. It has become known in the market for constantly delaying releases of its major titles for the sake of artistic output, ignoring pressure from its retail relationships and the investor community. For example, GTA V was released in September 2013 and the next version has yet to be released (or announced). Its predecessor, GTA IV, came out more than 5 years prior in April 2008. Similarly there was 8 years in between its critically acclaimed Red Dead Redemption releases (2010 and 2018). This contrasts with the annual release cycles of competitor franchises such as Activision's Call of Duty, Ubisoft's Assassin's Creed, or every other year for EA’s Battlefield and Star Wars series. This limited-release strategy tends to drive its shareholders mad, and would be seen as a detriment if its commercial results were not as spectacular. Taking the time to perfect its games has resulted in TTWO’s titles consistently being top ranked amongst AAA titles in terms of sales and critical reviews. It also helps to ensure less "franchise fatigue" among gamers. Of course, it also carries a heavier downside risk if the games were to be unsuccessful. But TTWO has by and large been hugely successful with its major titles and the management team has built up significant goodwill with investors, which is why it’s consistently valued at a premium to peers such as Activision and EA. Rockstar and 2K are amongst the most reputed labels in the Western world, which creates a bit of a halo effect around their games, even with the lower tier A-AA titles. Also, in recent years TTWO’s development approach has broadened with it now having its largest pipeline ever with 93 games over the next 5 years. This is a materially higher rate of output than what it’s achieved historically. The company has always said that its biggest constraint to releasing more games has been development capacity, and as a result it has been ramping up headcount both organically and through acquisitions to tackle this, adding over 1,700 developers during FY21 (total developer headcount now of over 5K).

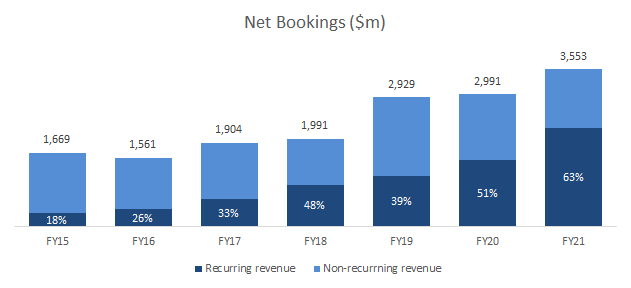

Gaming-as-a-service

Before I step through the details of each of the labels and their IP, it’s worth understanding the overall shift in philosophy and business model that game publishers such as TTWO have been going through. Investors who avoid gaming stocks tend to think of them as a hit driven business with ‘box office’ style lumpy revenues from upfront sales of games on consoles or PC. Traditionally that used to be the case, however as development cycles and costs have ballooned over time, and competition has increased with more titles vying for customer attention, a reliance on one-off upfront revenue has become a significantly risky model. So to improve the ROI on development costs and bridge the revenue between longer release times, publishers have been finding ways to increase the recurring revenues related to a game. This has been achieved through a Gaming-as-a-Service philosophy, including ongoing expansion packs, downloadable content (DLCs) and content drops, and in-game microtransactions. This shift in business model has come jointly with the shift away physical product distribution via brick and mortar retailers to digital distribution through various platforms such as Sony Playstation Store, Xbox Game Store, Steam, and Apple and Google App stores for mobile, which has made content much more accessible. As a result, the revenue profile for TTWO has become less lumpy and more stable year to year, and margins have improved over time as well. The below chart shows TTWO’s increasing proportion of recurring revenue. In FY21 it accounted for 63% of total bookings, up from only 18% in FY15, and in the Q1FY22 just reported this reached a new record of 69%.

“Providing new and innovative ways for audiences to stay engaged with our titles after their initial launch is a key strategic priority of our organization and represents an important long-term growth and margin opportunity. Our record levels of recurring consumer spending were largely driven by NBA 2K and Grand Theft Auto Online during the fourth quarter and were enhanced by the following offerings.“

Strauss Zelnick (CEO), Q4’21 earnings call

I will now step through TTWO’s different labels and their key gaming franchises. This will provide a good sense of the strength of their IP library.

Rockstar (35% of bookings in FY22)

Grand Theft Auto

Rockstar is the flagship studio of TTWO which owns and develops its tentpole gaming franchise Grand Theft Auto. First released in 1997 by DMA design studio, TTWO acquired this studio in 1999, renamed it as Rockstar North, and continued to be the publisher for the game globally. GTA defined its own category as an open-world action/adventure/driving game centered around vehicle theft, famous (or infamous) for its liberal violence and adult themes. It stands alone as its own unique genre which has never been successfully imitated despite a number of attempts (Cyberpunk 2077, Saints Row, Watch Dogs, True Crime).

The latest release, GTA V, has sold over 150m units from 2013 to date, and generated over $9bn in lifetime revenues, making it by far the highest grossing video game of all time, and arguably the most commercially successful entertainment property ever. The remarkable thing is that 8 years after its release it is still selling up to 20m units a year (comparable to other popular franchises such as Activision’s Call of Duty or EA’s FIFA, which have annualised releases). Of importance is the new component that helped make GTA V such a prolonged success, namely online play via GTA Online. GTA Online comes with every purchase of GTA V and will be released as a standalone game in November 2021. It allows players to download additional content and form teams online to complete missions. Rockstar has also released content for GTA Online periodically since launch, which has kept user engagement high and increased monetization of the game through online transactions (i.e. purchasing additional cars, weapons, etc.). The GTA Online model is seen as the archetype for how powerful additional in-game content and microtransactions can be. With an estimated 40m monthly active users, brokers approximate that GTA Online has consistently made over $500m annually over the last few years, and in the last year earned as much as $800m. GTA Online represents the majority of the ongoing revenue that TTWO generates from GTA products each year. In the recent earnings call management indicated that GTA Online is reaching new records of engagement and revenues, driven by successful launches of new content such as Los Santos Tuners, with more content updates to come over the year.

So what about GTA VI? All investor attention is on this as the next instalment of their tentpole franchise is likely to be the single biggest catalyst for the stock. Most brokers expect a release in 2023, although even this date has been pushed back from 2021/2022 just a few years ago, so this is something that is very difficult to predict. The important point is that Rockstar is not under any pressure to rush GTA VI given the continuing success of both GTA V and GTA Online. This ongoing success success does raise a question of how exactly Rockstar will navigate the transition to GTA VI while also not killing off this highly lucrative revenue stream. I will discuss this further in the Risks section.

Red Dead Redemption

Rockstar’s second major franchise Red Dead Redemption has been another critical and commercial success. Often described as GTA with a Western theme, it has similar open-world gameplay mechanics, but think horses instead of cars, train robberies instead of heists, and colt revolvers instead of Glock pistols. Its most recent version Red Dead Redemption 2 (RDR2) was released in October 2018 and has since sold 38m units and according to the company has been the 2nd-best selling title in the US over the last three years. Even though RDR2 is not as successful as GTA, it is still much earlier in its product cycle. Similar to GTA Online, the online version Red Dead Online was released free with every copy of RDR2.

I mentioned earlier TTWO’s supreme focus on quality and artistic perfection at the expense of costs and deadlines. GTA V and RDR2 achieved almost perfect, record-high, Metacritic scores, and were equally loved by gamers. The games are full of stunning details, both big and small, with dynamic worlds and sophisticated narratives that have intelligent, comical and often biting commentary on American life, politics and culture at their respective points in history. Reddit forums are always a good way to gauge the views of passionate gamers, and interestingly while the games of rivals, especially Electronic Arts, often receive heavy criticism, Rockstar’s games seem to be generally receive praise for all sorts of elements including gameplay, graphics and storytelling.

