Etsy Q2'21 Update - Is Post-Pandemic Growth Stalling?

Some thoughts on its rather mixed quarter

On Wednesday Etsy announced its Q2’21 earnings, and the stock subsequently plunged ~12% (at least temporarily) due to concerns around the slight decline in active buyers, soft outlook, and just general worries about the business maturing. The key question for investors is whether this is just a temporary blip or an indicator of impairment to the longer term growth prospects. As a long term holder, my view is that in the context of the immense growth in virtually all metrics of business performance that Etsy experienced in the last 15 months, there isn’t an immediate alarm for concern around the long term fundamentals at this stage, but the next few quarters will be important to watch. There was always a high chance that the post-COVID transition period was going to be patchy, and we have seen recent growth slowdowns and stock repricings of other COVID-beneficiaries (Netflix, Amazon, Pinterest, Roku). As I wrote in my Etsy deep dive article three weeks ago, a similar slowdown for Etsy was not unexpected, and as such, at the time I baked in significantly lower growth over the next few years in my base case to account for that (my original longer term forecasts are still lower than the newly revised analyst consensus). Based on these numbers, I concluded at the time that you could still achieve an acceptable long term return (~10% 5-yr IRR) based on the price then of $185, but that I would prefer to wait for the stock to reprice closer to the $170 mark for a better risk-return. I added a bit at $176 this morning and will continue to add at similar levels if opportunities allow.

Firstly, running through the Q2 results:

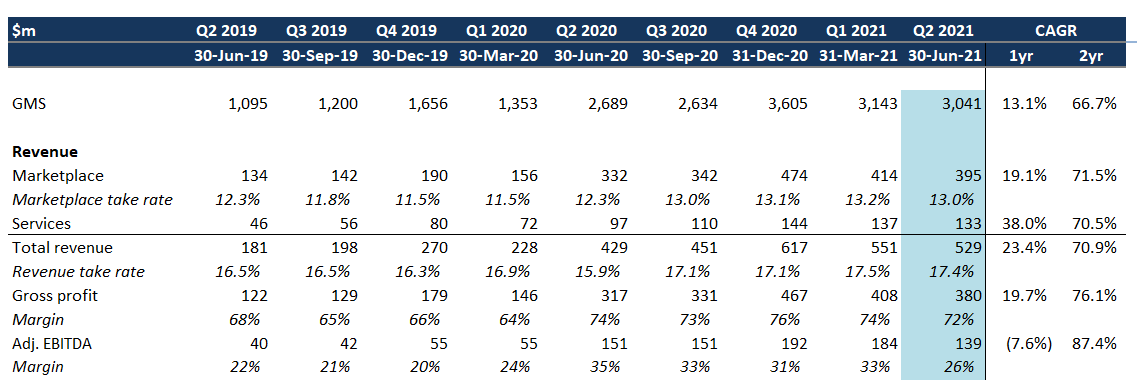

GMS ($3.04bn), revenue ($529m) and Adj. EBITDA ($139m) were all within guidance but below the top-end of the range (typically the company has beaten the top end of the range). GMS and revenue grew 13% and 23% yoy respectively on what was a huge quarter last year given it was peak-pandemic (GMS grew 146% in Q2’20). Excluding masks (which were 13% of GMS in Q2’20) GMS growth was much higher at 30%. Looking at 2-yr historic growth (‘19-’21), GMS and revenue CAGR of 67% and 71% is still exceptional

The company noted they are seeing sustained momentum in many of the categories that benefited broadly from the pandemic, including home furnishings. The company also noted a resurgence in categories exposed to reopening activities and the return of events, including wedding-related items and back-to-school products