“Red Dead Redemption 2 isn’t just Rockstar’s greatest achievement to date; it’s a game so lacking in compromise it’s tough to know where best to start discussing it.”

IGN, Oct-2018

Both GTA V and RDR2 will be released for the new generation of consoles this year (PS5 and Xbox Series X), with a range of technical improvements to take full advantage of the latest hardware, which should further boost unit sales.

Other Rockstar IP

Rockstar has a number of other latent IP titles that have already achieved success in earlier releases but haven’t seen new iterations for many years, likely due to development capacity. However these have recently been called out by TTWO in earnings presentations, suggesting that new instalments may be in the pipeline. These include:

LA Noire: crime thriller released in 2012 to much critical acclaim, particularly for its revolutionary facial animation technology. Reportedly sold-in over 5m units

Max Payne: cinematic action shooter which had three iterations, with the latest Max Payne 3 released in in 2012 and selling reportedly over 4m units in the first year

Midnight Club: a series of open-city street racing games which ran from 2000 to 2009 and has generally had good reception. The development team was disbanded in 2010 but the trademark has subsequently been re-registered

2K (55% of bookings in FY22)

NBA2K

The 2K label covers a range of genres but is most known for the NBA2K franchise, which is TTWO’s second largest revenue contributor after GTA. NBA2K is a basketball simulation game released annually since 1999, similar to EA’s FIFA and Madden series. The game has a license with the NBA to use player names, team names, and the latest rosters, so gamers tend to purchase the latest edition to have the most up to date content in game (jerseys, stadiums, etc.). Unlike FIFA and Madden however, NBA2K does not have an exclusive license with the NBA - EA also has a competing game called NBA Live. However, over time and with the help of some slip ups from EA, NBA2K became the dominant “winner-take-all” basketball franchise. Like with most sports franchises there is significant durability for once a community is settled on a game for their chosen sport, they will stick to it due to strong network effects. Over the last four years NBA2K has generated over 10m annual sales, with NBA2K20 hitting a new record of 14m, providing TTWO with consistent and growing annual revenues from this franchise. NBA2K is also a significant contributor to TTWO’s recurring revenue via in-game microtransactions through the use of “Virtual Currency” (VC). VC can either be earned through the game or purchased using real money, and can be used in-game to boost attributes of players, cosmetic upgrades, or purchase player cards for “myTeam” mode in which gamers can compete with others online using their built up teams. The game has extremely strong engagement, with 2.7m daily players, and is estimated to bring in ~$700m of recurring revenue, which along with GTA Online, makes up the majority of TTWO’s recurring revenue.

While most of NBA2K sales are in the US, the game has been growing internationally with efforts to localise the game for different markets. In particular, basketball (and specifically the NBA) is huge in China, where it ranks as the 2nd most popular spectator sport. TTWO has a license to sell PC title NBA2K Online in China with Tencent as the distribution partner. The title has become the number one PC online sports game with 54m registered users. This game is distributed as a free to play game, so the earnings contribution from this would be currently small, but it does provide an interesting growth option for TTWO in a market where it has historically been severely underpenetrated. 2K also has a number of mobile versions of the game. In Apr-2021 NBA2K21 was released for Apple Arcade, where it has become the most popular game. Other mobile versions of the game include NBA2K Mobile, and NBA SuperCard.

In Feb-2017 TTWO entered into a joint venture with the NBA to create the NBA2K League, the first esports league dedicated to a traditional sport in the US. Starting off originally with 17 teams in its first 2018 season, the league will now be commencing its fourth season with 23 teams, all operated by actual NBA franchises. It is similar to Activision’s Overwatch league, whereby teams franchise with professional esports athletes. The League airs live on Twitch and Youtube, and according to the company has had nearly 470m views. Nonetheless it does not seem that the league is a significant revenue contributor, but the real objective for TTWO is to drive more interest and engagement in the game.

WWE2K

2K’s other major sporting franchise is WWE 2K, a wrestling simulation game that is typically released annually and estimated to sell 2-3m units per year. TTWO skipped the 2K21 release after a massively negative response to 2K20, and its WWE 2K22 release this year will be taking a new direction with a new marketing campaign. 2K also released an arcade-style over-the-top version called WWE 2K Battlegrounds, and it also has a mobile version called WWE SuperCard which has been downloaded more than 24m times and remains 2K’s highest grossing mobile title.

PGA2K and NFL

In 2018, 2K announced it acquired the publishing rights to HB Studios’ PGA Tour golf games, and in 2020 released PGA Tour 2K21 which has since sold over 2m units. Earlier this year, 2K announced that it acquired HB Studios and at the same time announced that it is entering an exclusive long-term agreement with Tiger Woods to serve as its Executive Director and consultant. I believe this demonstrates very strong intent from 2K to create a consistent franchise out of PGA Tour 2K.

In 2020, 2K struck an agreement with the NFL to publish an arcade style non-simulation game, as NFL’s agreement with EA allows the nonexclusive development of non-simulation games. The game is currently in development and was set to launch during FY22 but has now been delayed.

Other 2K IP

Aside from its sports titles, 2K has quite a diverse portfolio of IP that is critically acclaimed and commercially successful. These include:

Borderlands - scifi themed open-world shooter/looter game developed by independent studio Gearbox Software. Franchise has sold over 70m units in total and the latest Borderlands 3 (released in 2019) has sold 13m units to date and has been 2K’s fastest selling title (Borderlands 2 sold 25m in total and is 2K’s top selling title). Borderlands 3 has a strong recurring revenue element as well with a number of add-ons and in-game purchase ‘vault cards’. Also, to further highlight the strength of the Borderlands IP and gaming’s synergies with other mediums, Lionsgate is producing a live-action film based on Borderlands, directed by Eli Roth and featuring Cate Blanchette, Jamie Lee Curtis, Kevin Hart and Jack Black. This should further boost interest in the game and possibly introduce a new audience to it, as typically happens when a game-based film or TV series is made (The Witcher game sales spiked after the Netflix TV show release).

Sid Meier’s Civilization - one of the world’s most classic and longest running strategy titles for PC. Developed by Firaxis Games, the franchise has sold over 58m units since its first instalment in 1991. Amazingly the latest Civilization VI (released in 2015) sold faster than all of its predecessors and has reached 11m sales to date, again highlighting yet another franchise which has grown in popularity over time.

Other big 2K franchises include BioShock (unique first person shooter with total franchise sales of 37m), XCOM (a remade version of a classic action strategy franchise), and Mafia (open-world action game). The fact that TTWO has consistently highlighted these titles in their recent earnings presentations suggests that they are working on new iterations of these games, and we know that they recently launched a new studio Cloud Chamber to develop the next installment of BioShock.

Private Division

This is the label that publishes unique games from independent studios and has its own studio that works on its key franchises such as Kerbal Space Program and other IP. Kerbal Space Program is a space flight simulation game that TTWO purchased in 2017. The game has sold-in over 5m units and a sequel is in development for release in 2022. In 2019 Private Division published a new game The Outer Worlds, developed by Obsidian (owned by Microsoft). The game surpassed all expectations and has sold 3m units to date and has been followed up with a number of expansion packs. The sequel is currently in development. Finally in 2019 Private Division in 2019 released Ancestors: The Humankind Odyssey, which has become its third game to sell over 1m units. Private Division has a number of other forthcoming games, and their track record to date gives me confidence that TTWO can successfully launch fresh IP out of its large pipeline. It’s worth highlighting that Private Division is predominantly a publisher, and doesn’t take development risk, which results in lower margins but provides TTWO with a more low-risk and stable revenue stream.

Social Point

In 2017 TTWO made a definitive move into mobile gaming through a $276m acquisition of Social Point, a mobile games publisher based in Barcelona. Up until that point, TTWO was largely focused on console and PC, and has for many years chosen to stay out of mobile due to CEO Strauss Zelnick’s belief that the free-to-play mobile games were unsustainable. However, with this acquisition, TTWO was publicly acknowledging that it could no longer avoid the rise of this category. Social Point’s five big games - Dragon City, Monster Legends, Word Life, World Chef, and Tasty Town, have been downloaded over 600m numbers. Its top two games Dragon City and Monster Legends are in the top 100 grossing on iOS and Android. No further financial information is available.

Playdots

In 2020 TTWO further entrenched its position in mobile through a $192m acquisition of Playdots, developer of casual, free-to-play mobile games Dots, Two Dots, and Dots & Co. Founded in 2014 with a funding round from Tencent, Playdots is led by former King.com executive Nir Efrat and has a 70 developer team. Its Dots games have been downloaded over 100m times, with Two Dots being the most popular at 80m downloads and having 1m daily active users and 8m monthly active users.

Nordeus

TTWO’s most recent and largest acquisition to date has been Nordeus for $378m, a Serbian-based mobile game developer known for the world’s most successful mobile soccer management game Top Eleven. The game has been running for over 10 years and has 240 million registered users and around 78 million downloads over the years, and according to the company the game is still growing month on month.

INVESTMENT THESIS - WHY IS THIS A GOOD INVESTMENT?

Video gaming is a structural growth industry, growing faster than all other entertainment mediums

There is a reason why for years Reed Hastings has been saying that the biggest competitor to Netflix (other than sleep) is Fortnite, and why the company has announced they are now entering gaming. The gaming industry is experiencing structural growth and is becoming the dominant form of entertainment. According to Deloitte2, the youngest generation, Gen Zs, prefer gaming to all other entertainment activities, and for Millennials it ranks second only slightly behind TV/movies. This tilt towards younger demographics will help underpin the future growth of the industry. In dollar terms, it is expected to grow at a CAGR of 5% to reach $286bn by 2025, which is faster than all other entertainment mediums.

Essayist and venture capitalist Matthew Ball in his fantastic 2020 article “7 Reasons Why Video Gaming Will Take Over” beautifully articulated the reasons for the growth of the medium, and I highly recommend everyone read this article. Gaming has been driven by the intersection of many technological, cultural and business model trends. Of all the entertainment mediums, gaming is the one that’s always been the most constrained by technology, and thus when technology evolves, it tends to be the medium that makes the biggest leaps, increasing what’s possible in terms of content experiences, graphics, gameplay and business models. Technological evolution also tends to make game sequels better and more commercially successful over time as the graphics and gameplay advance with each new iteration. This is not necessarily the case with movie or TV sequels. Technology has also democratised access to games through things like faster broadband, digital distribution, mobile gaming, cloud gaming and streaming. All of these things have helped to make games more ubiquitous and immersive experiences than TV or movies. Games have also reached a cultural tipping point with games like Fortnite becoming part of conversation and increasingly become places where people can just socialise and hang out. Unlike TV and movies, games also have almost unlimited content leverage which makes them highly scalable and more engaging. As a single-player game, Red Dead Redemption 2 can be 47 hours long (main game), or 76 hours (main + core extras) or 161 hours (to complete everything). When you add on the social and multiplayer elements such as Red Dead Online, then the game never technically finishes (until all your friends stop playing it).

“Successful as The Incredibles is, and obsessed upon as the original Star Wars was, fans can’t spend hundreds of hours with the IP; its content doesn’t scale – even with physical toys. Yet, video games regularly achieve this level of engagement. Games are uniquely capable of capturing the full range of audience love for a franchise. Not only does it capture the linear story, but also infinite multiplayer experiences built atop that story, and increasingly, the myriad experiences that an at-home fan can dream up, too. The ceilings for audience love is infinite – and thus so, too, is the potential “play time” and monetization.”

Matthew Ball, 7 Reasons Why Gaming Will Take Over

Further, with the increasing industry push towards recurring revenues and “gaming-as-a-service”, business models have evolved to foster continued audience attachment to games via mechanisms such in-game monetisation, DLCs, online play, user-generated content, e-sports, and even just the huge rise in people watching others play games. For what it’s worth, the most popular video site in the world is YouTube, and it’s most watched content is recorded video game clips.

Finally, the pandemic accelerated engagement and spending on video games which seems to be normalising now at a higher level than pre-pandemic. TTWO management thinks there has been permanent shift in people’s relationship to gaming.

“We believe that the pandemic initiated a transformational shift in entertainment consumption, revealing the possibilities of interactive entertainment to a much broader market, with interactive entertainment becoming the number one entertainment vertical. We anticipate that the overall addressable market for our industry will be notably larger going forward than it was pre-pandemic.“

Strauss Zelnick (CEO), Q4’21 earnings call

Portfolio of best-in-class IP that’s incredibly resilient and less susceptible to competition

TTWO’s franchises are some of the leading names in the gaming industry, which bestows them with multi-year revenues and incredible user stickiness. I believe they also have qualities that make them less susceptible to competition and imitation. As I described earlier, GTA and RDR are iconic, genre-defining games which have no close competition despite a number of attempts. CD Project’s recent much anticipated attempt at open-world gaming Cyberpunk 2077 ended up as a high profile failure with a lot of technical glitches and bugs, with many critics saying it just tried to do too much. This underscores to me the complexity of building AAA titles like this and how difficult it will be to surpass Rockstar’s accumulated marginal gains in this arena. Sports titles tend to become winner-take-all markets given the strong network effects once a particular game has become preferred by players, and NBA2K is the clear winner in basketball. While Activision’s major franchises such as Call of Duty and World of Warcraft are clear heavyweights in their respective genres (first person shooters and MMORPGs respectively), these categories are quite competitive with a large number high quality titles vying for attention, which in my view makes more vulnerable. So overall I think TTWOs franchises have a much larger competitive moat than their competitors.

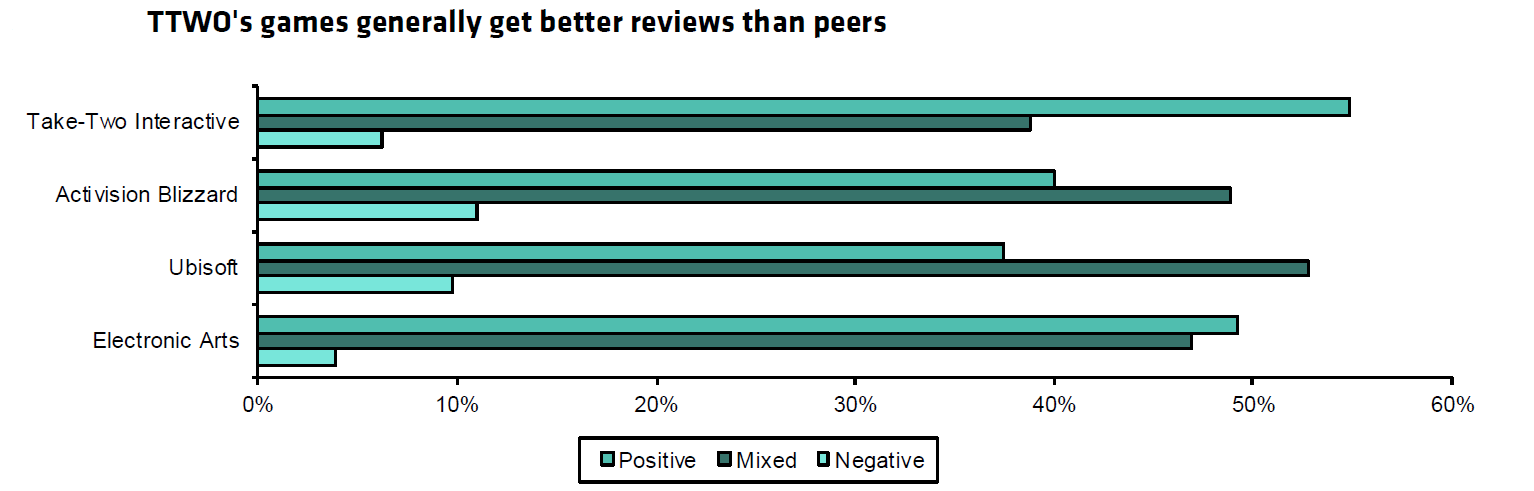

The competitive moat of TTWO’s franchises is further reinforced by their consistently higher critical response than competitors. The below chart shows a summary of Metacritic reviews for TTWO and its competitors, showing how TTWO generally has better reviews than its peers.