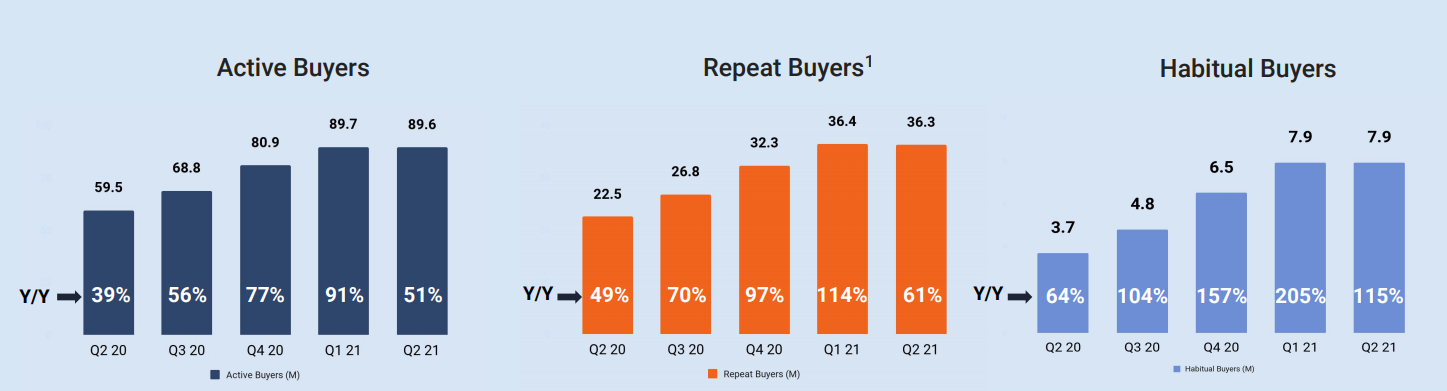

As seen in the chart above, a big concern was the no growth (in fact slight decline) in the active buyers, and similarly habitual and repeat buyers. This is the first quarter in its history that the company didn’t grow its active buyers, however it’s important to remember that Etsy has almost doubled its total buyer count from 46m at the start of 2020 to 90m currently, so no growth in this particular quarter doesn’t derail my longer term thesis. Etsy did actually add a very healthy 8m new buyers during the quarter (higher than pre-COVID average of ~5m new buyers pq), however this was entirely negated by churning buyers, which according to management were predominantly mask buyers. Buyer numbers will be important to watch over the next few quarters particularly given the increased investments in marketing that the company is making

Despite no growth in net active buyers, GMS and revenue were still still comfortably within guidance as a result of strong growth in GMS per active customers (increasing 22% yoy) and GMS per new buyers (increasing 24% yoy) which was an encouraging sign (see charts above)

Adj. EBITDA margin of 26% was a sharp fall from yoy and the last quarter (over 30%), driven by a significant increase in marketing and other investments, as well as the dilutionary impact of the new acquisitions (Depop, Elo7) which have lower profitability and integration costs

There were a lot of operational updates both on the core business and the acquisitions:

Etsy launched XWalk, a large-scale real-time graph retrieval engine that dramatically expands the amount of available data used to capture what buyers are looking for and improves conversion rate by showing more relevant inventory to buyers. XWalk leverages 2.7bn data points versus 240mm data points used in the platform's previous search algorithms Management says they are only just beginning to unlock its potential but it has already significantly reduced the amount of dead ends (queries returning zero results), and has applications beyond search such as making recommendations more relevant and improving marketing

Significant improvements achieved on delivery predictability, with higher delivery date displays (from 73% to 89% of orders) and more than doubling of origin zip code coverage (from 40% to 85% of orders) which allows more accurate delivery time estimations

In September Etsy will launch the Star Seller program which will award sellers based on targets around response times, on-time shipping and customer reviews. This will elevate certain sellers in search results and incentivise all sellers to deliver higher customer service. This seems like a good idea in theory, but there have been quite a few comments in forums with some sellers being unhappy about it, saying it’s been poorly designed. Keen to see how this evolves

Top of funnel brand marketing seem to be paying off with brand awareness increasing in Germany and the UK

Integration of Depop and Elo7 has kicked off and will probably take multiple quarters and years. The focus is on leveraging Etsy know-how in marketing, conversion optimisation, value-added services, and buyer and seller experience, amongst other things, to make improvements to these businesses

They highlighted the significant growth opportunity in LATAM and how Elo7 gives them entry into the Brazil market which otherwise has high barriers to entry

$180m of share buybacks were executed, which seems like it was quite opportunistic and a good piece of capital allocation given the share price corrected ~20% during the quarter