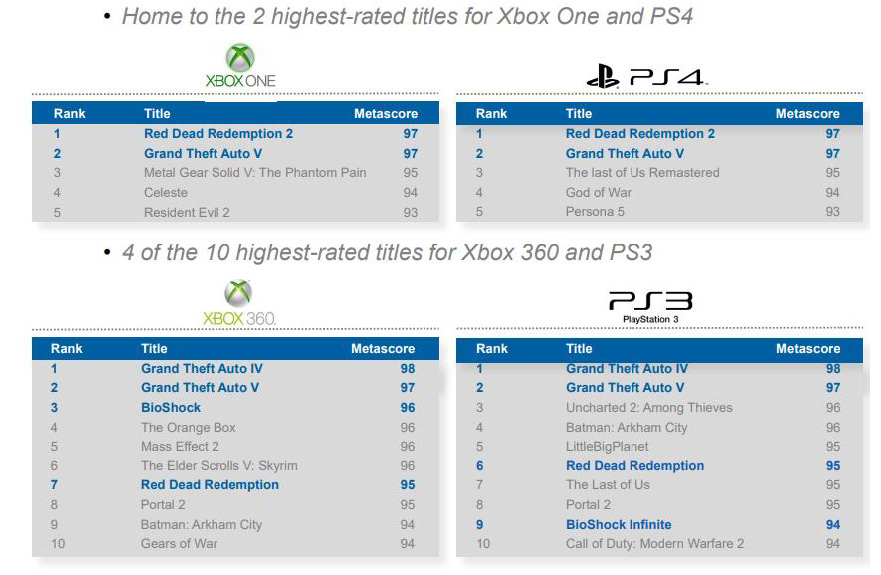

GTA and RDR are among the highest scored games by critical reviewers. GTA V is the equal all time highest Metacritic scored game. Its predecessors GTA San Andreas and GTA III are equal no.2. RDR 2 is the equal no.1 highest Metacritic scored game. Civilisation, Bioshock and X-Com typically receive 85-95 scores representing generally the top 1% of critically reviewed games. This is all a reflection of TTWO’s supreme focus on quality and polishing games to perfection at the expense of regular release deadlines.

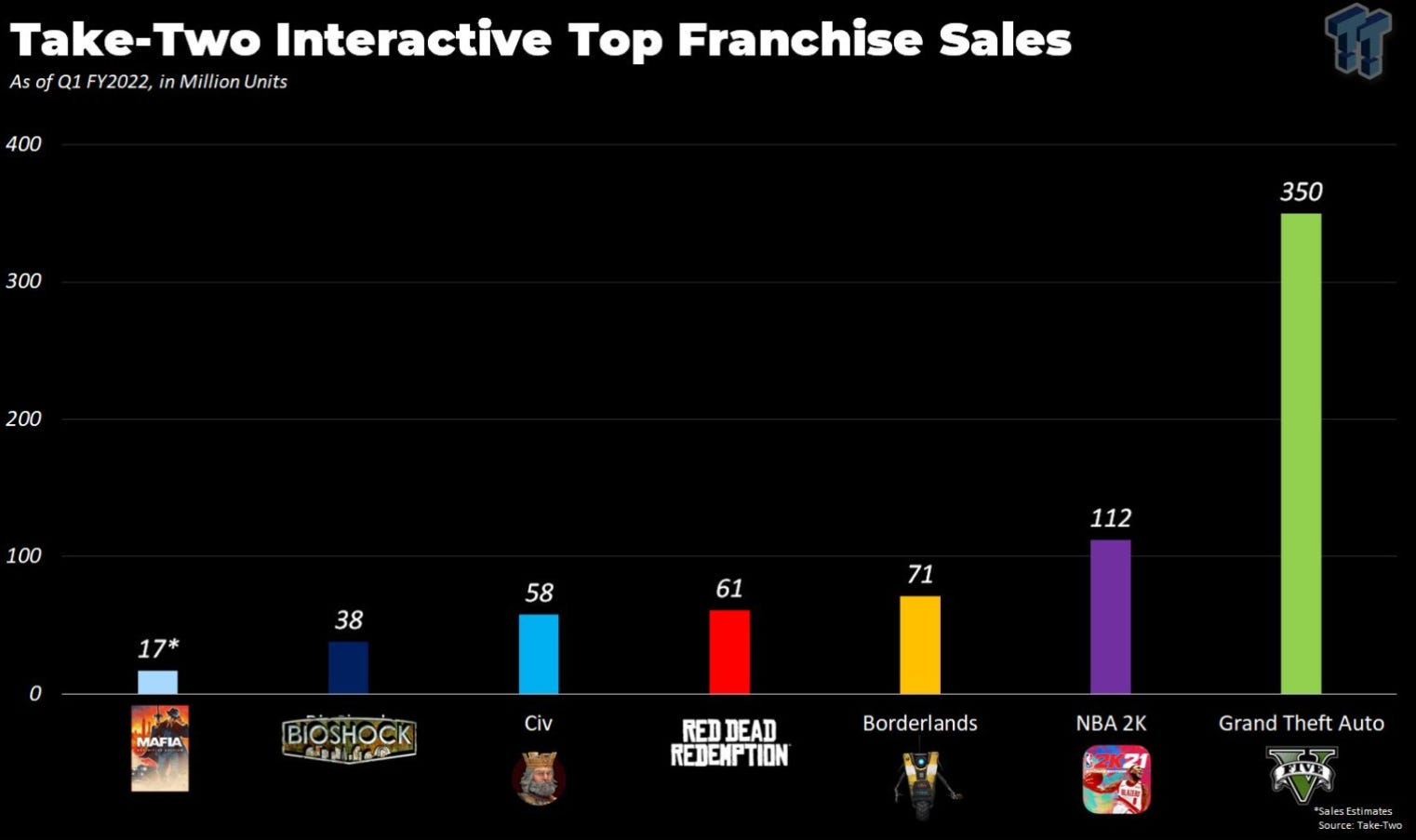

Finally, in terms of commercial success, the below chart summarises the exceptional lifetime unit sales of TTWO’s major franchises, which is even more impressive given some of the franchises like Civilisation and Bioshock target more niche audiences. In all of these cases, the titles have become more popular with every iteration, with the newer versions outselling its predecessors. GTA V sold 150m (to date) compared to GTA IV sales of 25m. RDR2 sold 38m (to date) compared to RDR1 of 22m, and NBA2K20 sold 14m compared to NBA2K15 of 5m. This gives a sense of the growing popularity and resiliency of their franchises over time.

A number of growth options from large pipeline, latent IP and expansion into new categories and markets, which are not priced in

TTWO’s core franchises form the foundation of the business and create a relatively stable and consistent base of earnings and value. On top of that, the company currently has its largest pipeline of releases to date; 93 titles planned for release through FY2025, more than double what it was five years ago. This pipeline provides a free option on unexpected hits, which could structurally increase their earnings. As is typical of TTWO, there is little information about what games exactly are in the pipeline and the planned release schedule, but we do know that around half are new IP. Of course a lot of these games may never reach the market, but there is a reasonable chance that some of them may become new franchises. TTWO has a good track record of successfully generating fresh IP and there is a bit of a halo effect around their games as they have developed a reputation in the industry for supreme quality. For instance, I’ve highlighted Private Division’s recent successes, with The Outer Worlds in particular being a standout that surpassed all expectations. Aside from new IP, there is plenty of other latent IP in the TTWO library that has been released in the past with strong success, but hasn’t seen new iterations for many years, including LA Noire, Max Payne, Bioshock, and Midnight Club. The company has always said that their biggest constraint has been development capacity to work on all the titles in their library. With their significantly increased headcount of late there is a fairly good chance that some of these already proven titles are in the pipeline and may get revived.

There are two other areas for expansion where TTWO is currently severely underpenetrated - mobile and Asia.

Currently TTWO’s contribution from mobile is quite low (likely to be single digit). Mobile however is the fastest growing segment of the gaming industry and management has made its clear intent to build up presence here. We know that 21 of the 93 games in the pipeline are targeted to be mobile-only. Most of these will probably be through their Social Point and Playdots businesses. There have also been some attempts at porting its core Rockstar and 2K titles to mobile, with the most notable being NBA2K Mobile. However overall the potential for porting games like GTA is limited due to the high computing and processing requirements for such games, together with their complex gameplay and narratives, which makes them ill suited for more casual mobile play. So it is likely that most of its mobile growth will need to come from the library of Social Point/Playdots/other studios it acquires. Regarding geographic expansion, TTWO has predominantly been a Western country focused company, and it is fair to say that it has had challenges in growing significantly in Asia which are the fastest growing gaming markets. This is due to a few reasons. Firstly, these markets tend to be more mobile orientated, and as just mentioned TTWO’s games are predominantly focused on console/PC and it has had limited presence in mobile. Secondly, its key titles, GTA and Red Dead Redemption, are currently banned in China and unlikely to ever be approved due to their content (violence, crime, drugs etc). Thirdly, games like GTA and Red Dead Redemption are very much based around American culture and history, which makes them less appreciated or relevant in Asian markets. TTWO has had much better success in penetrating China via NBA2K. As mentioned before, basketball is the second most popular spectator sport in China, and NBA2K has the monopoly on basketball. TTWO’s NBA2K title is currently the most popular sports PC game in China. Further, with Tencent as the distribution partner, and the console market growing rapidly in China, there could be potential to grow this franchise significantly in that market.

Experienced management team with a strong track record of execution and capital allocation

TTWO is led by CEO and Chairman Strauss Zelnick, who has been Chairman of the Board since 2008, and CEO since 2011. His 2IC is Karl Slatoff, who is the President of TTWO, and was previously the COO between 2010-2013. Both have had significant senior leadership experience in the media and entertainment industry prior to TTWO. Mr. Zelnick was previously the CEO of BMG (music and entertainment giant), CEO of Crystal Dynamics (producer/distributor of game software), and President and COO of 20th Century Fox. Mr. Slatoff was previously the VP of New Media at BMG, worked in strategic planning at Disney, and investment banking at Lehman Brothers prior to that. Both Mr. Zelnick and Mr. Slatoff are currently partners of ZelnickMedia, a private equity fund focused on media and communication industries that Mr. Zelnick founded in 2001. This connection to ZelnickMedia is worth diving into as it is quite an unusual structure which does raise some questions. ZelnickMedia has a management agreement with TTWO, which was entered into in 2007 after previous CEO and original founder of the business Ryan Brant was found guilty of falsifying business records. Mr. Zelnick and Mr. Slatoff are both paid directly by ZelnickMedia, not TTWO. TTWO pays a management fee to ZelnickMedia, along with cash incentives and long term equity incentives. The cash incentives are based on Adjusted EBITDA targets, where the main adjustments are for adding back the deferred revenue and costs, and stock-based comp. The adding back of deferred revenue is not ideal but is not overly material, as the delta between bookings and GAAP revenue is not large in this business (<10%). The equity grants are based on market performance and business performance targets. The market performance component (75% of equity grant target) is based on TSR vs. the NASDAQ index. The business performance component (25% of equity grant target) is set as follows: 50% based on unit sales of key IP and 50% based on recurring revenue. While I would have liked to see some ROI-linked components as it would help incentivise better capital allocation decisions such as avoiding expensive M&A deals to grow earnings, this is an area where I have less concern with given the background of Mr. Zelnick and Mr. Slatoff and their actions to date (will discuss shortly). Overall the structure seems like it would provide appropriate alignment with long term value creation and focus on balanced growth.

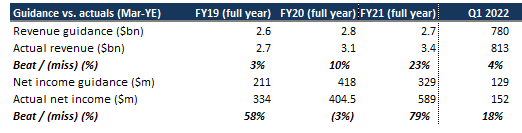

The structure with ZelnickMedia does raise some obvious questions around potential conflict of interest - who’s interests are Mr. Zelnick and Mr. Slatoff really looking after? However this management structure has been in place for a very long time now, and I believe the track record to date has quelled these concerns for investors such that they now largely ignore this issue. I have discussed extensively throughout this article the track record of this management team in consistently delivering creative and commercial success in its core franchises, successfully producing new IP, adopting new business models and driving recurring revenues and profitability. I also like to see a track record of meeting or exceeding guidance, which highlights management’s ability to deliver on what they promised and a good handle on business forecasts. As can be seen below over the last 3 years as an example, Mr. Zelnick and his team have largely consistently beat the top end of their revenue and net income guidance set out at the start of the year. FY21 (year ending Mar-21) was understandably an unusual blowout year given the unanticipated tailwind of the pandemic during 2020. Earlier years provide a more normal benchmark and there we also see generally consistent guidance beats. Net income in FY20 came in slightly lower than the top end of their original guidance although it was still right at the mid-point of the range. Its most recent Q1FY22 results were also well above the guidance.