Onto the outlook:

Q3’21 GMS guidance was $2.9-3bn which represents 12% growth at the mid-point, however this does include the contribution from Depop and Elo7 which were not there last year. The guidance for Etsy standalone was mid-single digit growth. While this does appear low, as a reminder Q3’20 was a sensational quarter where GMS grew 120%. Excluding the impact of masks from the Q3’20 number, Etsy standalone growth is expected to be mid-teens, which seems more reasonable. Revenue guidance of $500-525m represents 13.5% growth at the mid-point, and implies a take rate of 17.4% (in line with this quarter’s take rate). On a 2-yr basis the CAGR for GMS and revenue respectively is 57% and 67%, a very strong growth rate.

They also suggested that Q4’21 and Q1’22 would be tough comps as well given the end of year holiday seasonality and impact of government stimulus. This suggests that growth may be patchy at least for the near term, which was no doubt a big driver of the stock price plunge

Projections

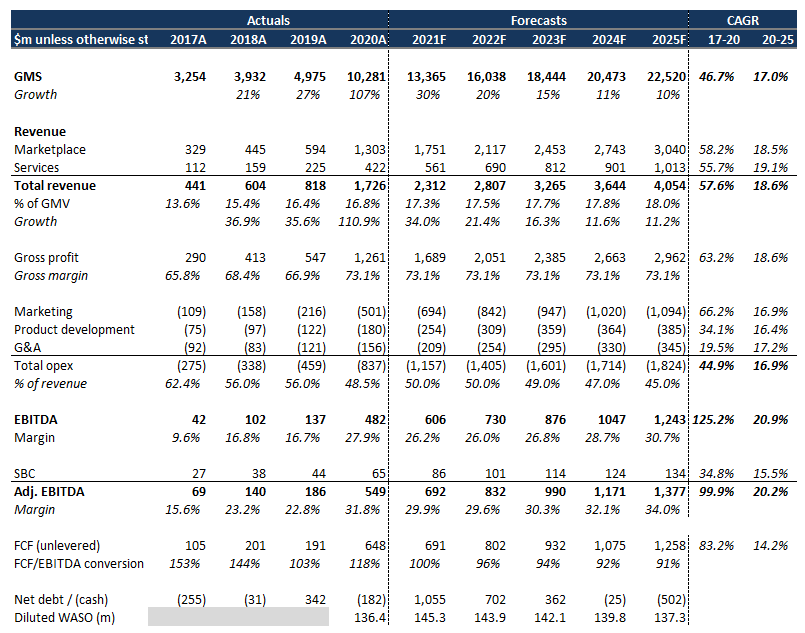

My base case projections from my deep dive three weeks ago are below:

Considering the Q2 actuals and soft Q3/Q4 guidance, my FY21 estimates admittedly appear a bit on the high side now, however in the years beyond that I incorporated a significant slowdown (GMS / revenue CAGR of 17% / 18% FY20-25 respectively) which makes me relatively comfortable. On the earnings side, I baked in a reduction in overall profitability for FY21 to account for the impacts of the aforementioned higher opex investment in marketing, product and the acquisitions. I also don’t expect margins to recover to their FY20 levels until FY24 which I believe is fairly conservative. Overall my original longer term revenue and earnings forecasts are still below the updated analyst consensus which have now been revised downwards. The key thing is that I am not too focused on the accuracy of the year to year numbers (which are always going to be off) as I am on the ballpark trajectory of the business over the long term.

Conclusion

As a long term holder, I am not too concerned about Etsy’s long term growth prospects at this stage, but it will be important to watch the performance over the next few quarters as the post-COVID transition settles. Operationally I am comforted that management seems to be continuing to execute well and are constantly trialing/implementing new initiatives that should strengthen the platform and drive longer term growth. I have previously built in a fair degree of conservatism in my base case forecasts to account for the post-pandemic slowdown, and depending on where the share price moves over the next little while there could be some opportunities for a better risk-return.

Many thanks for reading. If you liked this article and enjoy this sort of content on TMT companies, please subscribe to my Substack below. I will be dropping my next deep dive on gaming leader Take-Two Interactive in the next week.