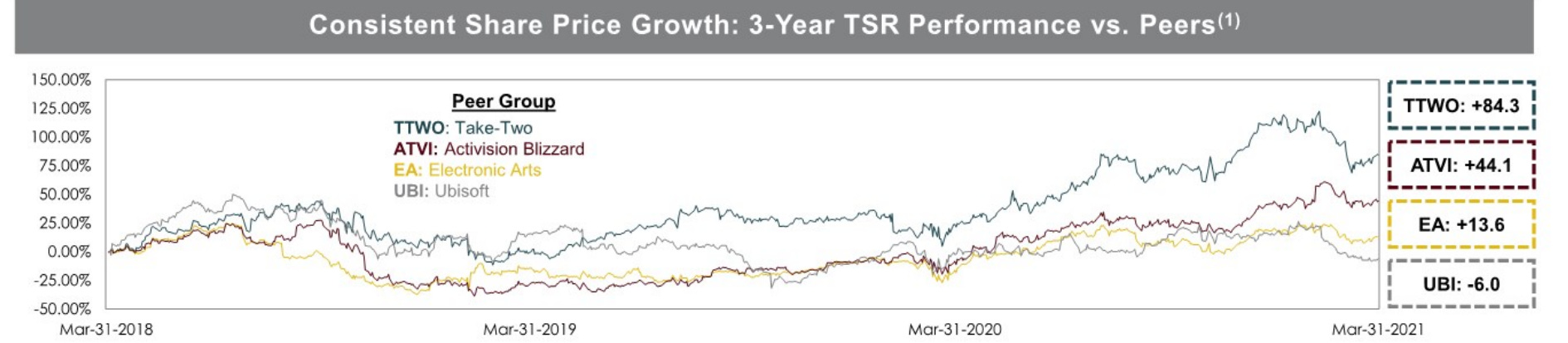

From a capital allocation perspective, the fact that both Mr Zelnick and Mr. Slatoff are experienced private equity professionals gives me significant comfort that they approach capital allocation with an ROI-maximising mindset. They have been highly selective in doing buybacks - management has noted previously that the company will only buy back stock if they see “deep value.” And they seem to be disciplined with M&A as well. Of note, they walked away from the high profile acquisition of Codemasters in 2020 after the price got too expensive (EA acquired it at the end for $1.2bn). Most of the deals have been smaller acquisitions of development studios and IP, and most recently mobile game companies. Its most recent Nordeus deal has been the biggest at $378m. According to management they have never had a failed acquisition from an earnings accretion standpoint. This is a very encouraging sign to me that the management team are not empire builders. The main use of capital has been reinvestment in the business, notably in development headcount and launch of new internal studios to execute its large pipeline. Overall management’s capital efficiency is evident in TTWO achieving higher ROIC than its peers (ATVI, EA) despite having lower margins. As a result, TTWO has had superior shareholder returns vs. peers as well.

Finally one more point on company culture. People and culture are of crucial importance especially in technology companies where you are working with assets primarily of intangible nature, and people become your main asset. The gaming industry in particular has been in the spotlight of late given the recent allegations of harassment and toxic work environment at competitor Activision. On the last earnings call Mr. Zelnick spoke a lot about TTWO’s culture of high performance but zero tolerance for discrimination. Their management team and Board is highly diverse in terms of race and gender, and encouragingly their staff turnover is half that of the industry average and been trending down (whereas industry turnover in general is trending up). Based on Glassdoor reviews, employee satisfaction at TTWO and its labels seems very high. TTWO (parent company) has a very high rating of 4.5 out of 5, and Mr. Zelnick has a 99% approval rating as CEO. Rockstar and 2K are run as relatively standalone entities which house all the creative and marketing talent. Rockstar has a Glassdoor rating of 4.4 out of 5 and 2K has a bit weaker but still strong rating of 3.9 out of 5. The great thing is that all of these ratings have been improving over the last year, suggesting the company trajectory is heading in the right direction.

FINANCIALS AND VALUATION

Financial profile

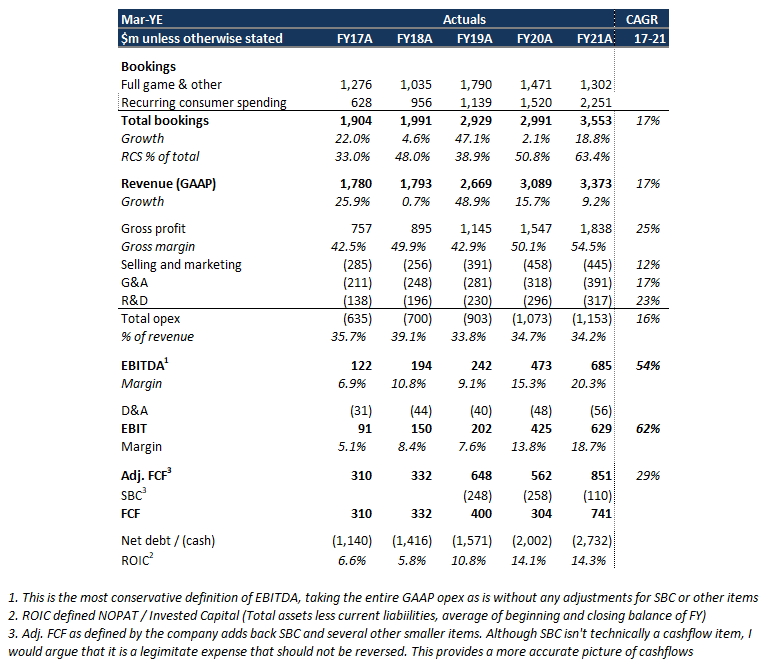

The below table summarises the last few years of financial performance for TTWO. there is a lot to like about the financial profile. A couple of observations:

Revenue: As is typical of a gaming company, there is some volatility from year to year particularly as a result of big game launches. FY19 saw a huge 49% revenue jump as a result of the launch of RDR2 in Oct-2018, which sold over 25m and was the top selling game of that year. The subsequent year growth was just about flat, but then accelerated again in FY21 as a result of the pandemic. Looking through the volatility, TTWO has grown its revenue base over time at a very healthy CAGR of 17% from FY17-21. The encouraging point is that recurring revenue has been continuously increasing as a % of total bookings from 33% in FY17 to now accounting for the majority of bookings at 63%. This has resulted in a much more stable revenue profile over time. It’s also worth noting that the big three franchises, GTA, NBA2K and RDR, account for the majority of the revenue, approximately 80-85% according to broker estimates. While this does present some concentration risk, such concentration is not atypical of gaming companies: Activision’s three core franchises (Call of Duty, World of Warcraft and Candy Crush) account for 76% of its revenue (CY20). As I’ve discussed extensively throughout this article, the leading game franchises have astounding durability and with TTWO becoming exceptionally good at generating recurring revenues from these franchises, I feel like this risk is manageable.

Margins: Both gross margins and operating margins have grown consistently over time. This has been driven by two key trends: 1) the shift away from physical distribution to digital distribution, which comes with higher margins due to almost no product and distribution costs, 2) increasing proportion of RCS, which is very high margin revenue given it requires only incremental development and marketing costs (estimated ~80% gross margins)

FCF generation: TTWO has very high cashflow generation due to very low capex (1-2% of revenue) and low net working capital requirements aided by a large amount of deferred revenue (cash collection upfront). Its net cash position has been continuously growing year after year to now sit at $2.5bn, giving them a significant war chest for investment or capital return

ROIC: As RCS and margins have increased over time, ROIC has steadily been improving to now sit comfortably in the mid-teens level. Ideally I would like this closer to 20% or above, but as RCS and digital distribution continues to grow we can expect ROIC to continue its upward trajectory

Valuation

It is difficult to forecast a business such as TTWO a few years out as there is a lot of uncertainty around the timing of big game launches and how successful they will be. For instance, GTA VI will undoubtedly have a significant impact on earnings the year it is released, however the expected launch date was FY22 just a few years ago, and now consensus is FY23/24, with no guarantees that it will be released then either given very little news to date. As such, I have taken the approach of valuing the business using a probability-weighted sum-of-the-franchise methodology. This estimates what the key franchises could be worth based on lifetime unit sales and ongoing recurring revenues in base, bull and bear cases, and then sums the probability-adjusted numbers together3. The first part uses a DCF approach to value the franchise over a 8 year lifecycle (to capture at least 1 AAA release). I will step through the workings for the GTA franchise in a bit more detail and then summarise the key assumptions for NBA2K and RDR.

Valuing the GTA franchise

The below table summarises my key assumptions for valuing the GTA franchise.

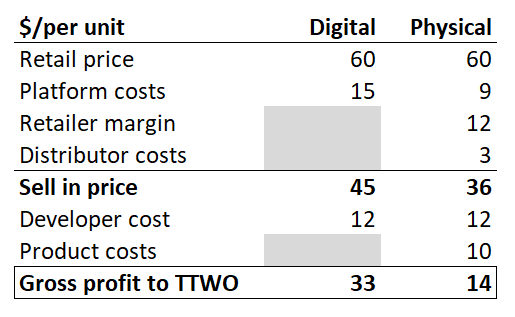

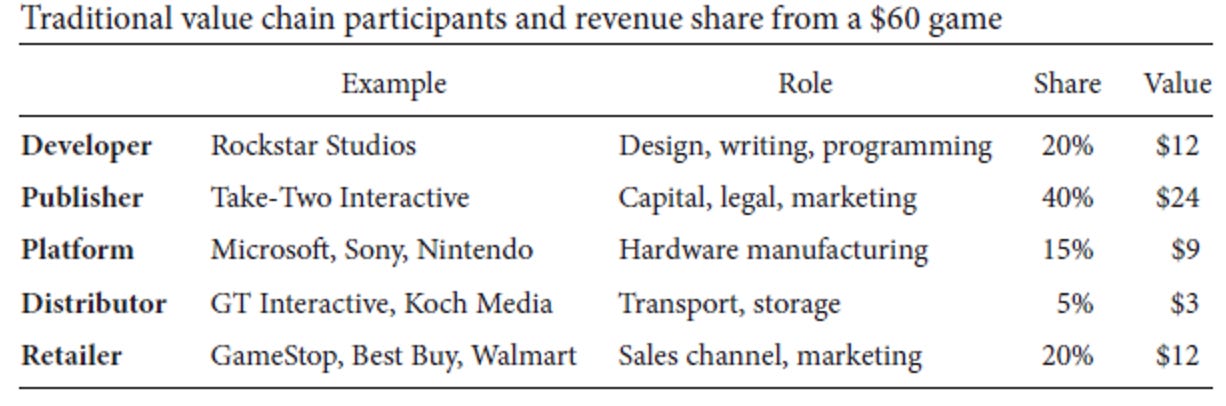

The big question with GTA VI is not whether it will be successful, but just how successful will it be. Therefore the key assumption is lifetime unit sales from this point into the future. We don’t know the exact date of the GTA VI release, so the above lifetime unit sale assumptions essentially capture a few years of GTA V followed by GTA VI when it launches. As mentioned, GTA V has now sold 150m units since 2013 to date. My base case conservatively assumes 90m total unit sales over the next 10 years, with 120/50m in the bull/bear cases respectively. The gross profit per unit will depend on whether the sale is digital or physical. I have assumed 75% of unit sales are digital, in-line with current trends of the business, however this is likely to be conservative given the growing trend towards digital in the future. Estimating the gross profit per unit is the tricky part and I had to triangulate this using a number of sources. For those interested, I have provided the complete details in the footnote4, but in summary for an average $60 retail game I estimate that the average gross profit per unit to TTWO is $33/unit for digital and $17/unit for physical, with the difference being that digital has no product or distribution costs. From this we can work out the total gross profit contribution from unit sales.

Next, we need to work out the recurring revenue from in-game microtransactions in GTA Online. While we don’t know the exact number of active monthly players in GTA Online, estimates are roughly around 40m based on figures released a few years. Not all of these players will be paying for in-game purchases, and Bernstein estimates that the portion of the total install base (150m) that is paying is likely to be around 10%, or ~15m in the base case (12/8% in the bull/bear cases respectively). Bernstein also estimates that GTA Online users spend around $60 a year in the base case ($70/$50 in the bull/bear cases respectively). While it is hard to be accurate around actual player numbers and ARPU, I take comfort that with these assumptions I get pretty close to the estimated annual revenue from GTA Online which we know based on company disclosures and broker estimates is around ~$800m. Assumed gross margins on this revenue are quite high at around 80%. I apply these assumptions to both the current GTA customer base and to the future unit sales, assuming they carry the same attach rate and spending patterns.

Using the above assumptions for unit sales and recurring revenues, we can work out the after-tax cashflows over 8 years with a terminal value (assuming 0% TGR, WACC of 8%). This results in a base case franchise value for GTA of $14bn, and bull and bear cases of $20.7bn and $8bn respectively. After probability adjusting them, I get a weighted valuation of $14.7bn. Note that this is before allocation of any overheads (applied later).

There is an important risk to consider in all of this and that’s how TTWO will transition players from GTA V and GTA Online, to the new GTA VI, which I will address further in Risks. Overall I feel like I’ve accounted for this risk by assuming lower unit sales for GTA VI in the base case and lower attach rates to the new online version in the bear case.

Valuing the NBA2K and Red Dead Redemption franchises

The same methodology was applied to NBA2K and RDR.

For NBA2K, the key difference is that it has an annual release cycle, so base/bull/bear cases revolve around the growth in annual unit sales. I’ve assumed that the next release sells 13m (NBA2K20 sold 14m) and it grows at 2% p.a. in the base case (5%/-2% in the bull/bear case). It also has a much higher ARPU for its in-game microtransactions, which Bernstein estimates is at around $100. I’ve assumed the same for my base case, and $130/$70 in the bull/bear case). Again I take comfort that with these assumptions I get recurring online revenue of fairly close to the $700m mark from company disclosures/broker estimates. The other assumptions are the same as for GTA. This results in a base case franchise value for NBA2K of $12.4bn, and bull and bear cases of $19.6bn and $7.5bn respectively. After probability adjusting them, I get a weighted valuation of $13.5bn.

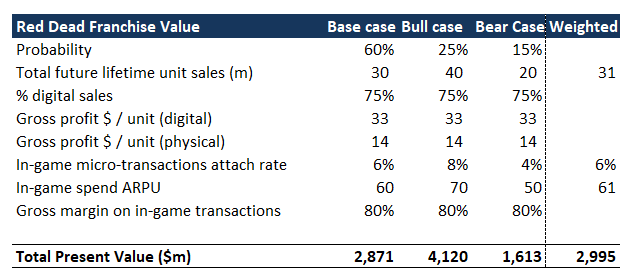

For RDR, I’ve assumed 30m unit sales in the base case over the next 8 years, which would be mainly RDR2 given it was just released in 2018, meaning it will likely be a while before the next iteration is released. 30m I think is still conservative though given RDR2 sold 25m in the first year, so assuming another sequel release in the next 8 years 30m should be readily achievable. I’ve assumed 40m/20m in the bull/bear cases respectively. The attach rate to online is also much lower at 6% in the base again based on Bernstein estimates (8%/4% in the bull/bear case). The other assumptions are the same as for GTA. This results in a base case franchise value for RDR of $2.8bn, and bull and bear cases of $4.1bn and $1.6bn respectively. After probability adjusting them, I get a weighted valuation of $3bn.

Sum-of-the-parts

Having valued the three core franchises, we need to come up with values for the other components of the business, which I’ve segmented as Mobile (Social Point/Playdots/Nordeus), and Other Pipeline. Mobile I’ve largely pegged to the original acquisition prices of the acquisitions, at around $1bn in the base case, conservatively assuming little value has been created since the acquisitions. Other Pipeline, which would include everything in TTWO’s vast IP library that’s not the top 3 and not mobile, I’ve estimated at $1bn in the base case. I think this is extremely conservative. WWE2K alone can potentially make up the majority of that given in the past it sold 2-3m a year, assuming the new edition can revive this franchise with annual releases. Given the vast amount of latent IP and the theoretical large potential of the 93 game pipeline, it’s essentially valuing the pipeline as a free option.

Finally, we need to capitalise the overhead expenses (after-tax), which I assumed to be $1.2bn, slightly higher than their FY21 opex (which was their highest in history). I capitalised at a 8% WACC.

The below table summarises the sum-of-the-parts valuation.

The weighted sum-of-the-parts approach based on the above assumptions is $212, which is a 34% premium to the last closing price of $158. A key point is that just taking the top 3 franchises alone, I get an implied price of $193, more than covering the current market cap and essentially valuing all the other TTWO assets (vast latent IP library, mobile, pipeline) for free. Given I believe I have been relatively conservative in my assumptions throughout, the business does appear significantly undervalued to me.

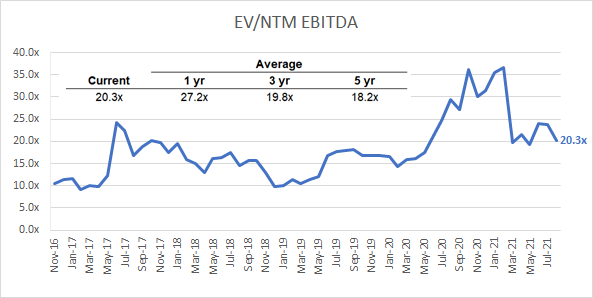

Multiples

TTWO has come off significantly from its peaks earlier in the year and is currently trading at 20x NTM EBITDA, which is almost exactly in line with its longer term 3-yr averages. One could argue that at this current valuation it’s fairly valued, however it’s worth noting that the one year forward estimate (largely FY22 since TTWO has a Mar-YE) is for earnings to decline, which inflates the multiple. This is based on management guidance which bakes in some normalisation from FY21 (a COVID-induced record year). Consensus is then for sequential growth to pick up again significantly in FY23/24, driven in large part by expectations of GTA VI. Therefore on FY23/24 EBITDA the stock looks much cheaper at 15.4x and 12.7x respectively.

So based on the SOTP and multiples, it appears TTWO is undervalued. The question then is why is the business trading so cheaply. The price has fallen almost 25% since the start of the year as the business started facing tough comps post the 2020 pandemic-induced record year and fears of a softer outlook for the next 1-2 years. Furthermore, in their Q1’FY22 earnings they announced delays in two of their immersive core releases by a few month which resulted in a round of broker earnings downgrades, triggering a further ~8% price drop. As a long term holder, I am not concerned about short-term game delays or soft outlook for the 1-2 years. I am focused on the long term value of the business, thus for me this current period looks like a good buying opportunity.

RISKS

Execution: The biggest risk with any gaming company is execution. Content botches do happen from time to time, even for TTWO who otherwise has a stellar track record. For instance WWE2K20 was slammed by critics and gamers alike and called one of the worst games of 2019. From a tired engine to poor graphics to a series of bugs and glitches, everything that could go wrong with it did. The results were so bad that 2K decided they were going to skip the 21 edition to spend more time to fix the issues. They are launching the WWE2K22 edition this year with a new direction and strategy. This shows that not everything that TTWO does is guaranteed to be a success, and a botch with one of its tentpole franchises could be potentially disastrous to its reputation and stock price. Certainly the bear case for TTWO would be that GTA VI ends up a disaster like Cyberpunk 2077. Firstly I think the chances of a complete disaster are low given TTWO’s philosophy of never rushing releases to meet deadlines, and even if there are issues with GTA VI, the strength of the IP should still allow it to generate decent sales over the long term. Nonetheless I have assumed in my modelling that GTA VI sells far less lifetime units than GTA V.

With TTWO having its largest pipeline in its history with 93 games over 5 years, there is a risk that it stretches itself too thin and jeapordises the quality of its titles, particularly its flagship AAA-titles. Some investors are concerned that this approach is a departure from what makes TTWO special, and would prefer that it just focus on sporadic but massively successful AAA-titles instead of running the risk of producing many but mediocre titles. Overall I am OK with their approach given I believe that the large pipeline is a free option, as long as it doesn’t destroy value. And given management’s track record and creative judgement to date, I will give them the benefit of the doubt here. Finally the significant ramp in developer headcount should help manage the execution of the large pipeline.

GTA VI: As mentioned earlier, the ongoing success of GTA Online does present some interesting questions as to how Rockstar will navigate the transition to GTA VI. Online multiplayer modes have potentially unlimited playtime, and millions of gamers would have already invested a lot of money into their GTA Online profile. So how does Rockstar incentivise them to give all that up and purchase GTA VI and whatever the new GTA Online mode is. Conversely if gamers flock to GTA VI, then does Rockstar risk killing off its current highly lucrative revenue stream from its large GTA Online player base? If they launch a GTA Online II that is linked to GTA VI there is also no guarantee that it will be as successful. For instance their Red Dead Online mode is nowhere near as big as GTA Online (~$800m for GTA Online vs ~$170m for Red Dead Online), so not everything they do is necessarily a slam dunk. These are all tricky questions to work through but the good thing is that Rockstar has some time to figure it all out.

Popularity of basketball: NBA2K is the winner-take-all franchise in basketball simulations which due to its sticky audience and network effects gives it a moat over competition. The big risk is the popularity of basketball itself. EA’s FIFA games will consistently do well as football (or soccer) is the most popular sport in the world. Basketball is either the second or third most popular sport depending on which metrics you use, however viewership has been falling; for instance 2021 NBA finals attracted 35% less viewers than 2019. This may be somewhat of a concern, however the NBA is investing heavily in boosting its popularity globally, and in particular it is huge in China where it is the most watched sports league and has 625m fans according to a 2018 Tencent survey. This should help provide a strong tailwind for basketball growth and the NBA2K franchise.

CONCLUSION

In summary, I believe TTWO is a compelling investment opportunity that is undervalued at the moment. It ticks all the boxes of a punch card investment. Its business is underpinned by secular tailwinds; it has unique, best-in-class IP that has a significant moat over competition and a loyal, sticky customer base; it has a large pipeline of releases that is a free option for the company; and an excellent management team that are disciplined capital allocators.

I have established a position in TTWO over the course of this year at an average price of ~$180, and have built up significant conviction through the process of doing this deep dive. I will be adding further at current prices up to a maximum of 4% allocation.

If you made it to the end, thank you for reading and hopefully you found the article helpful. I welcome all feedback, good or bad, as it helps me improve and clarifies my thinking. Please leave a comment below or on Twitter (@punchcardinvest).

If you like this sort of content please subscribe below for more, as I will be publishing a number of tech deep dives over the next few months.

For further reading / information on TTWO and the gaming industry:

Book: One Up: Creativity, Competition, and the Global Business of Video Games by Joost van Dreunen

7 Reasons Why Gaming Will Take Over, Matthew Ball

How Take-Two’s CEO Powered Up (The Wall Street Journal)

Take-Two: a different kind of Reddit stock (Seeking Alpha)

Based on last reported number of over 150m lifetime sales, and assuming $60 average retail price.

Deloitte Digital Media Trends, 15th Edition, April 2021

This approach is similar to Bernstein’s Todd Juenger’s methodology for valuing TTWO.

The profit contribution from each unit sale is based on analysis presented in Joost van Dreunen’s book One Up: Creativity, Competition, and the Global Business of Video Games. It breaks down the average revenue share of the traditional value chain participants for a typical $60 retail game. Helpfully, TTWO is also one of the key examples they use throughout the analysis based on author interviews with company execs, so we can take some confidence that these are probably in the ball park.

Based on this, we can derive the following calculations for per unit sale contribution.

From physical sales, from a $60 retail price, we subtract the platform costs, retailer margin and distributor costs as per the input from One Up above, which results in a $36 per unit sell-in price. From this we subtract the developer cost ($12) and the product cost (estimated $10 based on some sources I found), coming out at $14 gross profit per unit. For digital, distribution is done through digital stores such as Sony Playstation Store or Xbox Game Store. My understanding is that the platforms typically take about 25-30% of the retail price - for reputable AAA titles it would typically be towards the lower end. So assuming a 25% take rate on a $60 game, that leaves TTWO with a $45 sell-in price. Assuming there are no other product costs (discs, boxes etc), and no distribution costs, the only costs to take out are developer costs, where I’ve assumed the same $12. This leaves TTWO with a much higher $33 gross profit on every sale. Hence why the shift to digital distribution is so margin accretive for publishers.